Overview

What is a promissory note?

Whoever possesses that piece of paper is entitled to enforce the debt obligation. When mortgages get sold, this physical piece of paper is transferred. Whoever has the promissory note has rights to enforce debt obligation. If a borrower discontinues mortgage payment and goes into bankruptcy court proceeding, if a lender cannot produce this physical piece of paper, the borrower is off the hook.

So what is an eNote?

However, this move from physical notes to digital raises a new problem: what happens if two parties have a copy of this? How can a lender prove their copy is authoritative and enforceable in court?

To address this, we are using eOriginal's technology to ensure that all eNotes are created, transferred, and maintained in a secure eVault, where the eNote is stored with a tamper-evident seal. As the eNote moves and signatures are executed, the eNote is stored within eOriginal and registered with the MERS eRegistry to create a formal audit trail for use in court, if ever needed.

Prerequisites to use eNotes

- Encompass

- Hybrid eClosing

- Floify E-Sign or DocuSign (eNotes will be available for closing documents signed through either platform)

Configuration

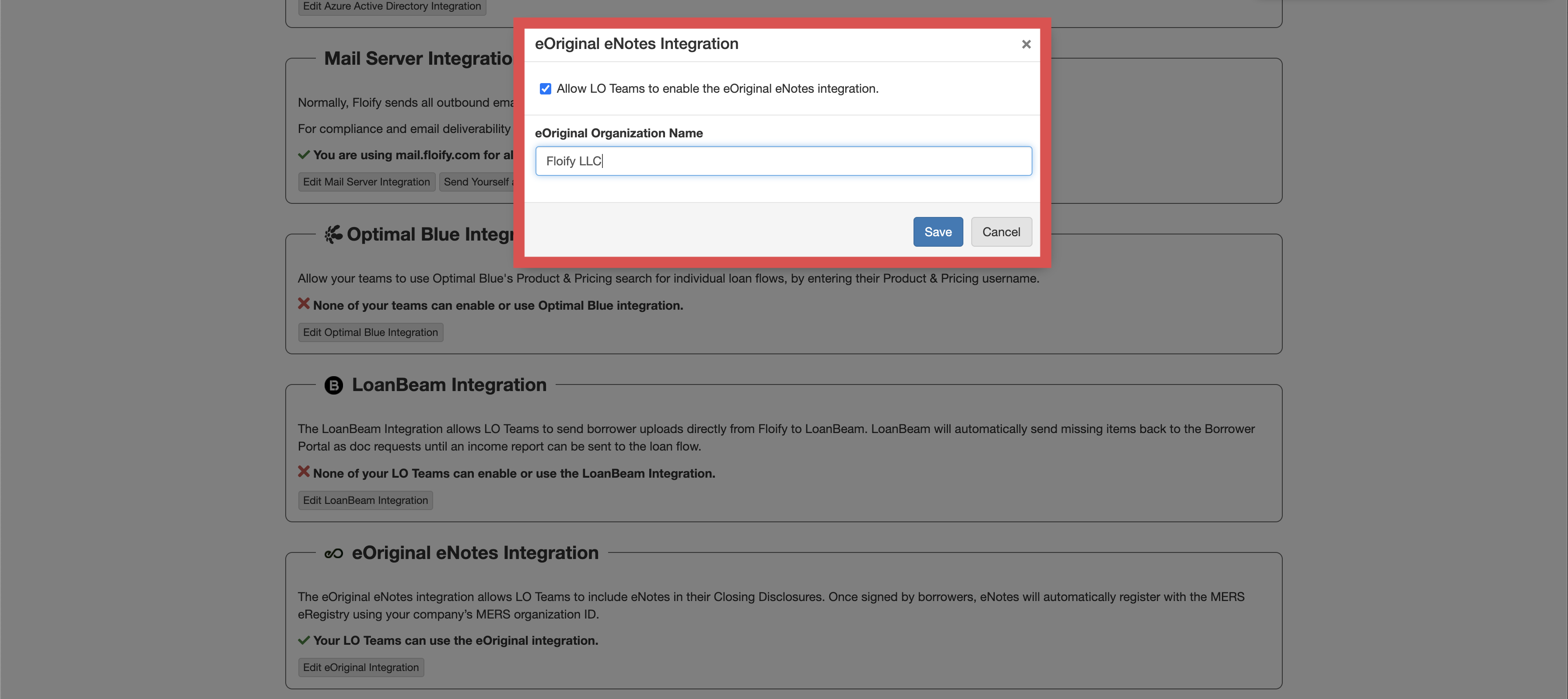

Enabling the eOriginal integration at the company level

Company admins can enable this for their LO Teams in the company dashboard under Company Settings > Integrations > eOriginal Notes Integration > Edit eOriginal Integration. They will just be required to enter their company's eOriginal Organization Name which is then inherited by all of their teams who use it:

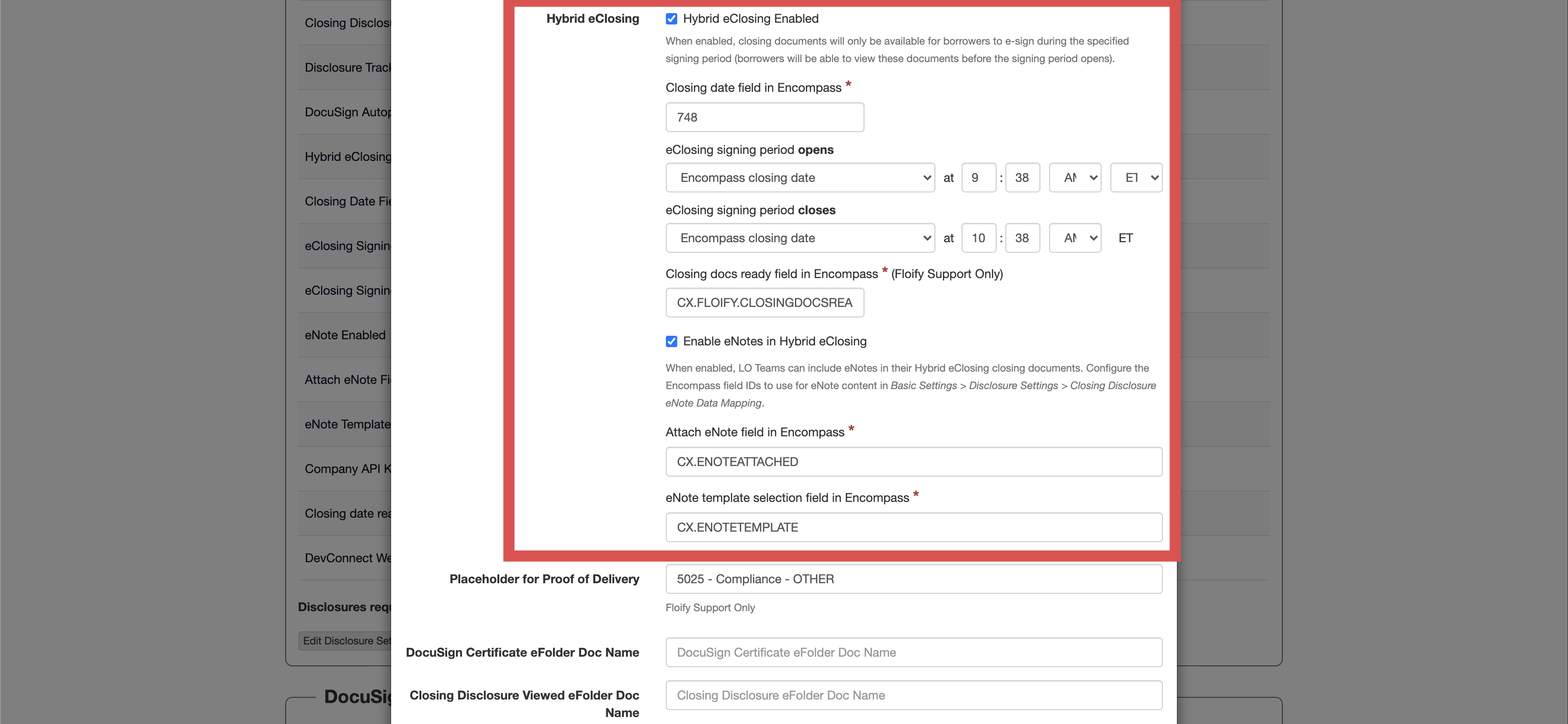

Enabling eNotes to be used in Hybrid eClosing

To enable eNotes in the Hybrid eClosing workflow, company admins must access Company Settings > Basic Settings > Disclosure Settings > Edit Disclosure Settings and enable the feature.

Once this checkbox is checked, the user will need to enter two IDs for custom Encompass fields which they will need to create. One to link to a checkbox inside each loan file in Encompass that allows teams to order an eNote for that particular loan, and another to a dropdown that teams will use to specify the specific eNote template to use for that loan:

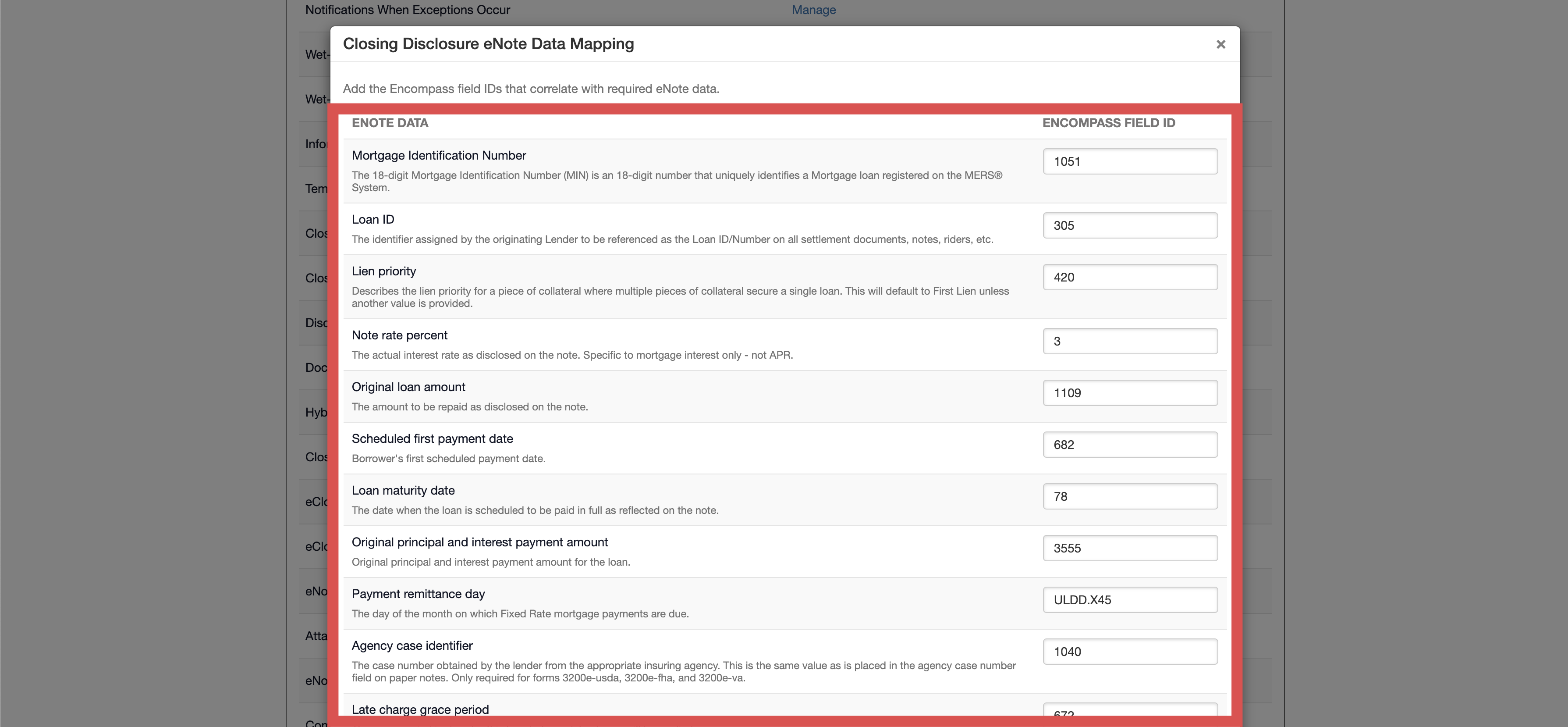

Mapping eNote data to Encompass field IDs

When an eNote is generated, Floify sends through data pertaining to the loan, borrowers, lender, etc. that eOriginal stamps on the eNote prior to signatures being executed. The types of data being stamped will vary by each template.

To ensure that the data being stamped is suitable for each company's preferences, the company admin can customize each piece of data to be stamped to the Encompass field ID of their choice by accessing Company Settings > Basic Settings > Disclosure Settings > Closing Disclosure eNote Data Mapping:

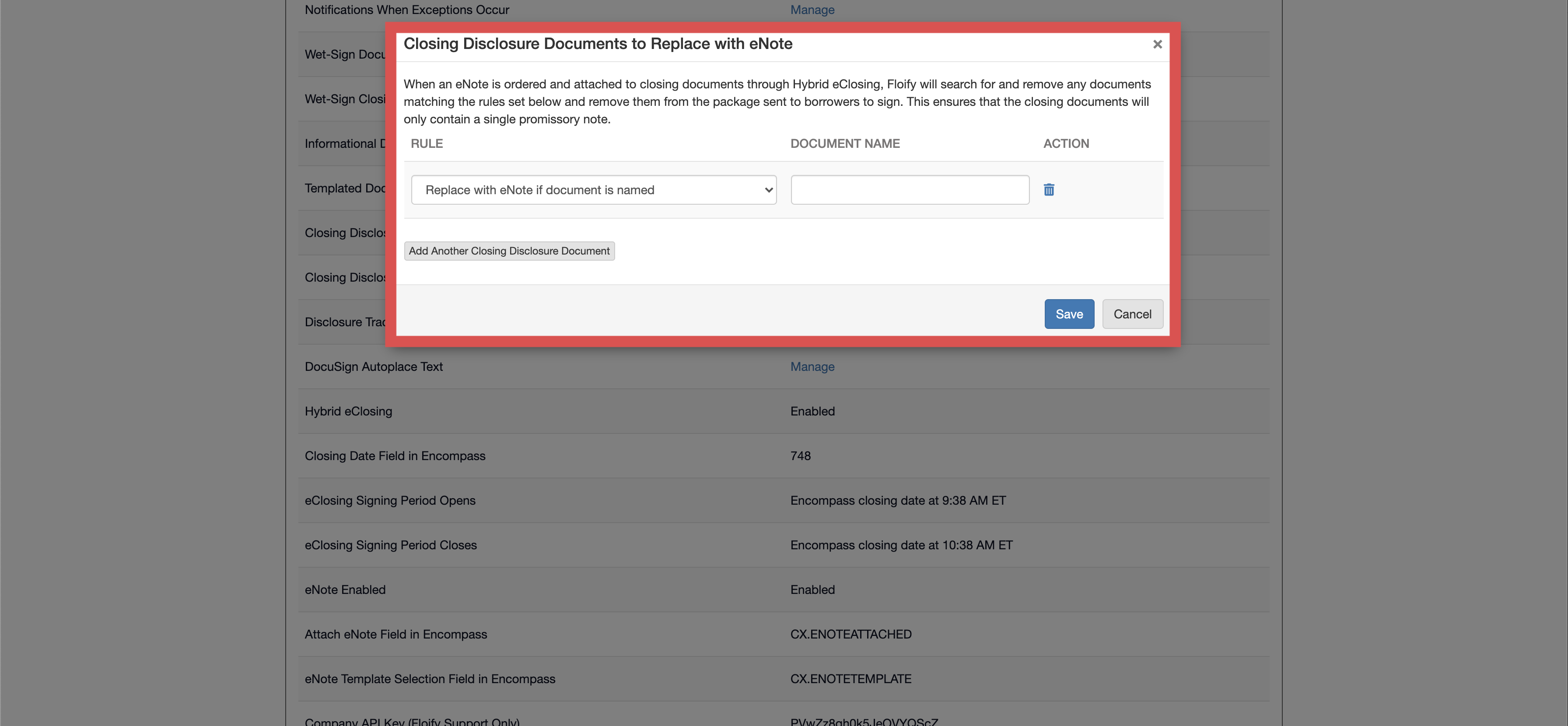

Declaring eNote documents from other sources to replace with Floify eNotes

One thing that must be avoided is two different promissory notes (digital, physical, or either) being delivered to borrowers to sign in the closing documents package. To ensure this does not happen, company admins can access Company Settings > Basic Settings > Disclosure Settings > Closing Disclosure Documents to Replace with eNote and set up rules for documents to remove if a Floify eNote is in the closing docs. For example, if loans through my company receive promissory notes through Ellie Mae and they always have a naming convention including "Promissory Note", we can set up a rule here to essentially say "if I am adding a Floify eNote, check for any documents containing the term 'Fixed-Rate Note' and remove them.":

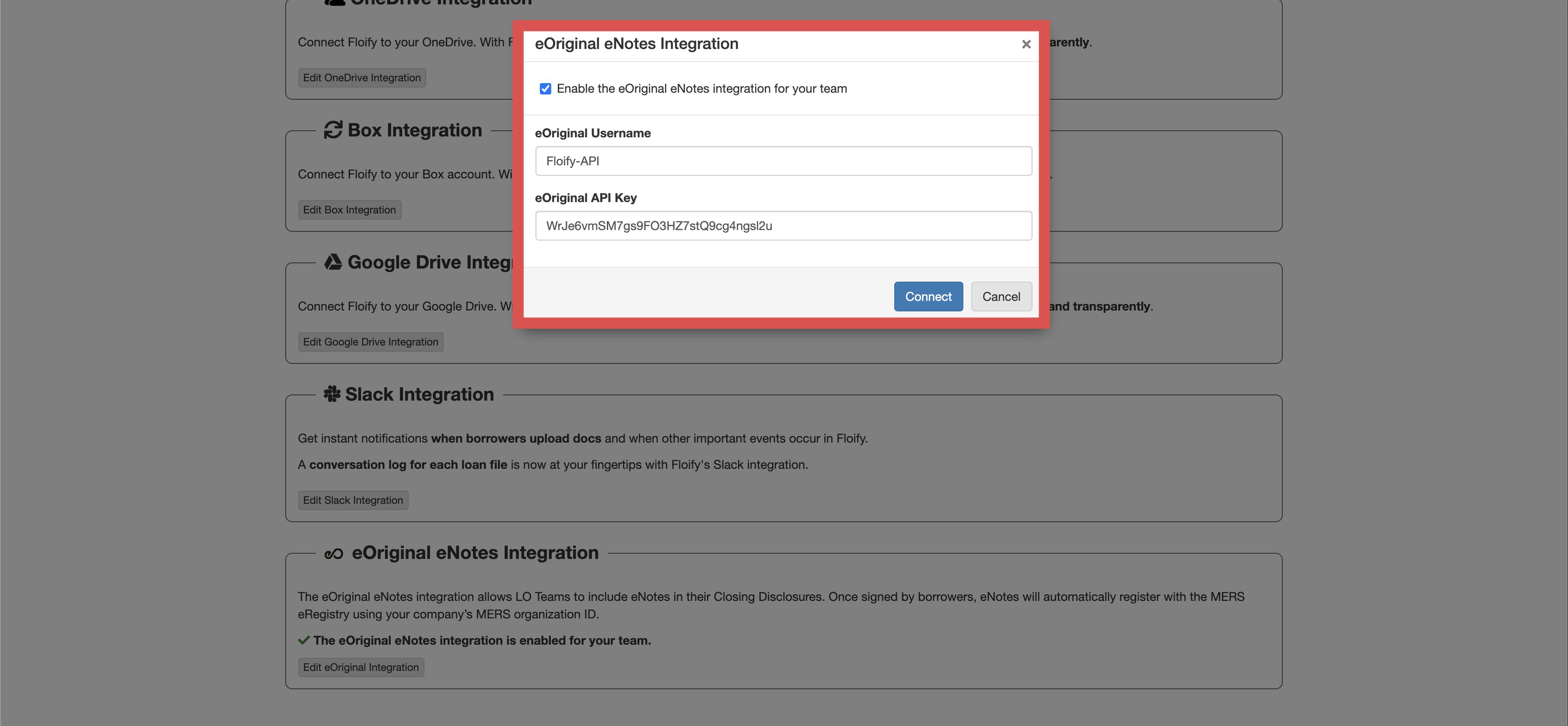

Enabling the eOriginal integration at the team level

When the LO team is ready to enable the eOriginal integration (and subsequently the eNotes feature), they can do so in Settings > Integrations > eOriginal eNotes Integration > Edit eOriginal Integration. The team will only need to provide their eOriginal username and API Key generated in eOriginal's Command Center:

Ordering an eNote through Encompass

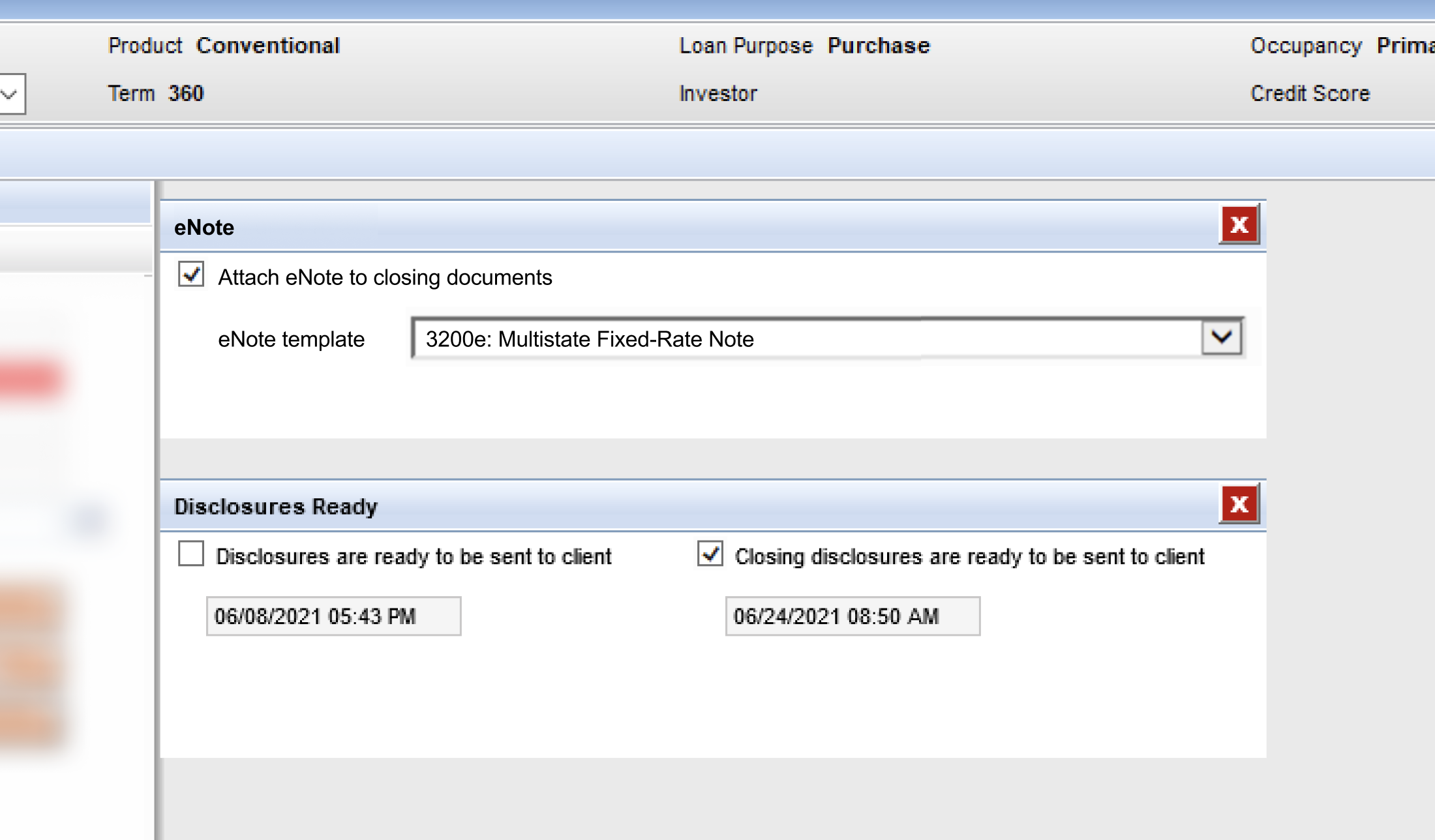

If a loan requires an eNote to be created through eOriginal, users will check the Encompass field labeled "Attach eNote to closing documents" before selecting the specific eNote template that needs to be used from the dropdown labeled "eNote template":

There are many different templates offered by eOriginal, catering to different loan information such as rate type, property state, and many other factors. The user must decide which template to use based on the loan in question.

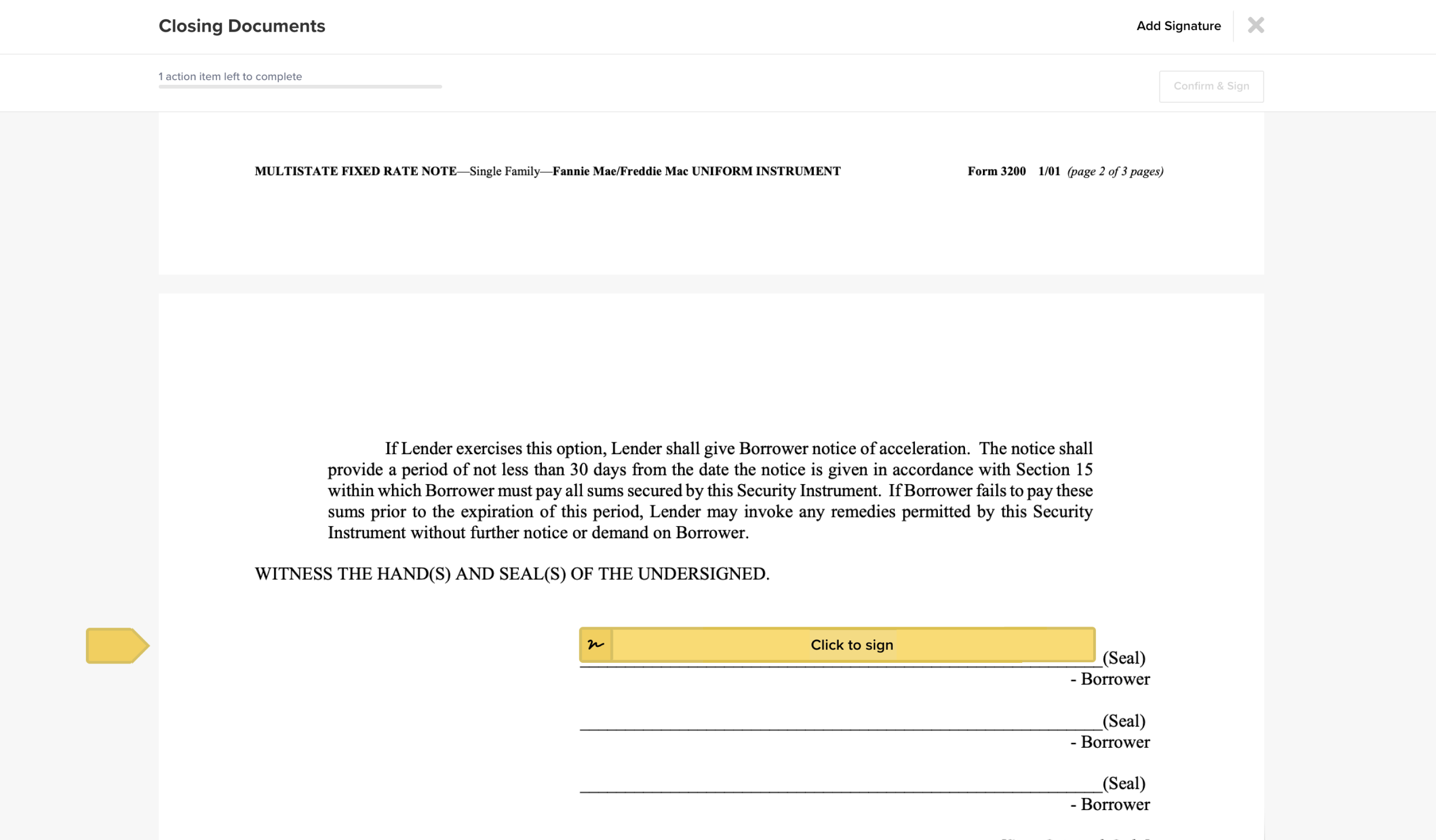

Signing view for borrowers

After signatures are executed (watermarking and MERS registration)

- All copies of the eNote that reside outside of the secure eVault will be watermarked with something indicating that it is a "Non-Authoritative Copy", meaning that it cannot be used to prove entitlement to enforce debt obligation on the loan. The only "Authoritative Copy" of the eNote will reside in that secure eVault.

- The eNote will be registered with the MERS (Mortgage Electronic Registration System) eRegistry, which provides a clear system of record for identifying the holder of the the authoritative copy of the eNote.

Please sign in to leave a comment.