Who is MeridianLink?

Better. We all strive for it every day. We want to live it.

At MeridianLink, we work diligently each day to connect you and your customers to better. Better ways to be efficient and streamline experiences so your customers can live better lives. It’s no wonder we are the leading provider of enterprise business solutions for financial service organizations.

Our passion for excellence is reflected in our web-based credit reporting, lending and new account opening and deposit technologies. All of our products have a solid reputation of being cutting edge, reliable and affordable.

Integration type: Verification of Assets, Income, and Employment

What will the Floify—MeridianLink Integration support?

Some of the most well-known and heavily used credit agencies amongst those integrated with Floify are also affiliated with MeridianLink’s Mortgage Credit Link (MCL) solution, including:

|

Through their association with MeridianLink, these CRAs also provide simplified and streamlined access to verifications of assets/deposits (VOA), income (VOI), and employment (VOE) through existing partnerships with vendors AccountChek™ and Equifax The Work Number®.

Floify enables this capability through a special MeridianLink configuration.

Once enabled, loan origination teams will have the ability to order these verification services for any borrower – directly from the add new doc screen of the loan flow or triggered within the borrower's application – and have the corresponding reports delivered seamlessly back into the client’s loan flow.

How to Set Up and Use

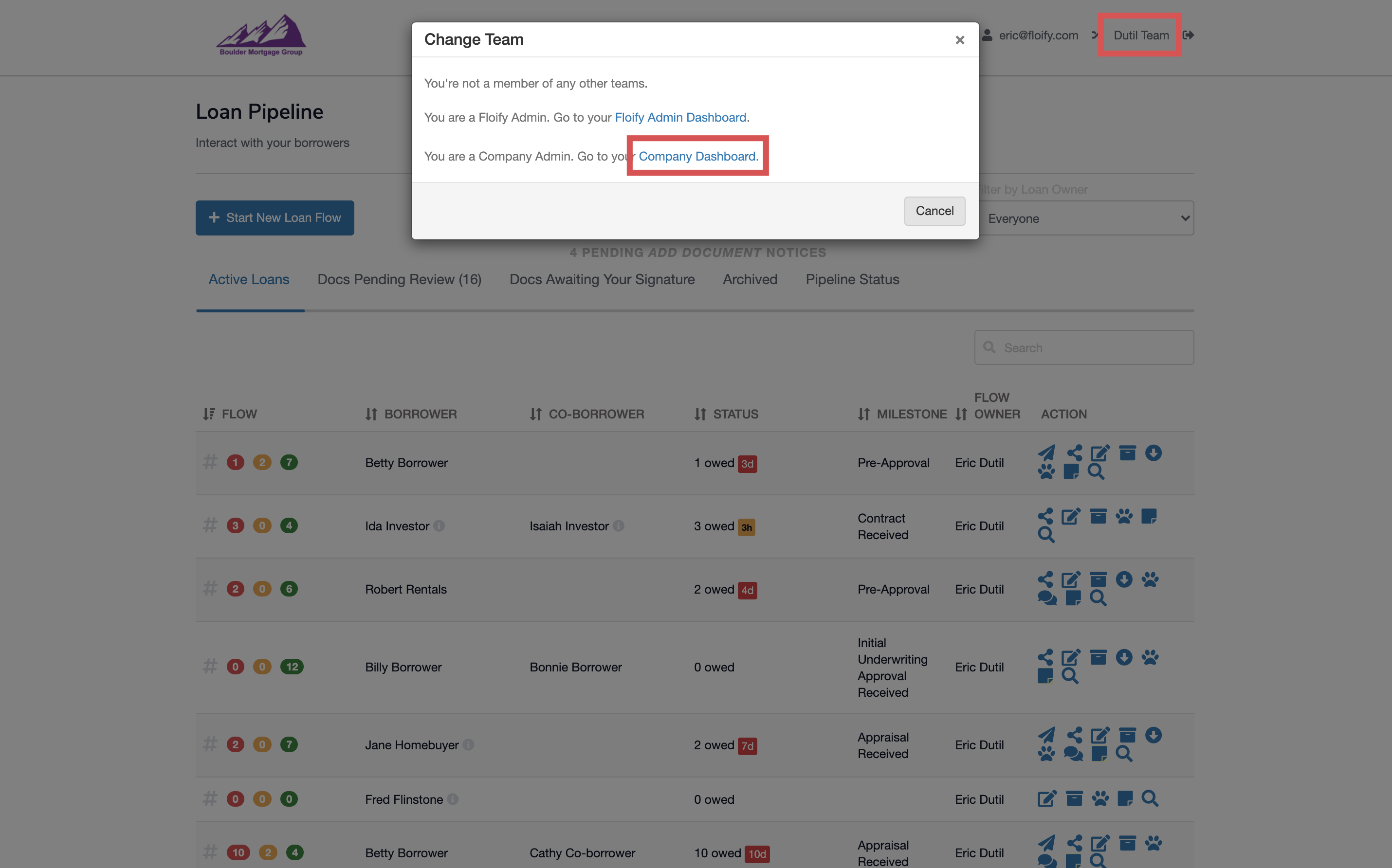

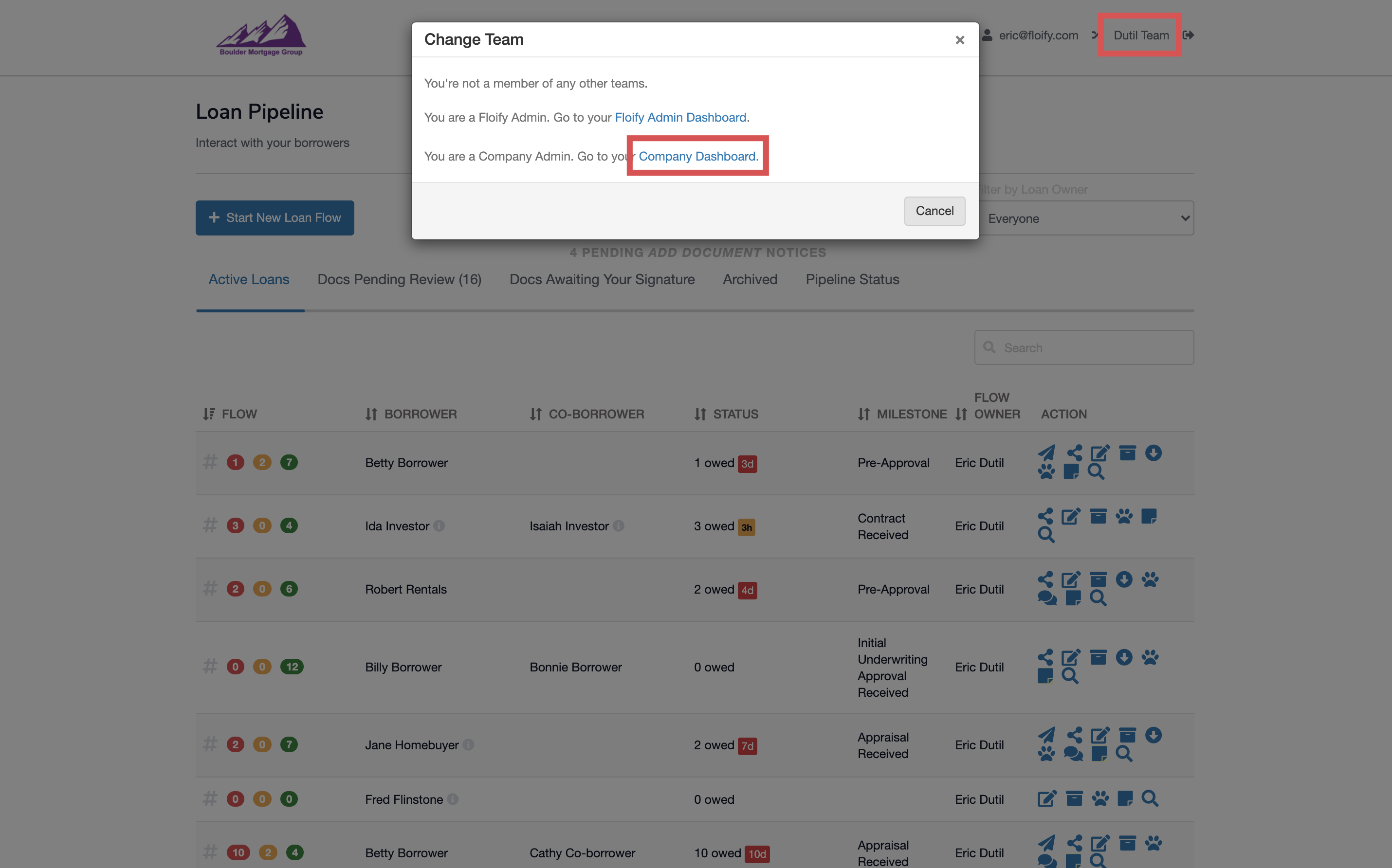

From the team pipeline, choose the team name in the upper right-hand corner and select the option to navigate to the Company Dashboard:

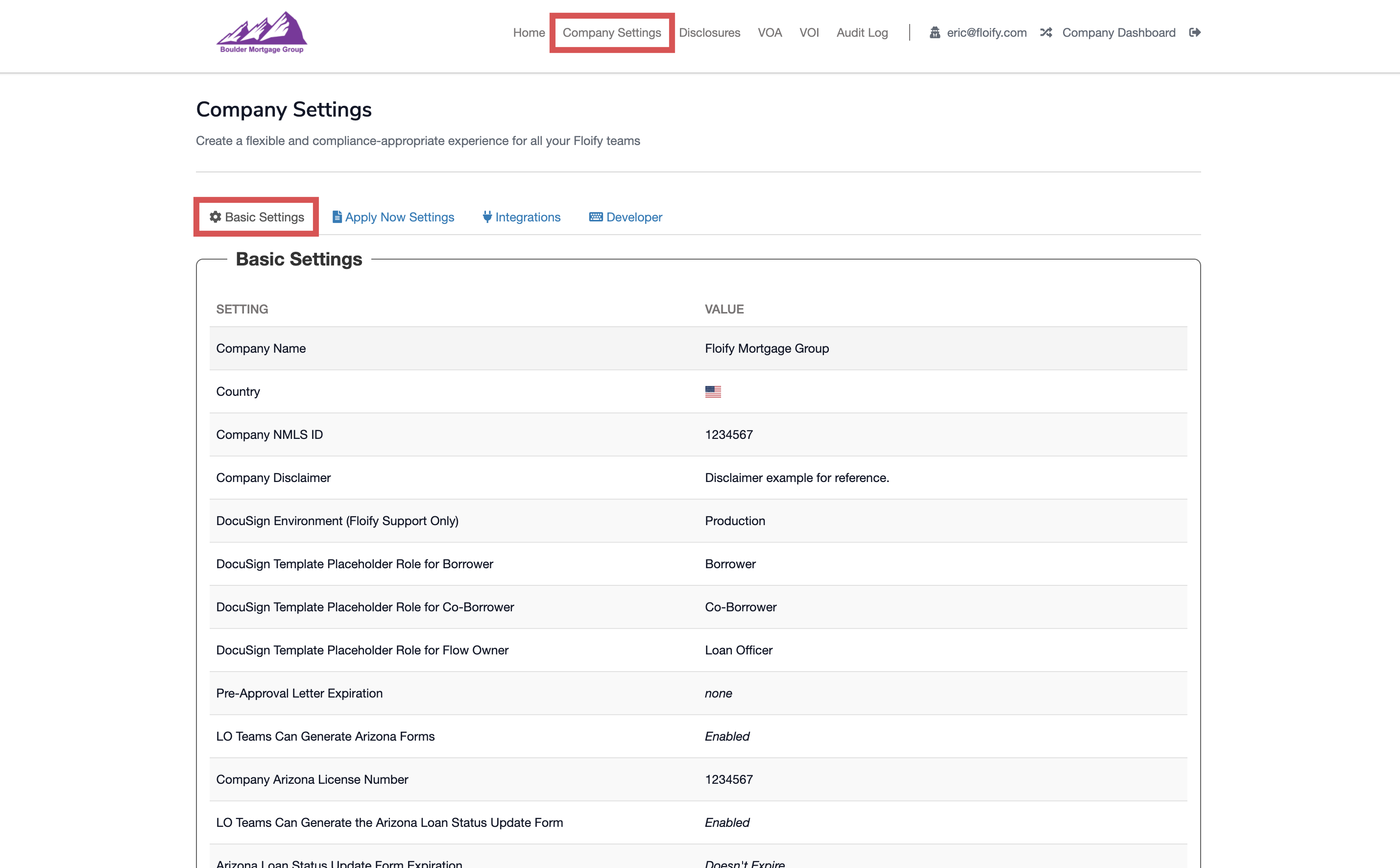

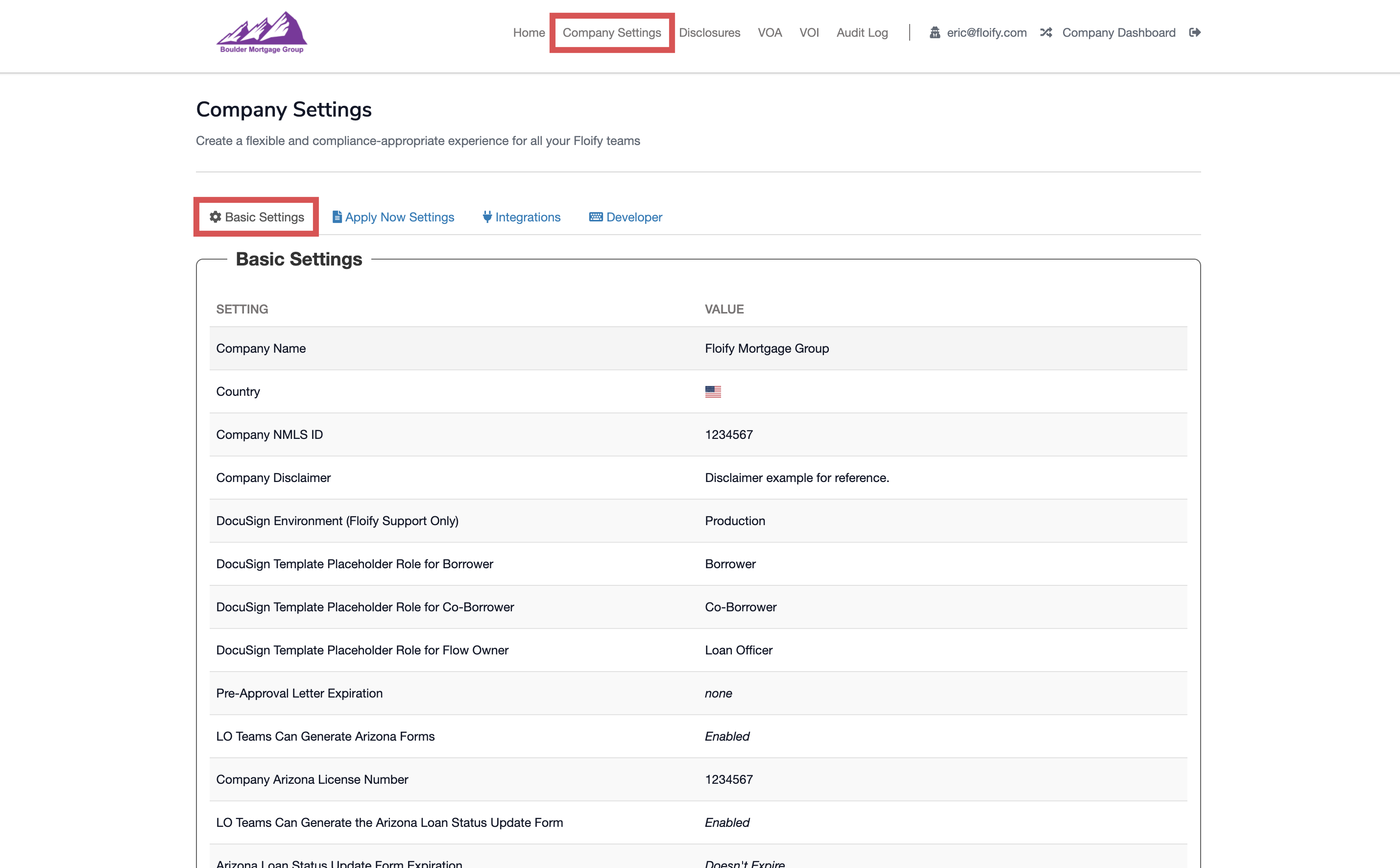

Navigate to Company Settings and select the Basic Settings tab:

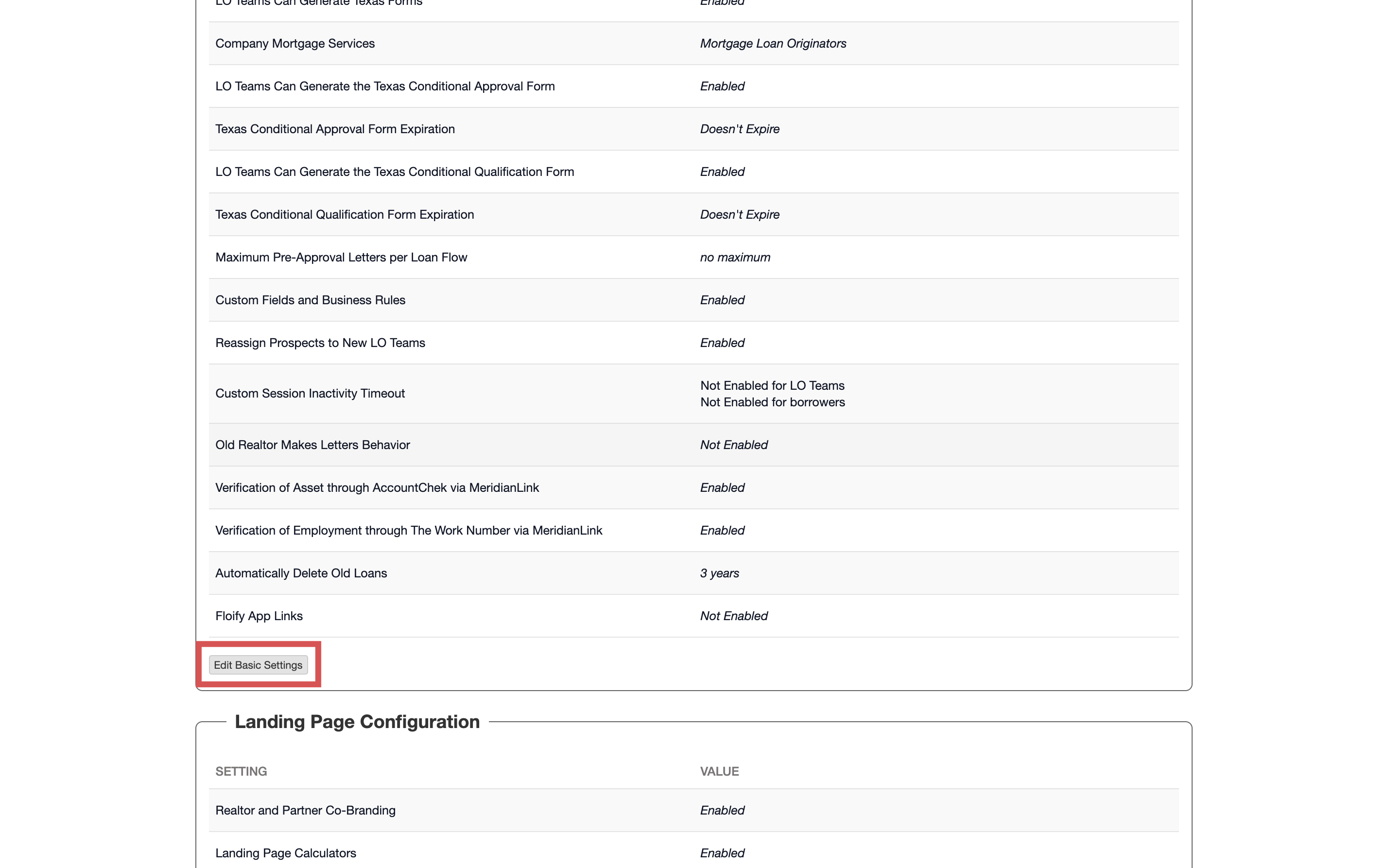

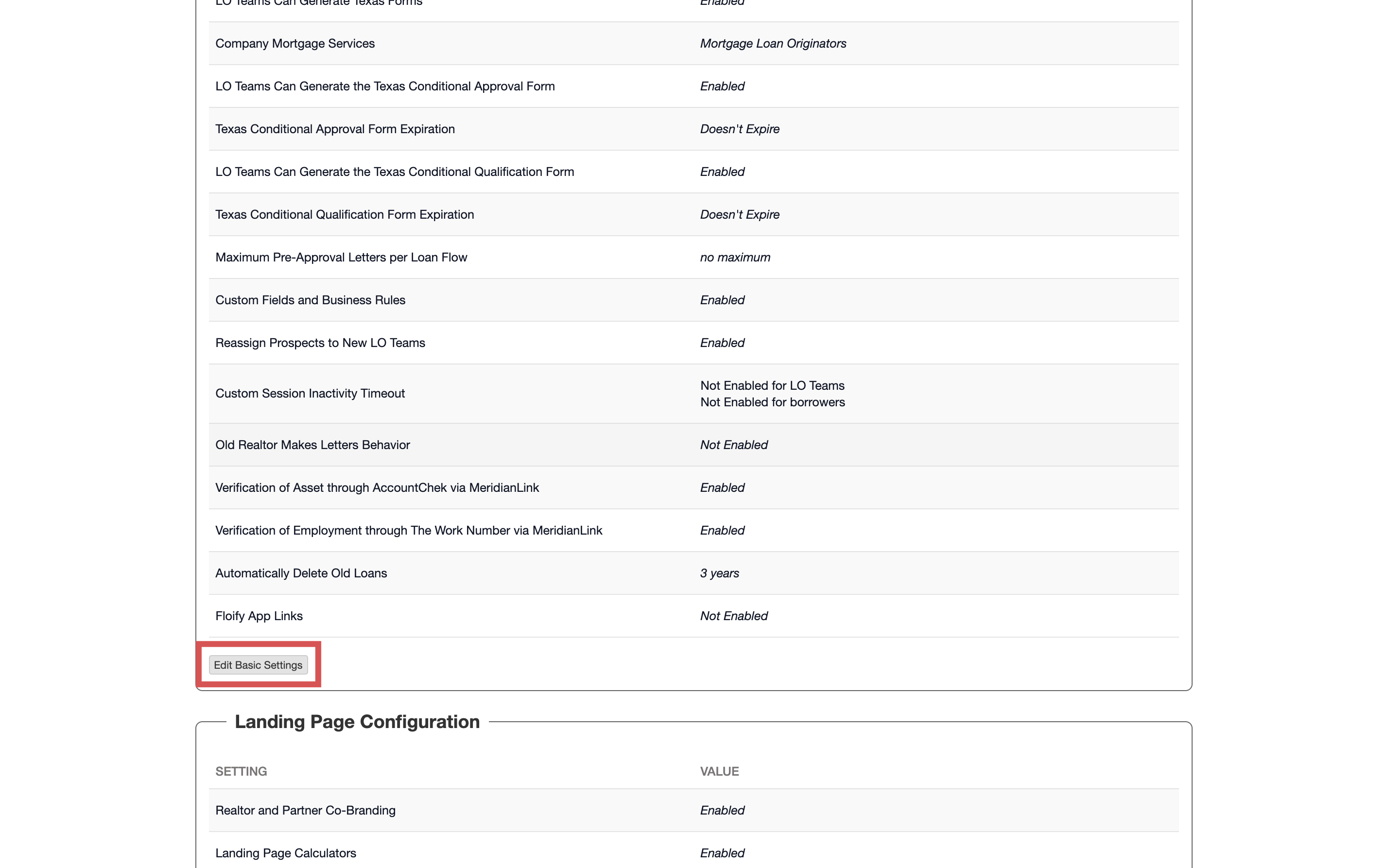

Scroll down and select Edit Basic Settings:

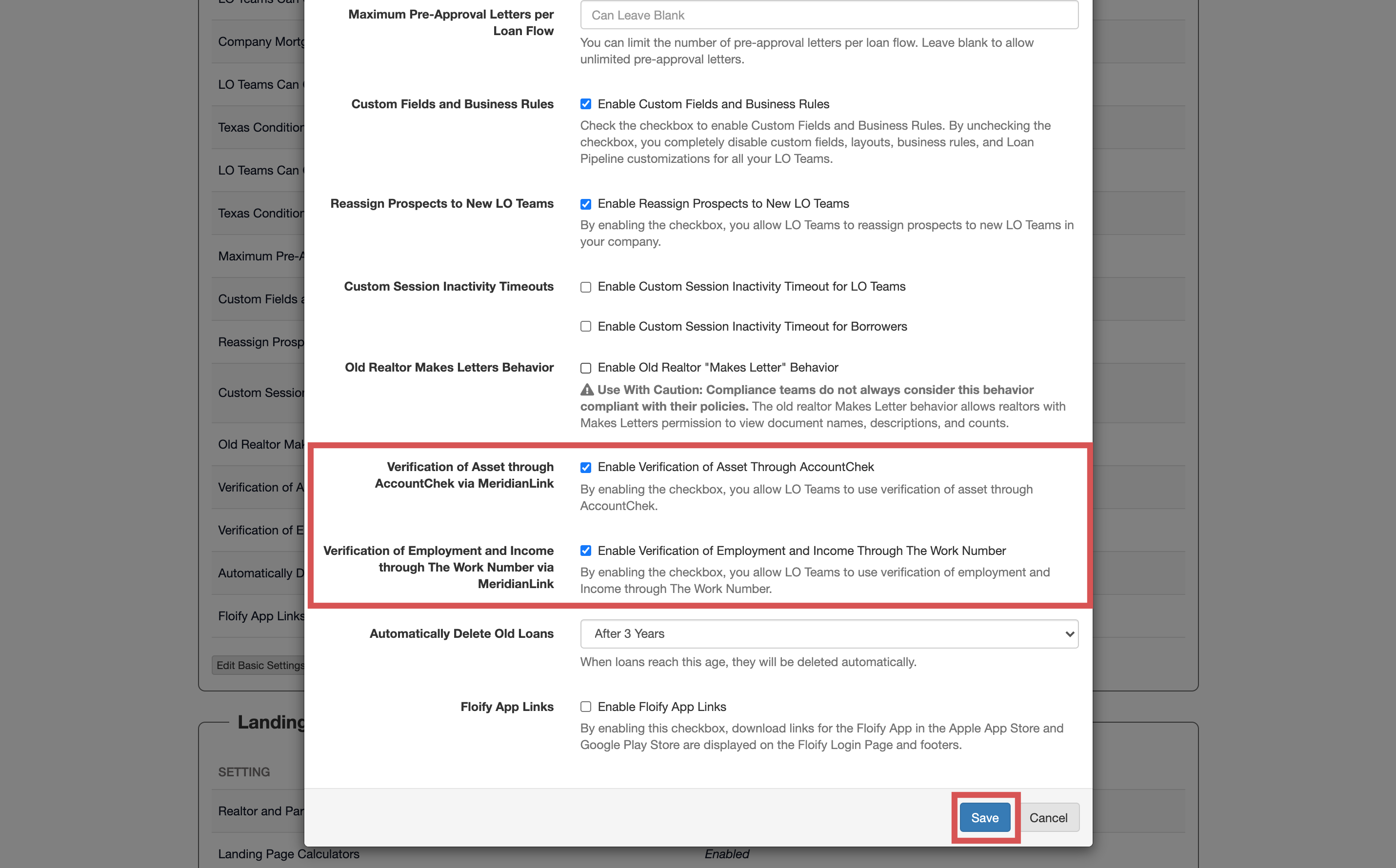

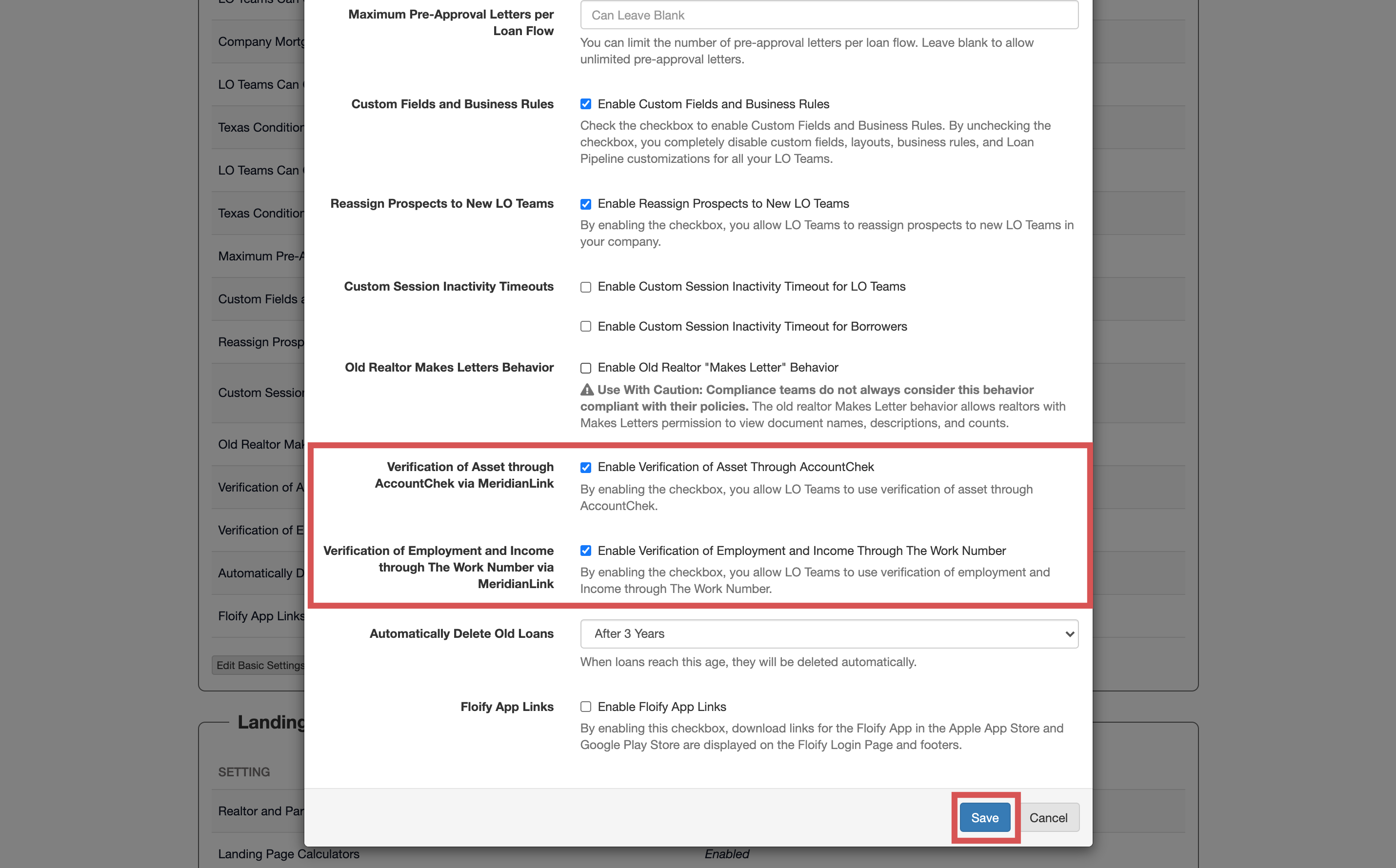

Enable Verification of Asset through AccountChek via MeridianLink or Verification of Employment and Income through the Work Number via MeridianLink as applicable. Make sure you select Save to confirm the changes:

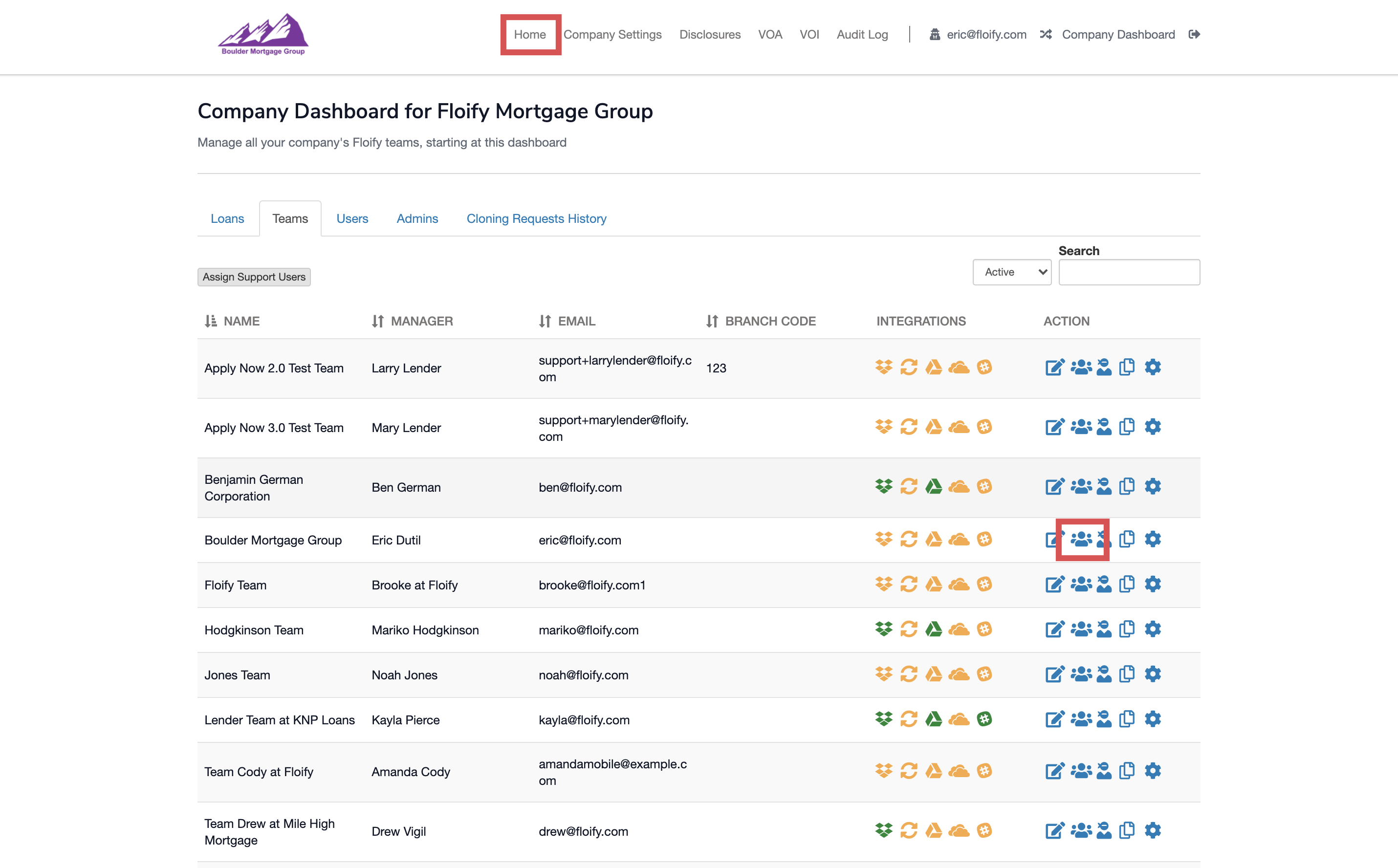

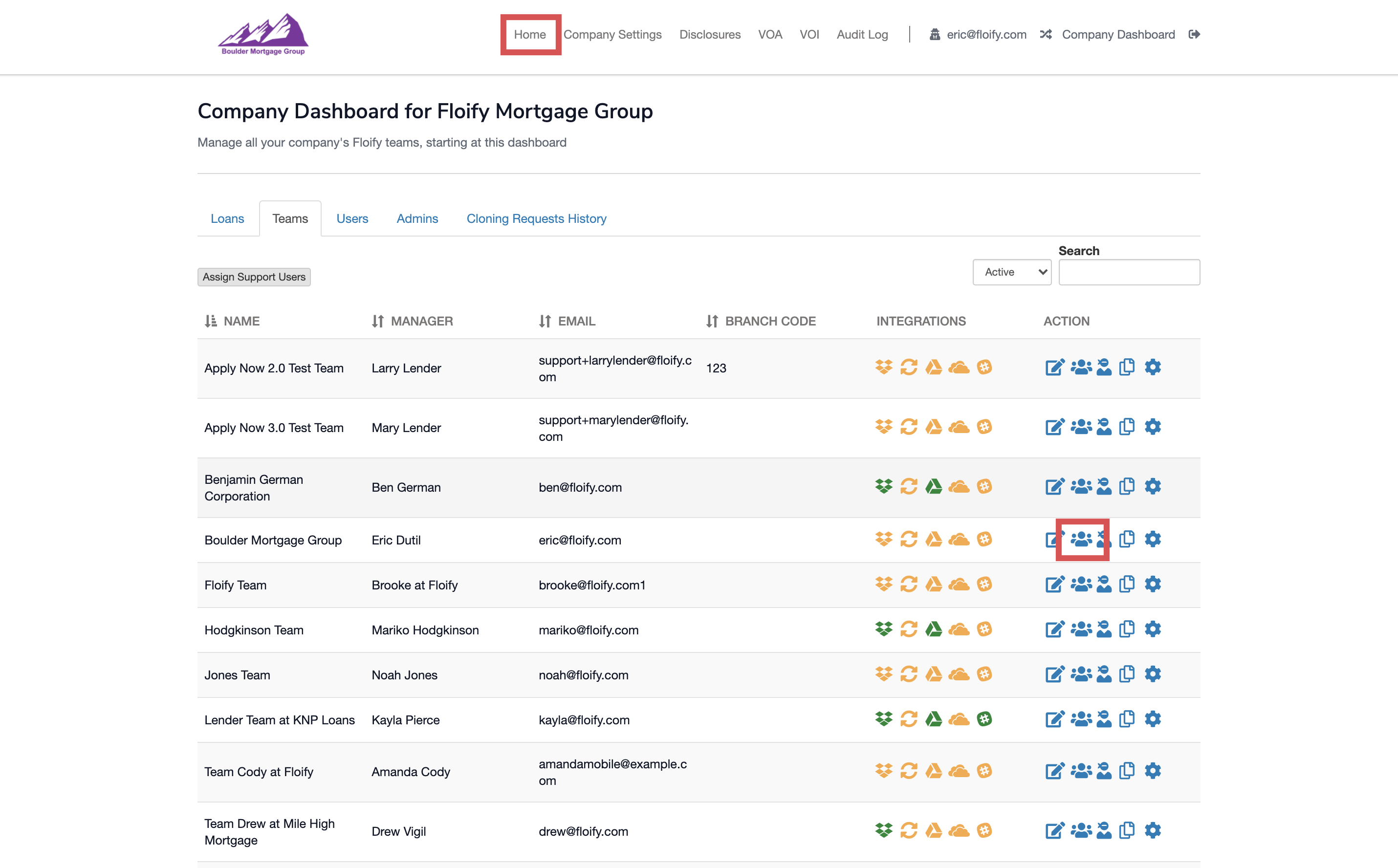

Navigate to Home and switch back into the user's account:

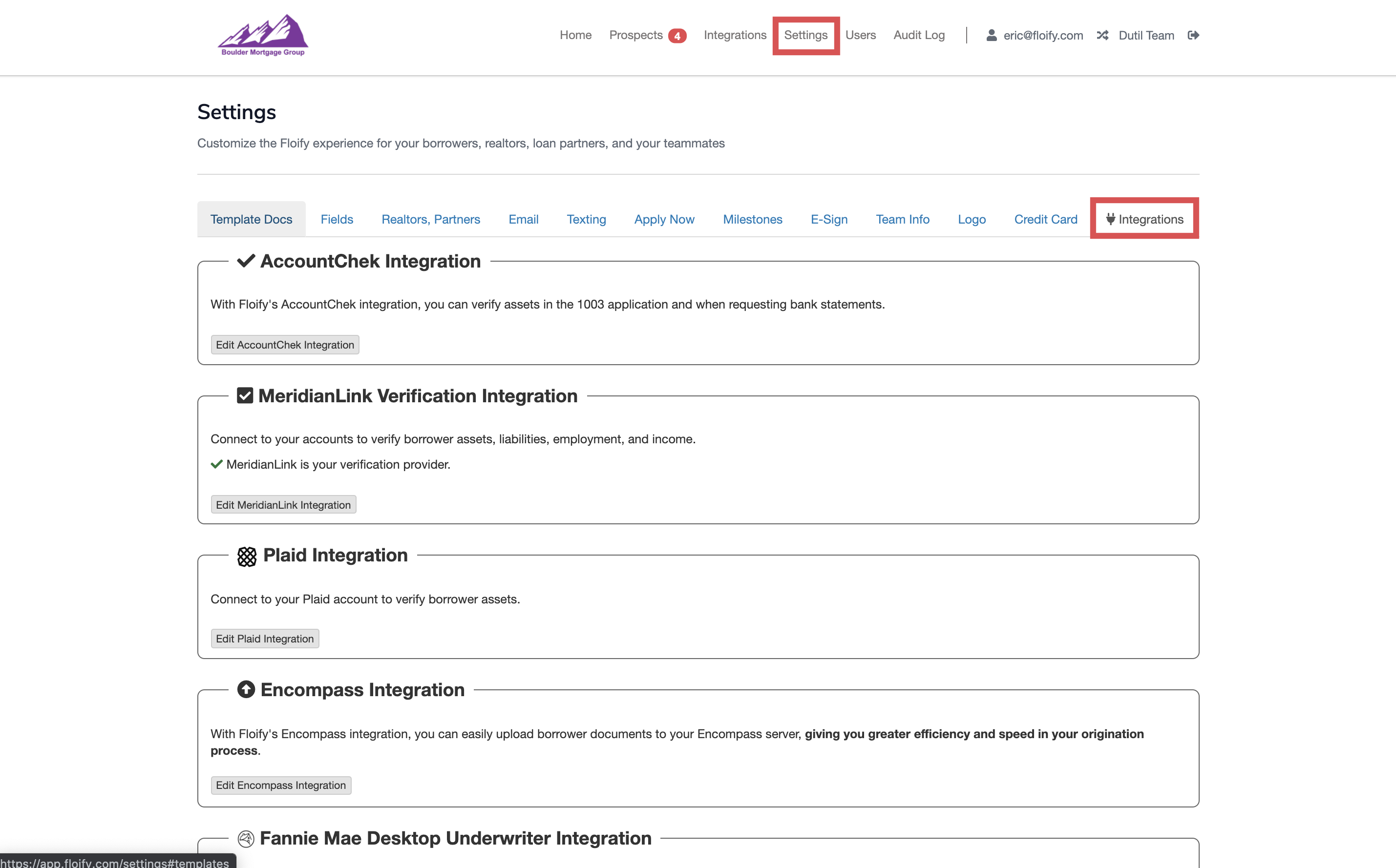

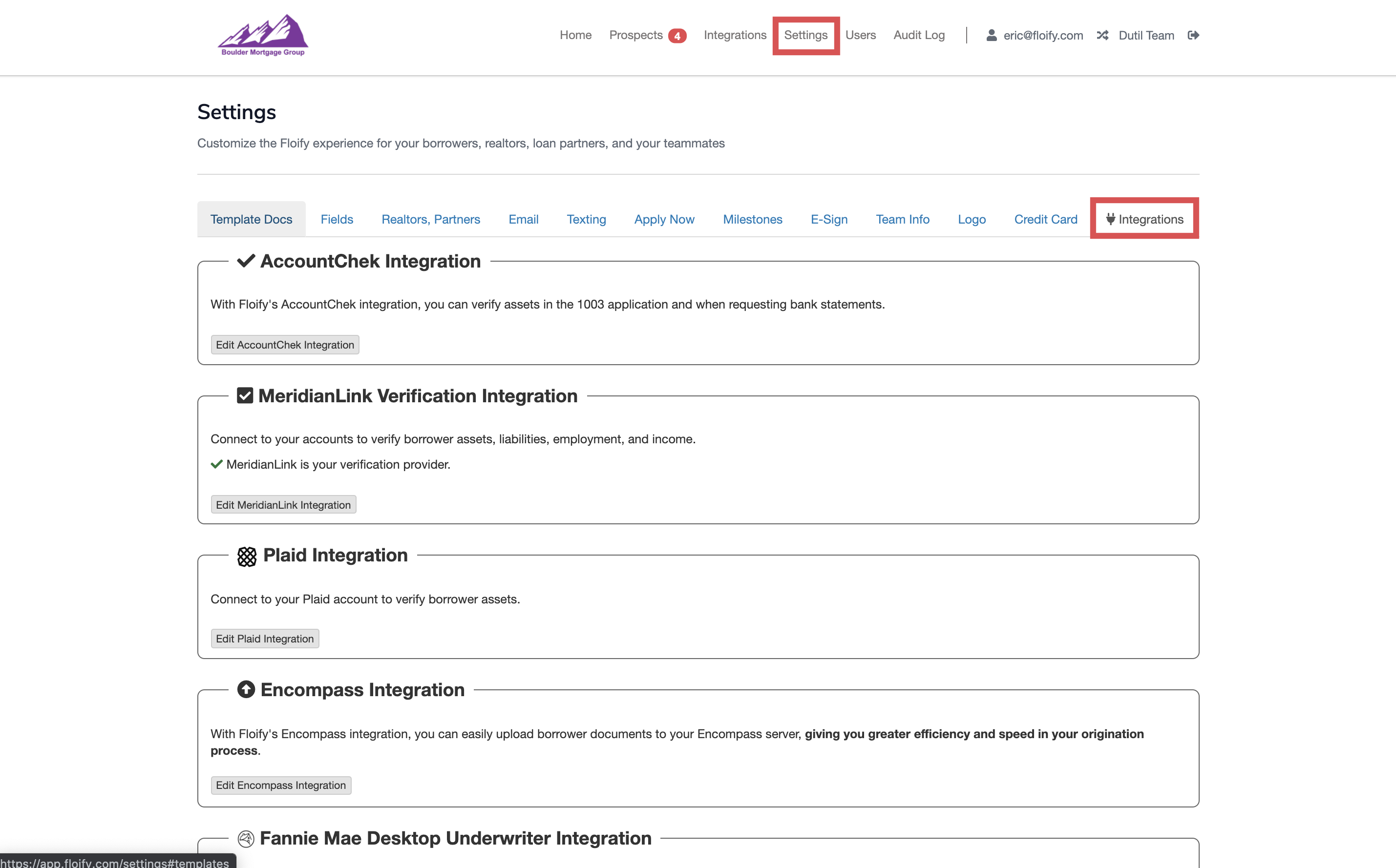

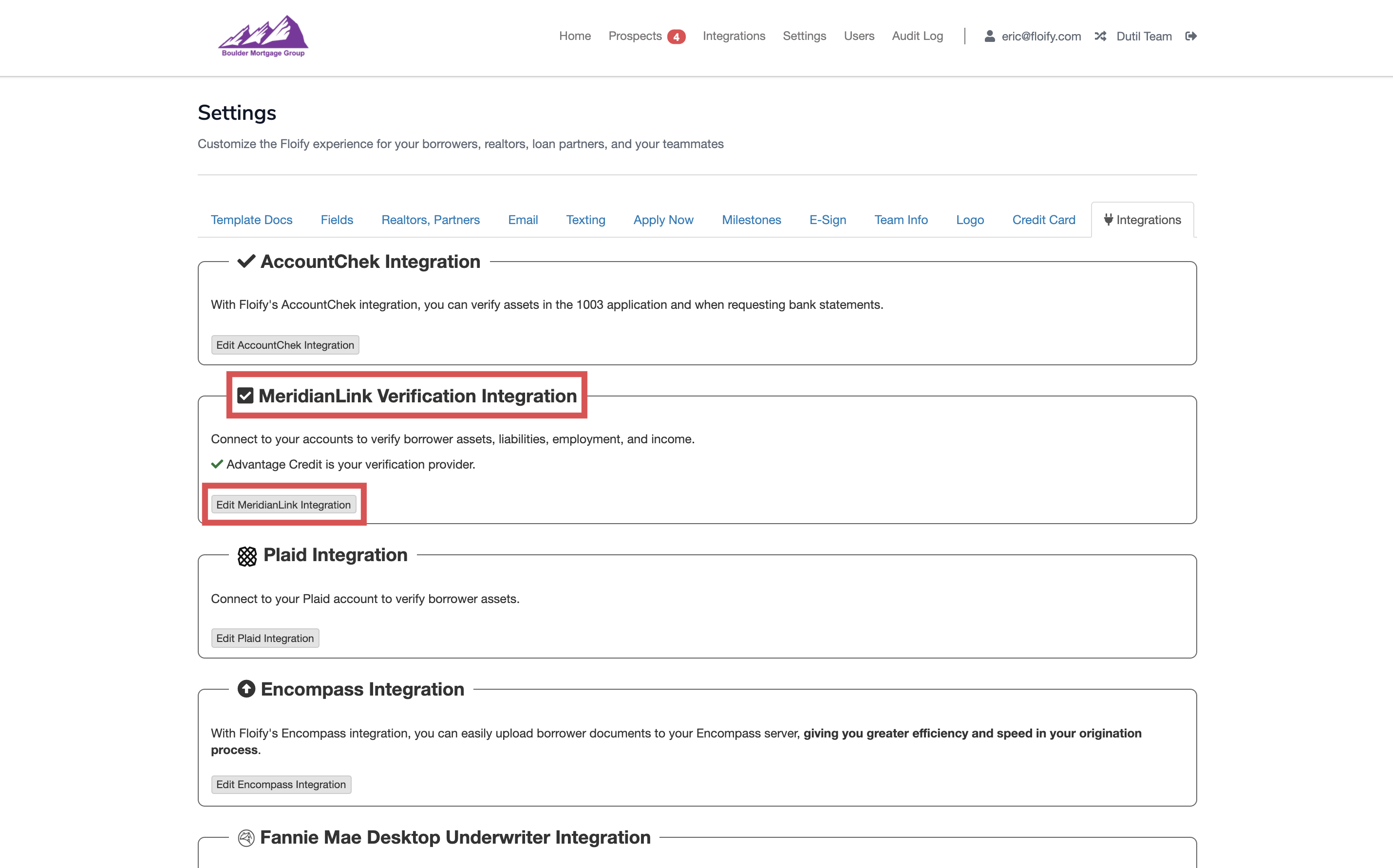

From the team pipeline, navigate to Settings and select the Integrations tab:

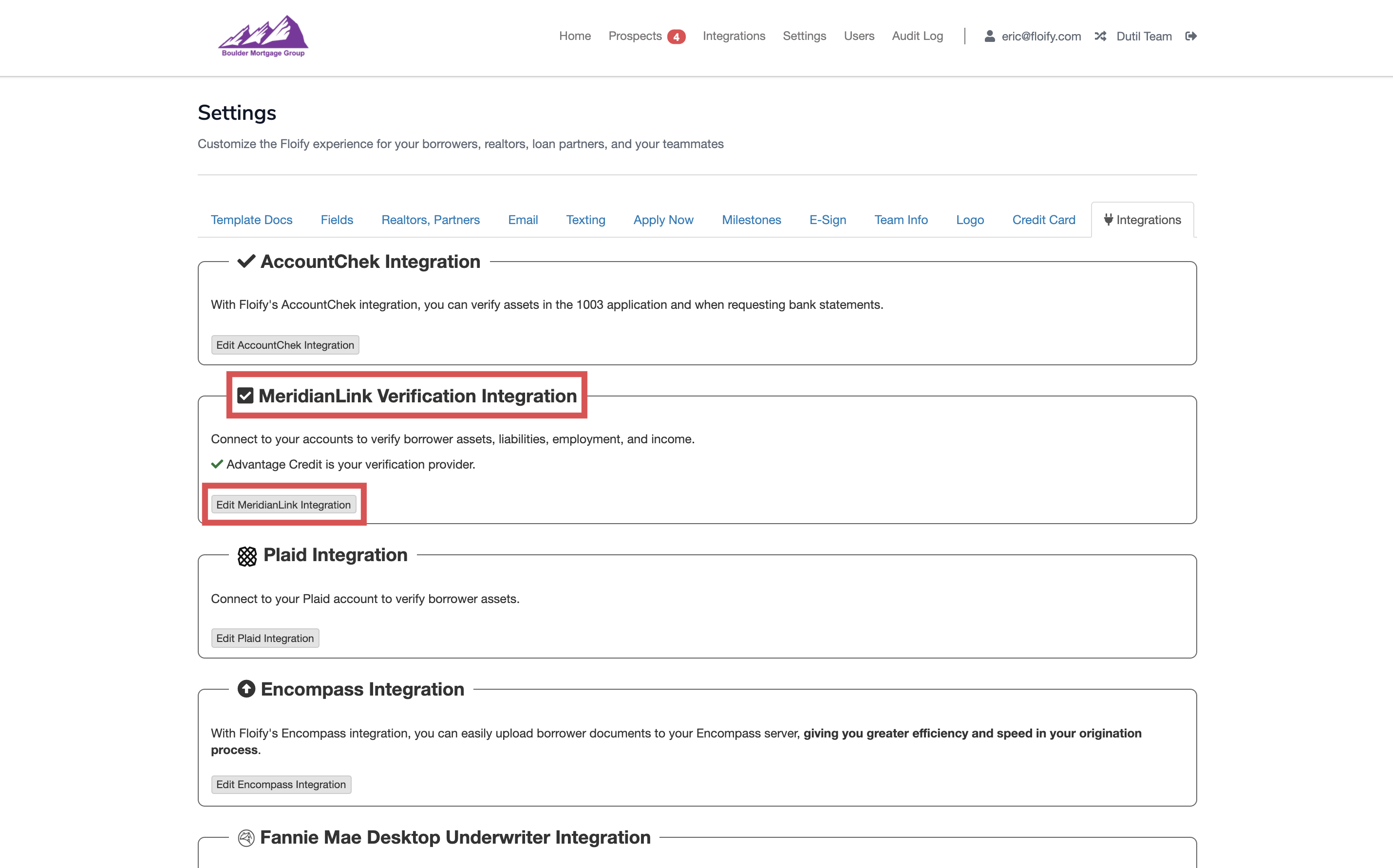

Scroll down to MeridianLink Verification Integration and select the option to Edit MeridianLink Integration:

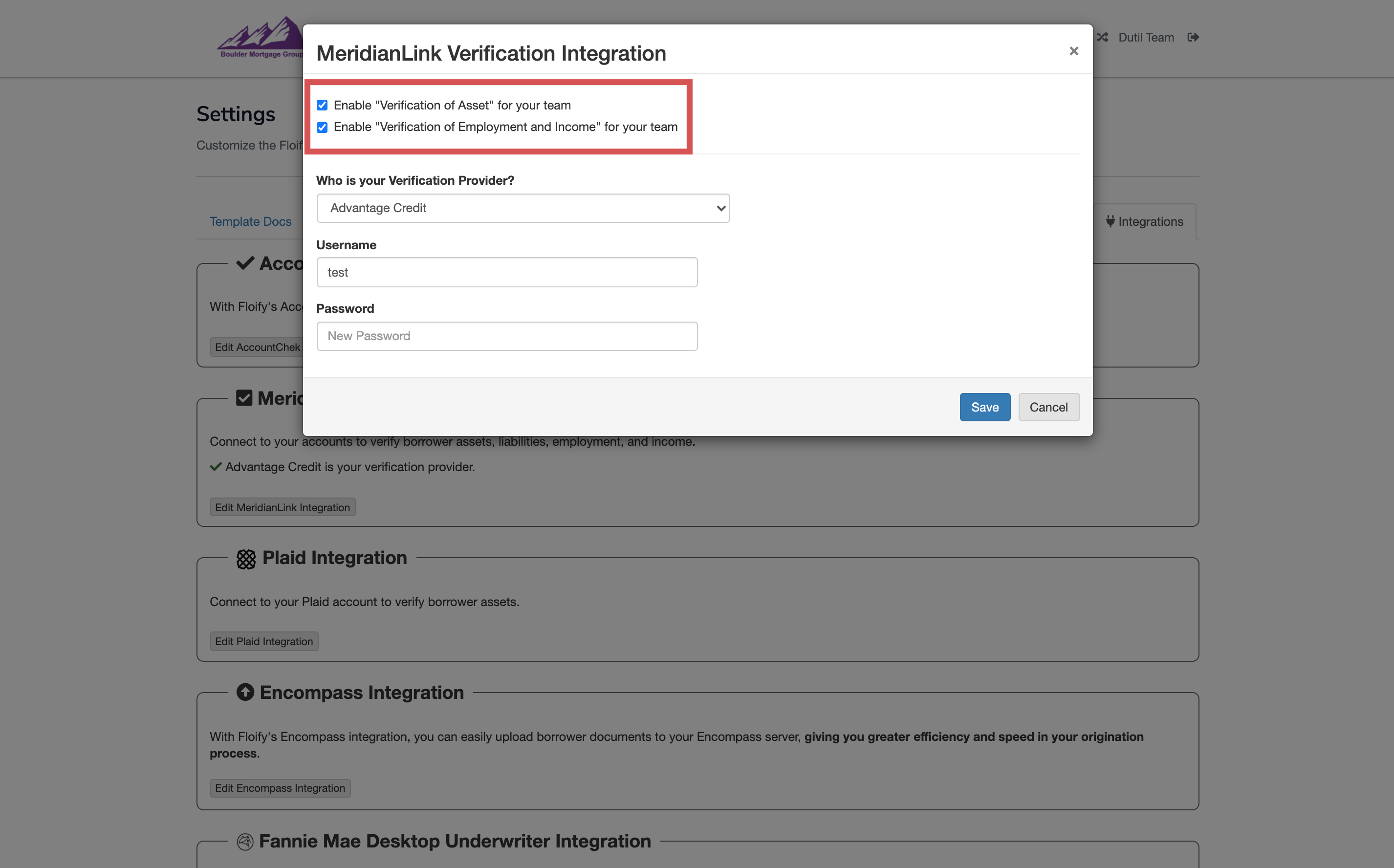

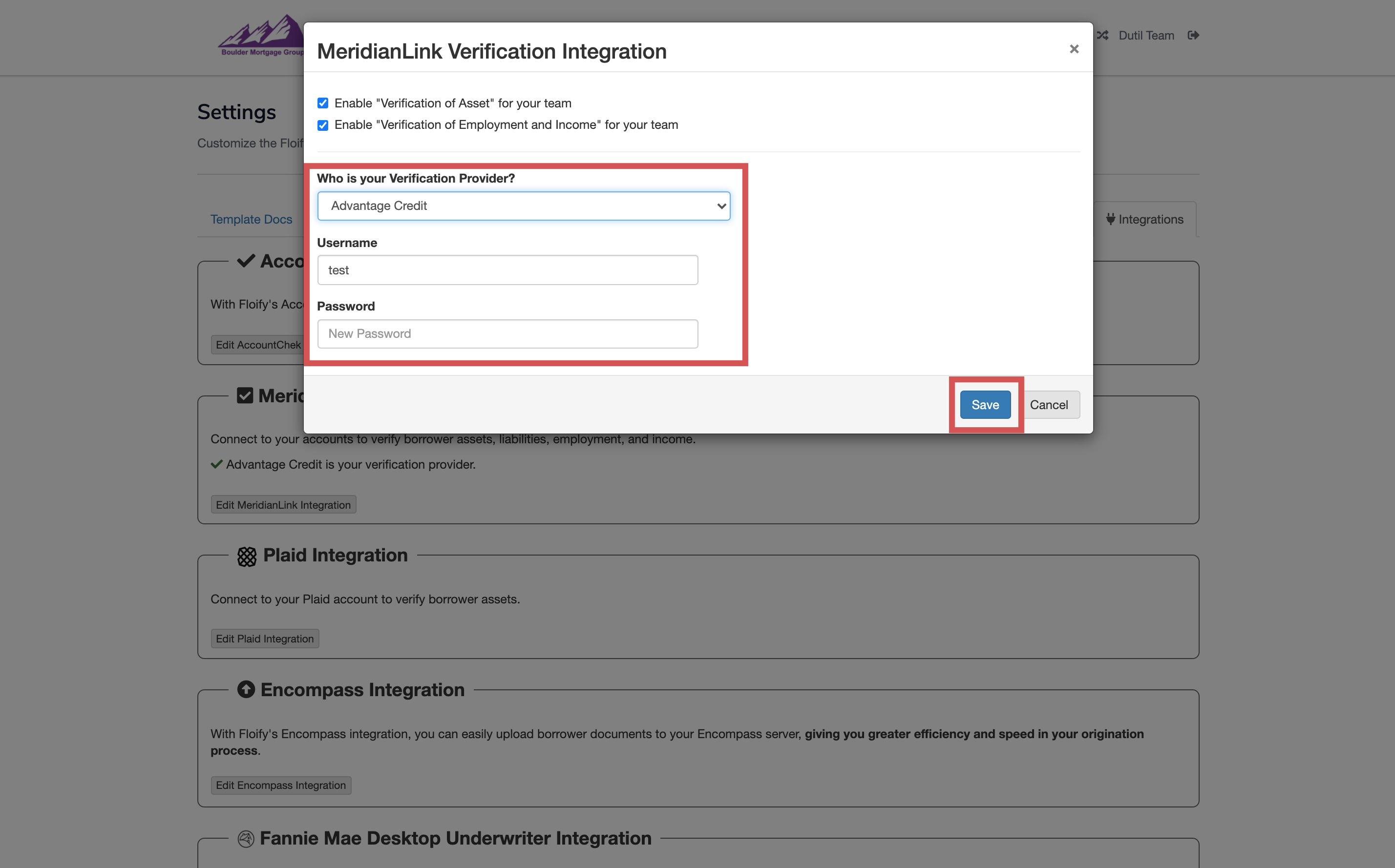

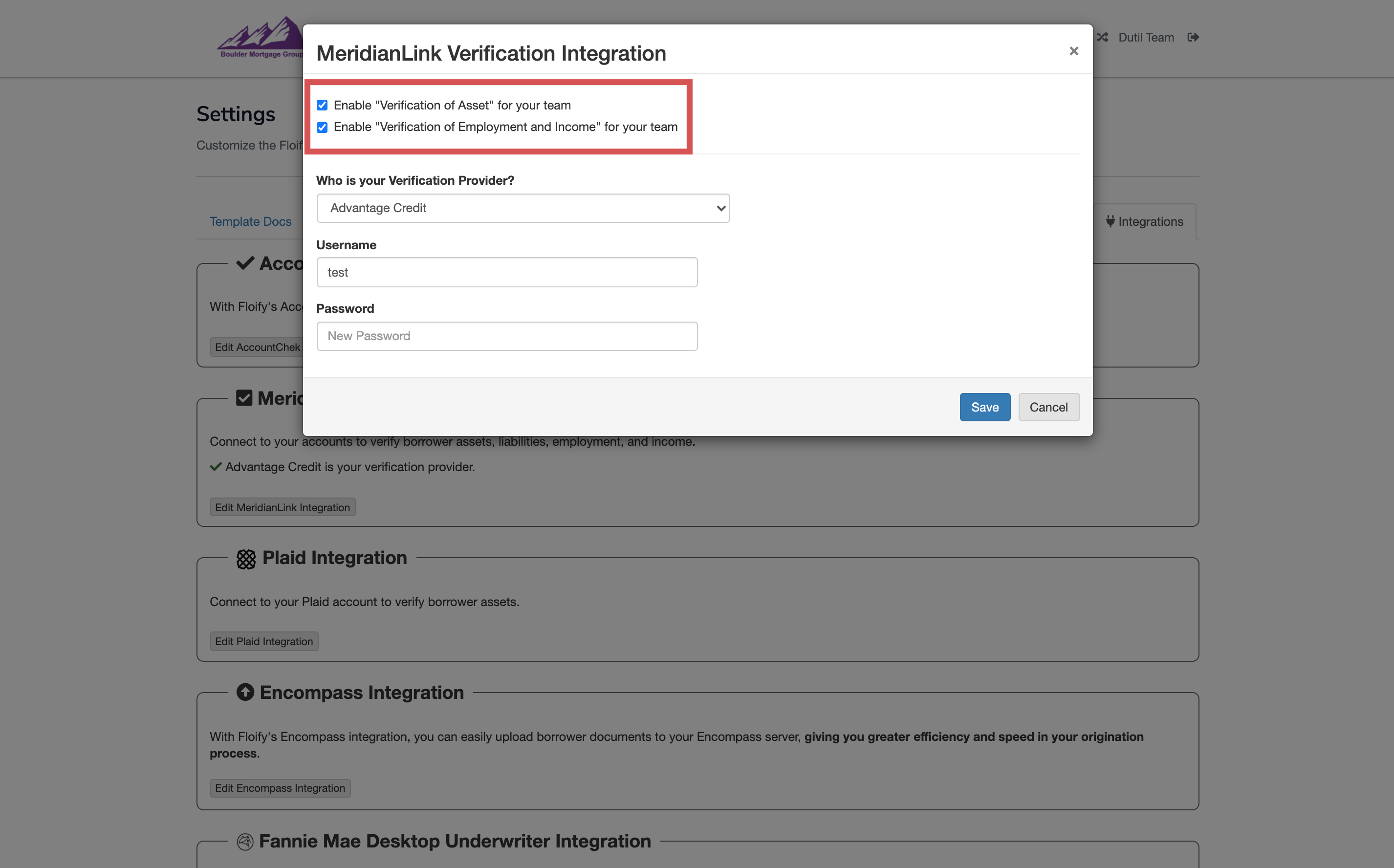

Enable Verification of Asset or Verification of Employment and Income as needed:

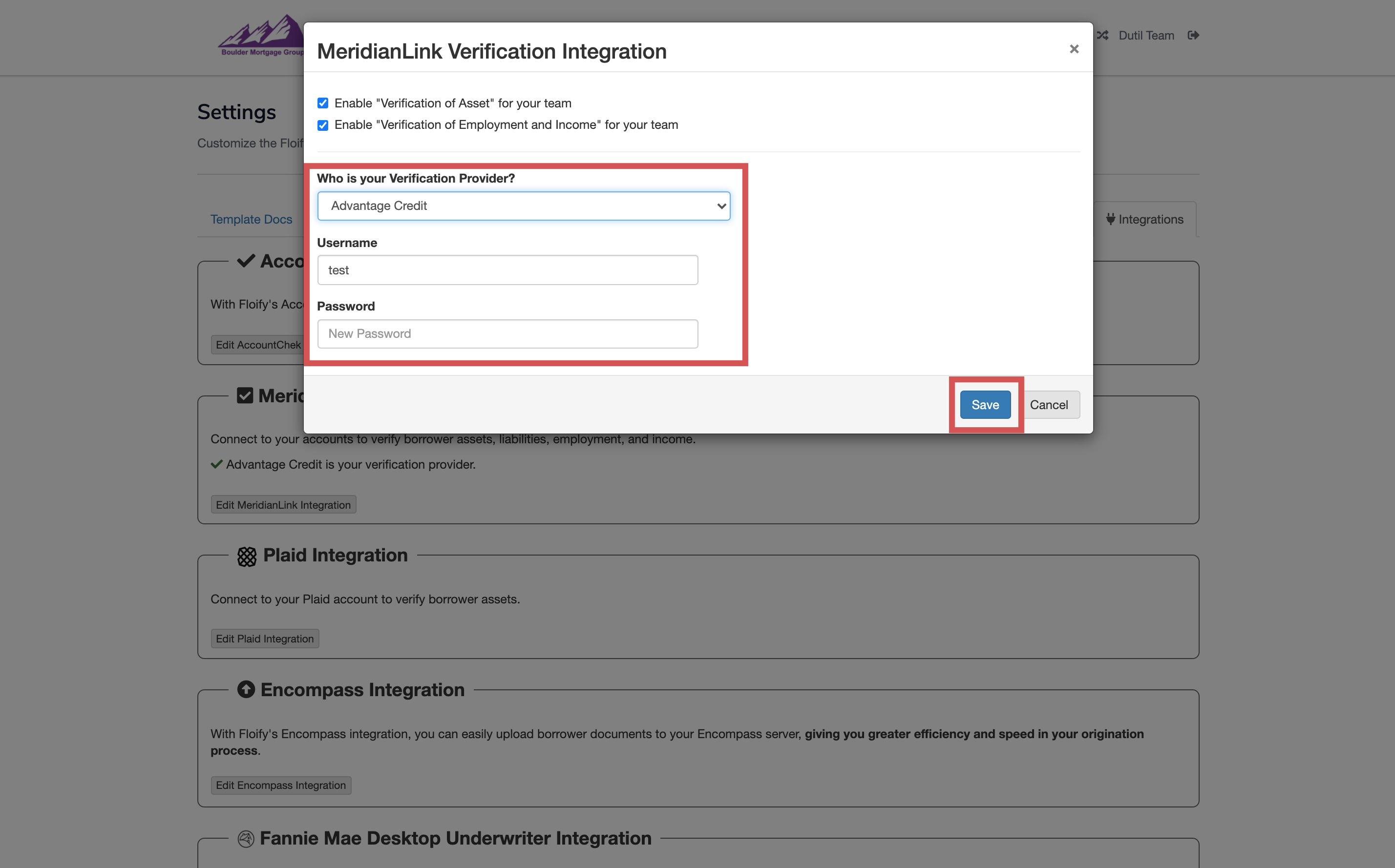

Select your verification provider from the dropdown and enter the credentials. Make sure you select Save to confirm the changes:

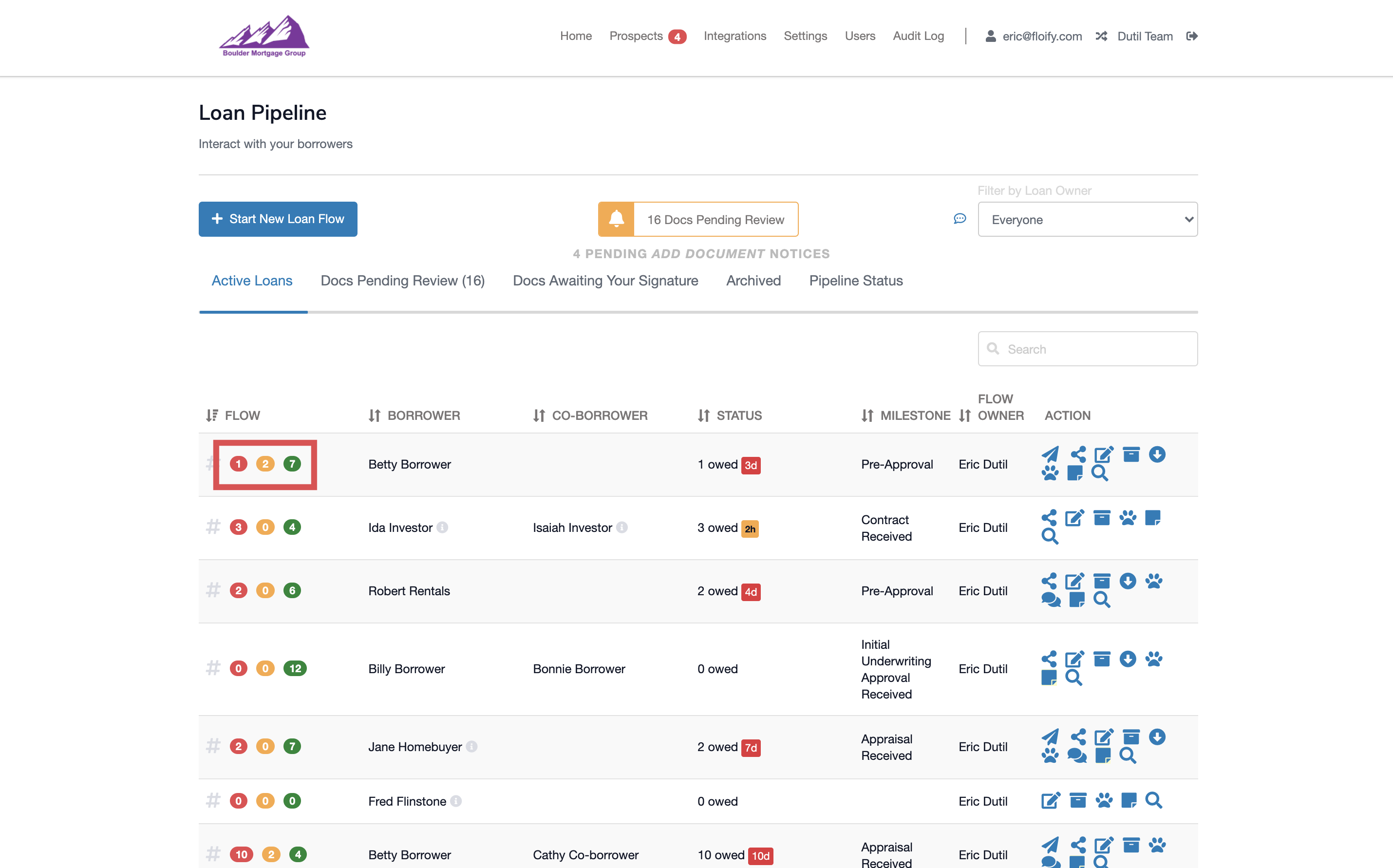

Click the red, yellow, or green buckets to get into the desired borrower's loan flow:

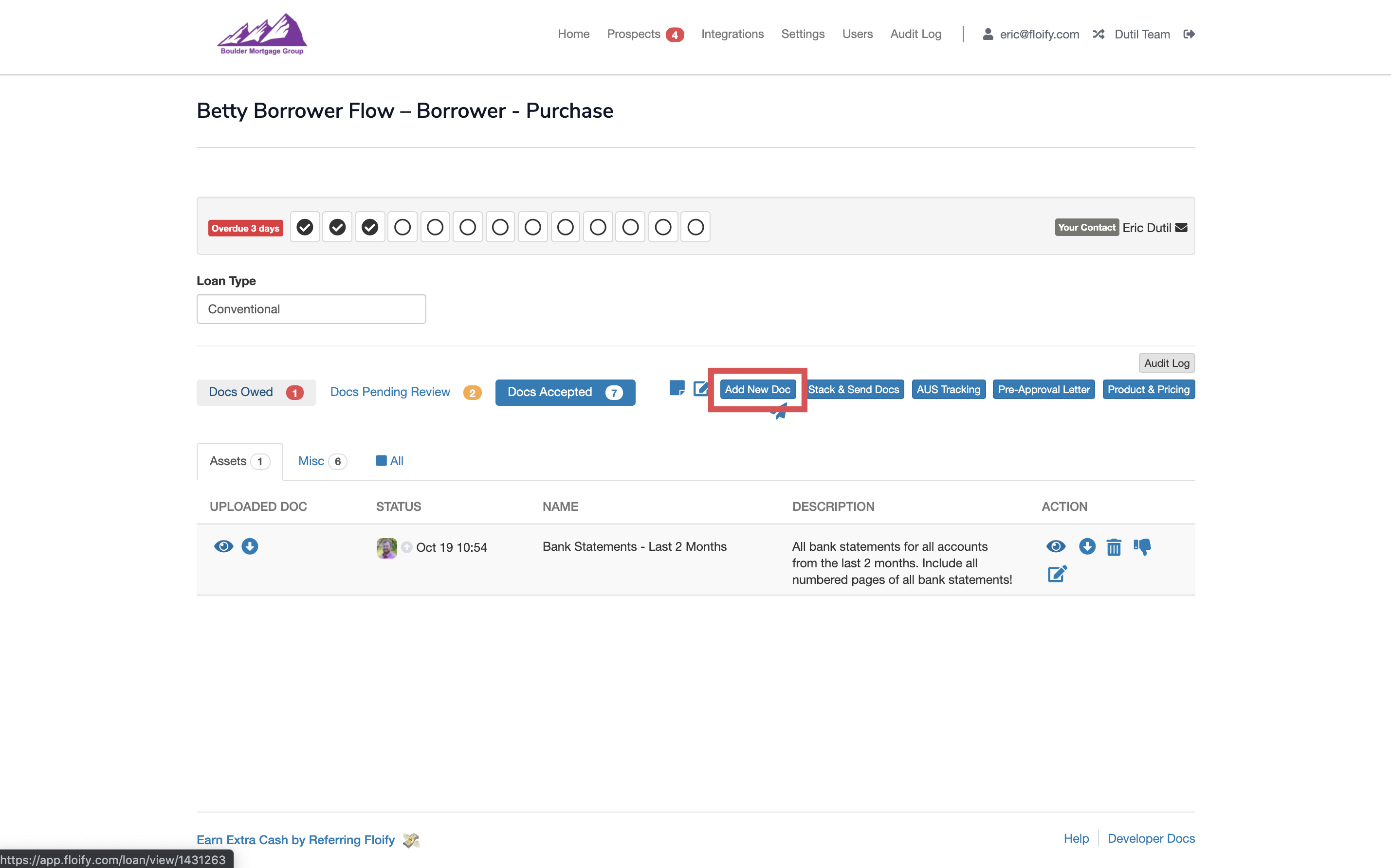

Select the Add New Doc button:

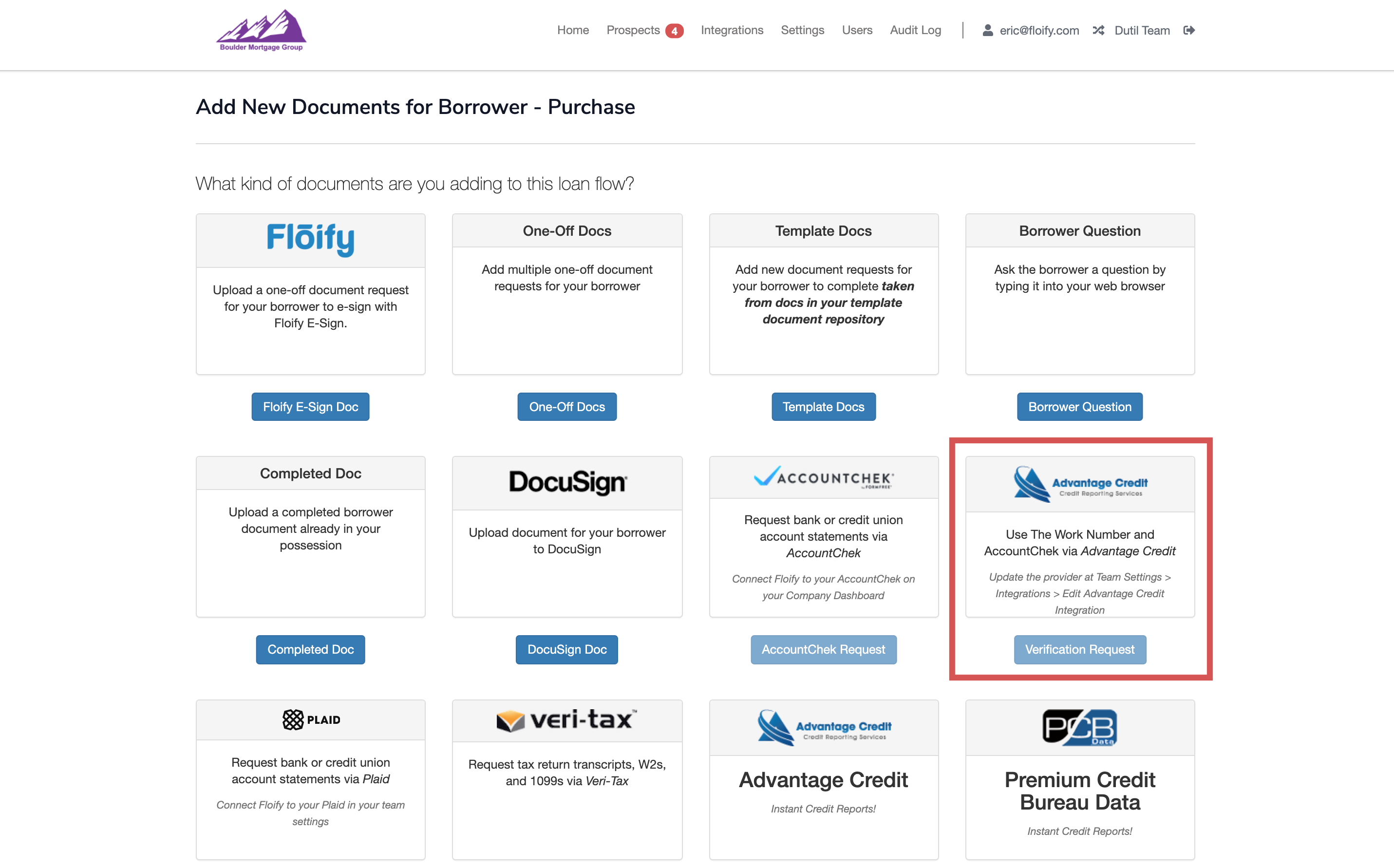

Locate the option to initiate a Verification Request for your specific vendor:

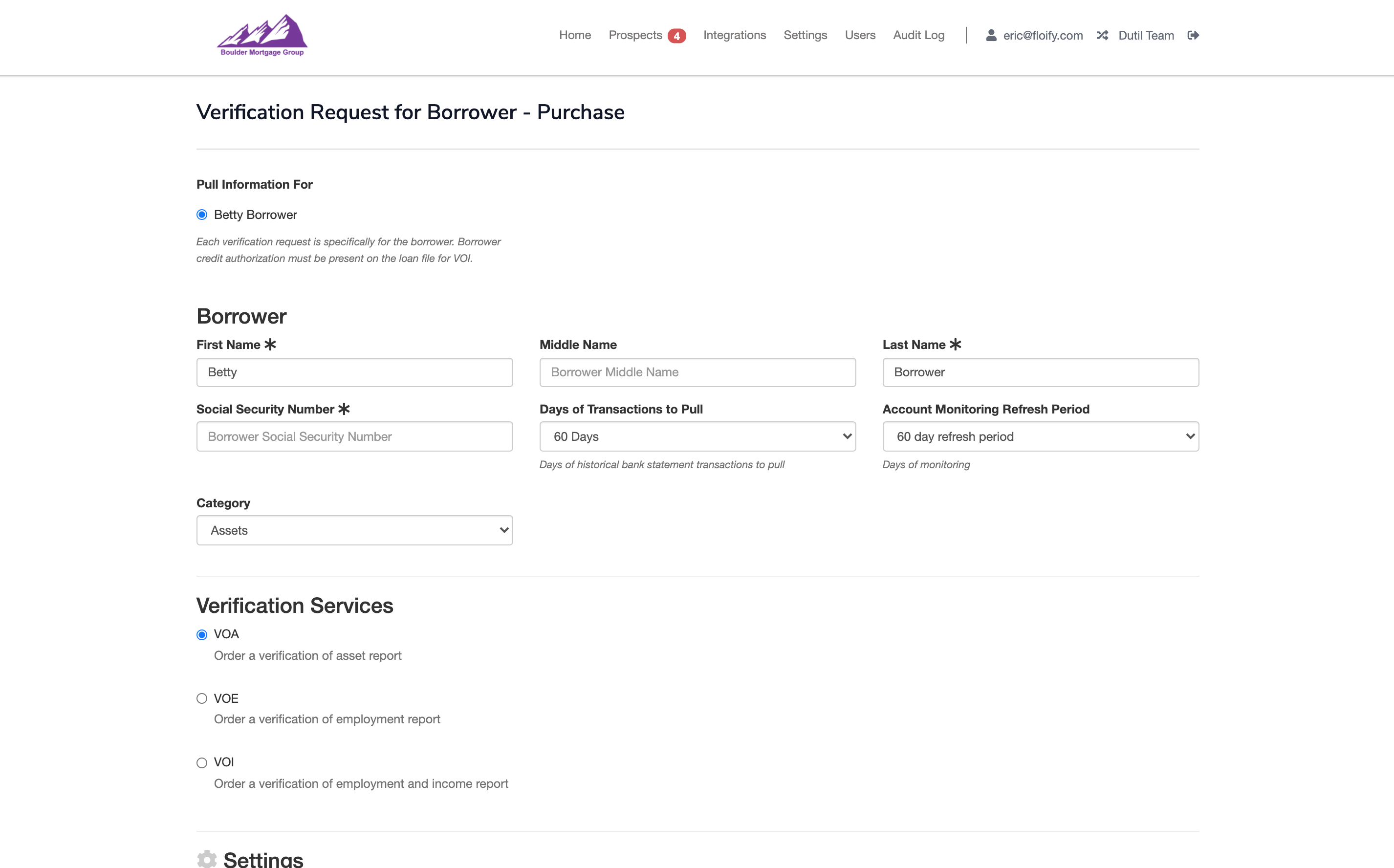

Complete the Verification Request and select the option to Place Order:

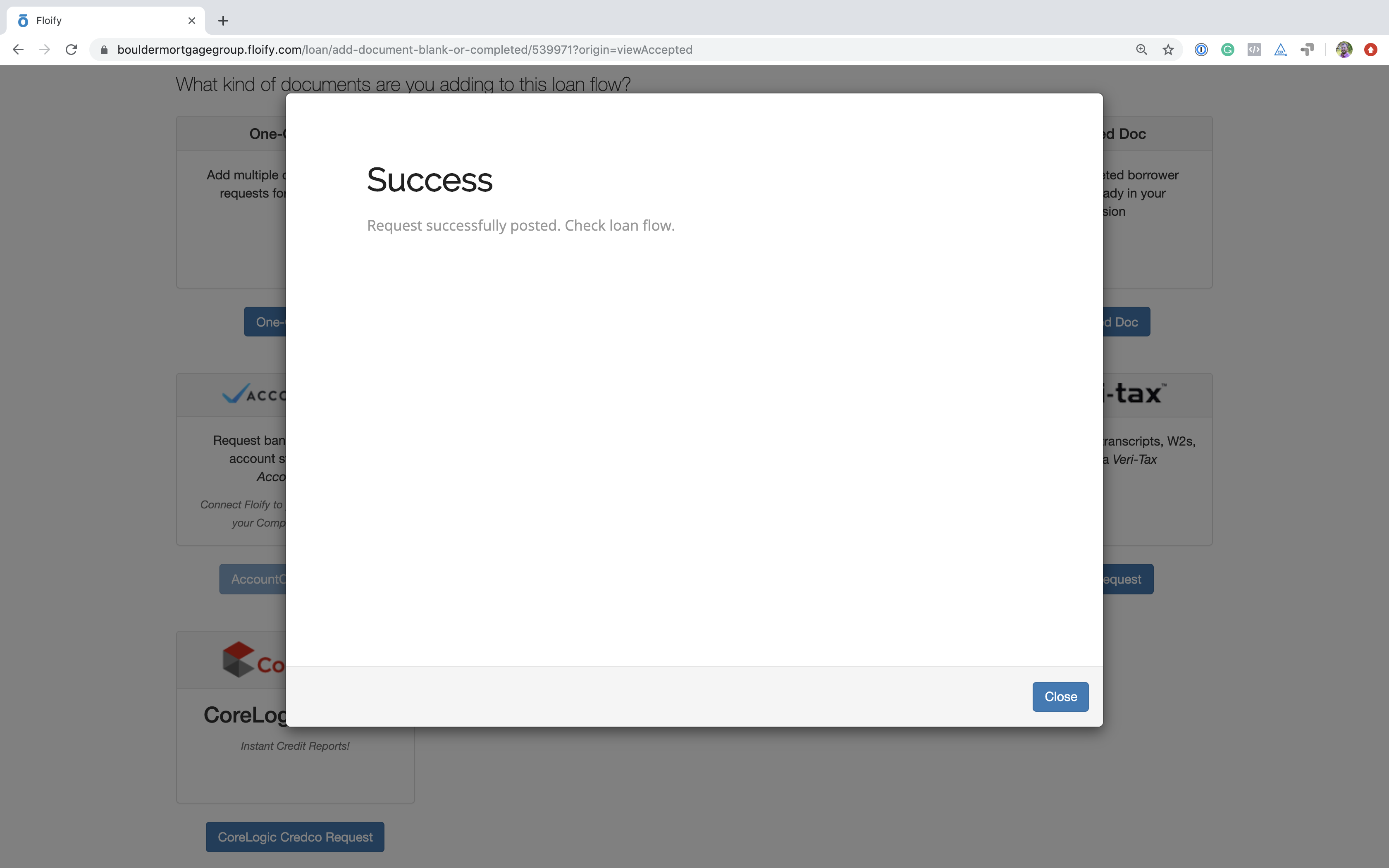

You will receive a Success message once the order has been placed:

After submitting the order form, the borrower’s VOA, VOI, or VOE report will be delivered to the yellow bucket of the corresponding loan flow within moments.

You can request verification of assets (VOA) only automatically upon completion of the loan application.

From the team pipeline, choose the team name in the upper right-hand corner and select the option to navigate to the Company Dashboard:

Navigate to Company Settings and select the Basic Settings tab:

Scroll down to locate Edit Basic Settings:

Enable Verification of Asset through AccountChek via MeridianLink or Verification of Employment and Income through the Work Number via MeridianLink as applicable. Make sure you select Save to confirm the changes:

Navigate to Home and switch back into the user's account:

From the team pipeline, navigate to Settings and select the Integrations tab:

Scroll down to MeridianLink Verification Integration and select the option to Edit MeridianLink Integration:

Enable Verification of Asset or Verification of Employment and Income as needed:

Select your verification provider from the dropdown and enter the credentials. Make sure you select Save to confirm the changes:

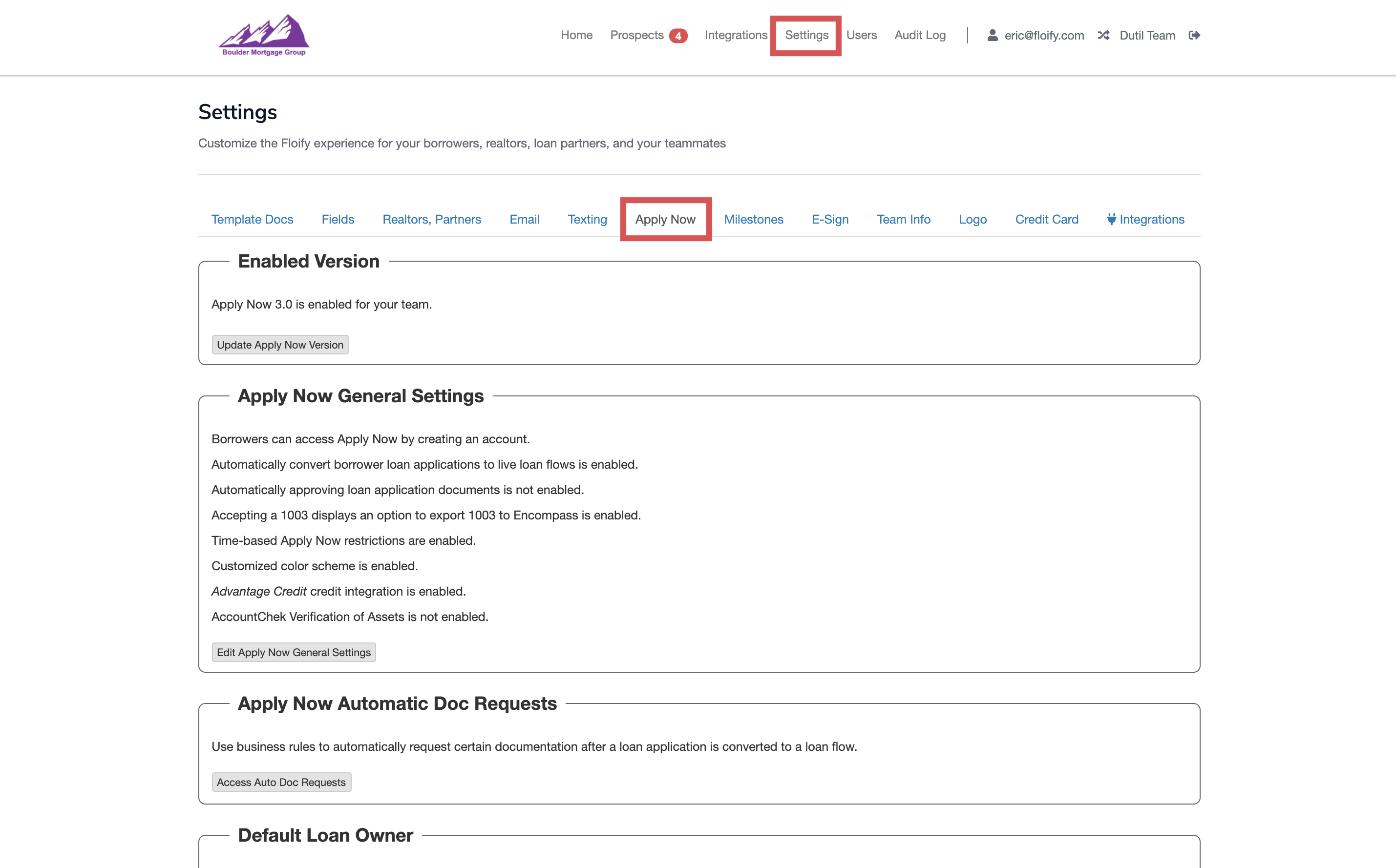

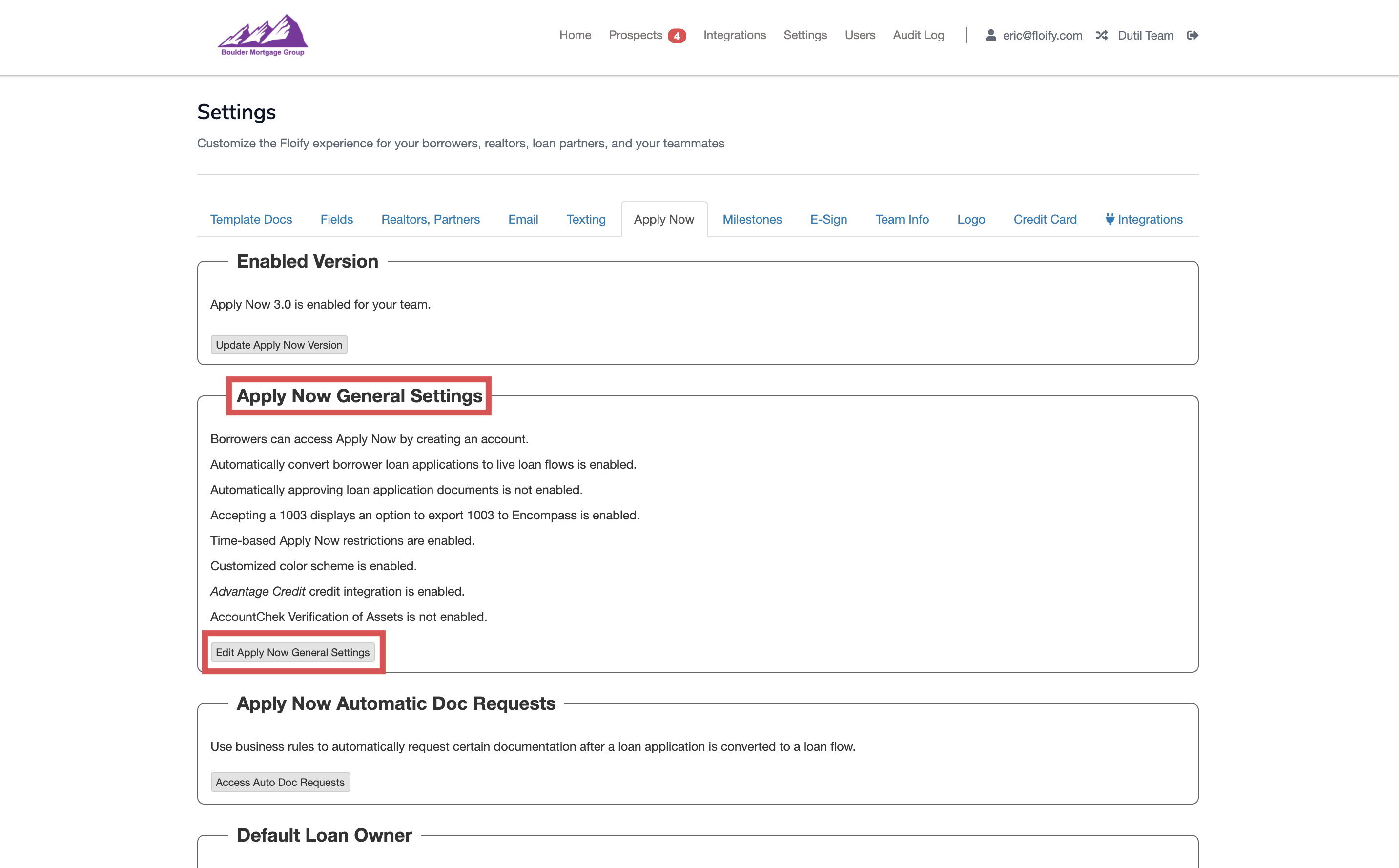

From your team pipeline, navigate to Settings and select Apply Now:

Scroll down to Apply Now General Settings and select the option to Edit Apply Now General Settings:

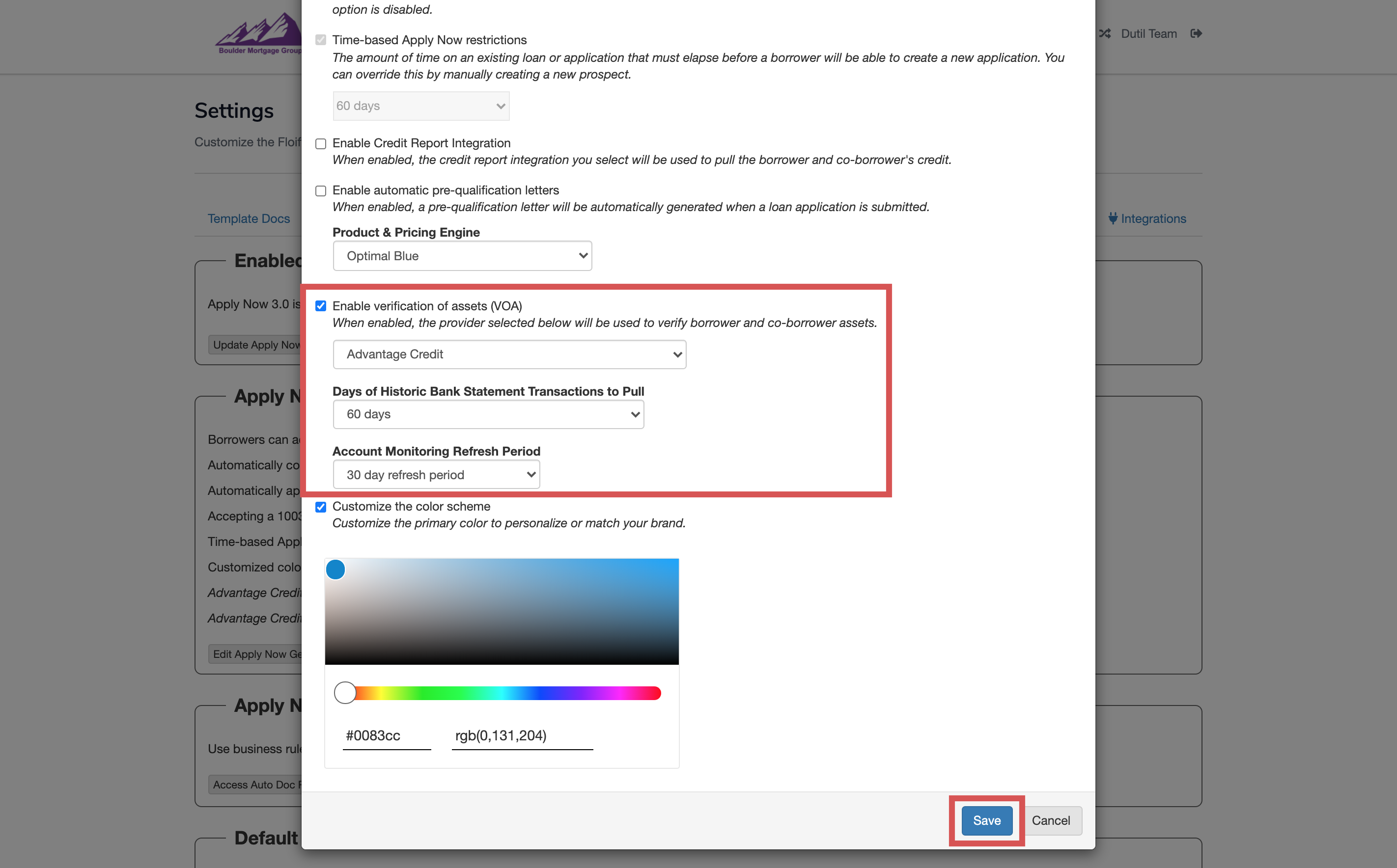

Select the option Enable verification of assets (VOA). Select the vendor from the dropdown. You will also have the option to select how many days of historic bank statement transactions to pull as well as the account monitoring refresh period. Make sure you select Save to confirm the changes:

Note: Only verification of assets (VOA) can be set up to be pulled automatically. VOI and VOE will need to be done as manual requests.

Ready to go! When a borrower applies this will automatically pull a VOA and the borrower’s VOA report will be delivered to the yellow bucket of the corresponding loan flow after it is converted from a prospect to a live loan flow.

Please sign in to leave a comment.