Who is Encompass?

Ellie Mae is a leading provider of innovative on-demand software solutions and services for the residential mortgage industry. Ellie Mae’s Encompass digital mortgage solution provides one system of record that enables banks, credit unions and mortgage lenders to originate and fund mortgages and improve compliance, loan quality and efficiency.

Contact Encompass via https://www.elliemae.com.

Integration type: LOS

What will the Floify—Encompass Integration support?

When the integration is configured and active:

- Documents uploaded to Floify will be synced the the loan folder within Encompass

- Encompass loan files can be automatically created upon the start of a loan flow in Floify

- Seamless importing of Fannie Mae 1003 loan data will be available

- One-way sync of milestones from Encompass to Floify and triggering of Floify-based automated email/SMS updates will be available

- Borrower electronic consent (eConsent) will be uploaded into Encompass

How to Set Up and Use

This section describes the Floify Encompass integration implementation details for two-way data communication between Floify and Encompass.

The steps detailed in the articles in this section are typically performed by your Encompass Administrator.

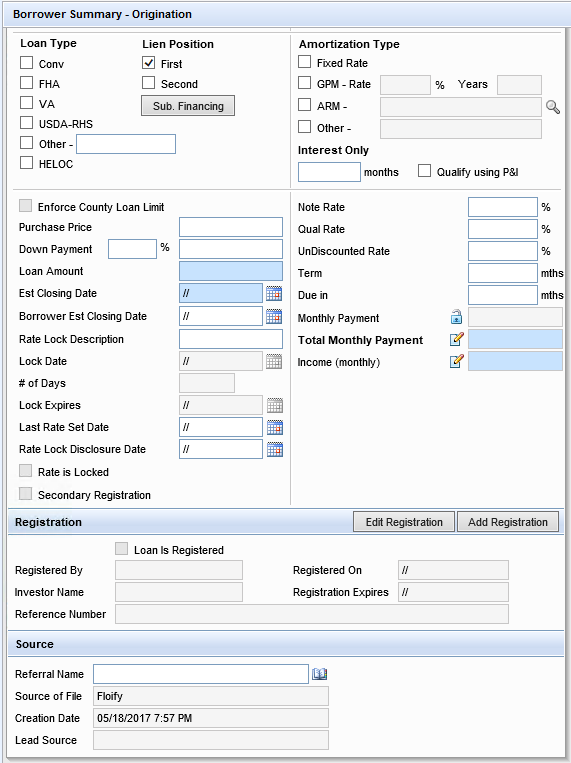

When Floify’s Encompass integration is enabled, once the borrower submits the loan application, the following occurs:

- An Encompass loan file is created.

- The LO is assigned ownership on that Encompass loan file.

- The “Source of File” field is set in Encompass on that loan file.

- The LO Team is notified by email.

- The loan application is added to the LO Team’s Prospects page, along with the eConsent and Credit Auth in PDF form.

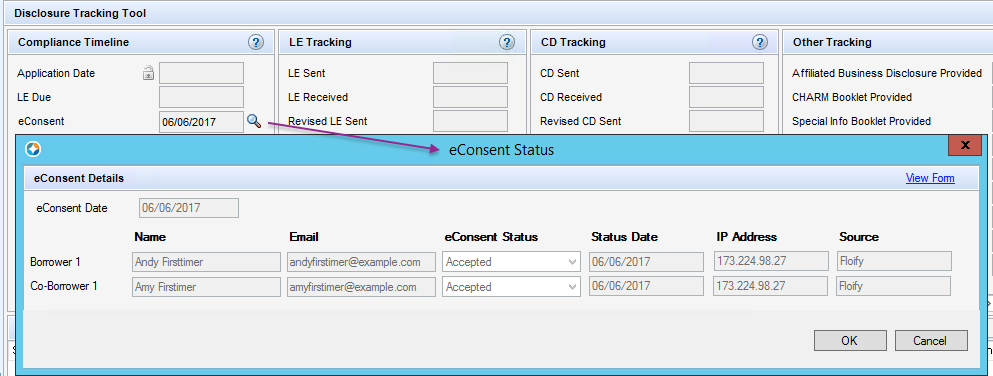

Floify has the ability to set the following fields within eConsent Details in Encompass in order to reflect the eConsent collected by Floify, both within Floify's Apply Now as well as when borrowers enter Floify by receiving a Needs List email.

Floify also sets appropriately Encompass fields for the Borrower Credit Authorization, detailed below.

eConsent

| Encompass Field ID | Encompass Field Description |

|---|---|

| 3983 | eConsent Date — The date on which the last borrower on the loan file eConsents. |

| 3984 | Borrower 1 eConsent Status — "Accepted" or blank |

| 3985 | eConsent Borrower Date Accepted Pair 1 |

| 3986 | eConsent Borrower IP Address Pair 1 |

| 3987 | eConsent Borrower Source Pair 1 — "Floify" |

| 3988 | Co-Borrower 1 eConsent Status — "Accepted" or blank |

| 3989 | eConsent Co-Borrower Date Accepted Pair 1 |

| 3990 | eConsent Co-Borrower IP Address Pair 1 |

| 3991 | eConsent Co-Borrower Source Pair 1 — "Floify" |

eConsent alerts are cleared on the loan when all borrowers complete their eConsent

Borrower Credit Authorization

Borrower Credit Authorization fields in Encompass are detailed below.

| Encompass Field ID | Encompass Field Description |

|---|---|

| 4073 | Borrower Y/N |

| 4074 | Borrower Date Authorized |

| 4075 | Borrower Authorization Method - Internet |

| 4076 | Co-Borrower Y/N |

| 4077 | Co-Borrower Date Authorized |

| 4078 | Co-Borrower Authorization Method - Internet |

Floify updates different Encompass fields in different situations, which are documented below.

| Encompass Field ID | Use Case |

|---|---|

| 1822 (Referral Name) | When a borrower completes an online loan application and completes the Who Referred You to Us? field. |

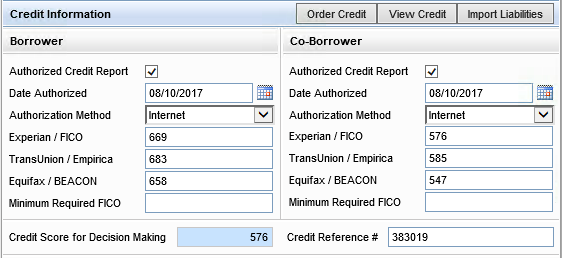

Credit Report Apps in the Floify App Store

For Credit Report apps in the Floify App Store, the following Encompass fields are populated when a Credit Report app returns credit scores.

| Encompass Field ID | Encompass Field Description |

|---|---|

| 300 | Credit Reference # |

| 67 | Experian / FICO Borrower |

| 60 | Experian / FICO Co-Borrower |

| 1450 | TransUnion / Empirica Borrower |

| 1452 | TransUnion / Empirica Co-Borrower |

| 1414 | Equifax / BEACON Borrower |

| 1415 | Equifax / BEACON Co-borrower |

Borrower Summary - Origination Form with updated credit score information.

The Work Number App in the Floify App Store

The Work Number app in the Floify App Store will be enhanced to populate the following borrower and co-borrower fields in the 1003 after a verification of employment request completes.

| 1003 Field |

| Name & Address of Employer |

| Yrs on this job |

| Dates (from - to) |

| Position/Title/Type of Business |

| Business Phone (incl. area code) |

AccountChek Encompass Fields

When Floify receives a Verification of Asset report from AccountChek, Floify updates the following Encompass fields with the AccountChek reissue key for the VOA report.

Fannie can take either the report ID or the reissue key. Freddie expects the reissue key.

| Encompass Field ID | Encompass Field Description |

|---|---|

| FANNIESERVICE.X3 | GSE Vendor Provider Data - AccountChek ID (Bor) |

| FANNIESERVICE.X4 | GSE Vendor Provider Data - AccountChek ID (CoBor) |

| CASASRN.X31 | Freddie Mac AccountChek Asset ID (Bor) |

| CASASRN.X32 | Freddie Mac AccountChek Asset ID (CoBor) |

Please sign in to leave a comment.