Overview

Enabling soft credit pulls allows Floify to run a soft credit pull automatically when a borrower successfully submits a loan application started from the landing page, apply now page, or Prospects page. A soft, tri-merge credit report will then show up in the borrower's loan flow for review. The report is private so a borrower is not able to see it.

Soft credit pulls will pull a tri-merge report from all 3 credit bureaus (Equifax, TransUnion, Experian).

This help article provides a tutorial on how to enable soft credit pulls at the company and team levels.

We support soft credit pulls with the following credit reporting agencies:

- Avantus

- Advantage Credit

- Alliance 2020

- Birchwood Credit Services

- Certified Credit Reporting

- CIC Credit

- CIS

- Cisco Credit

- Clear Choice Credit

- CoreLogic Credco

- Credit Plus

- Credit Technologies

- Credit Technology Inc.

- CRS Credit

- Factual Data by CBC

- Informative Research

- ISC Credit

- KCB Credit

- Partners Credit

- Premium Credit Bureau

- Premium Credit Bureau Data

- Sarma

- SettlementOne

- Universal Credit Services

How to Setup and Use

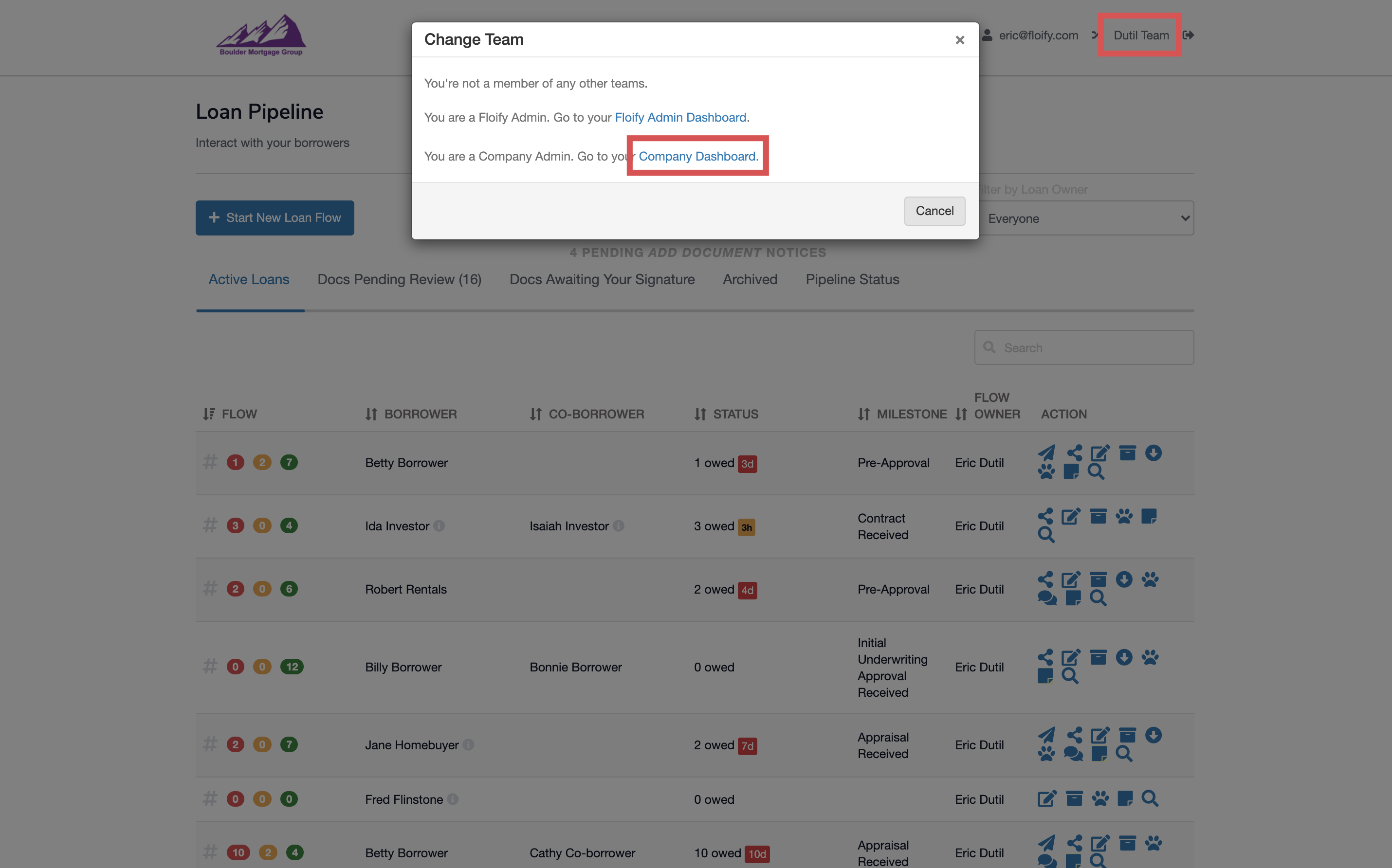

From the team pipeline, choose the team name in the upper right-hand corner and select the option to navigate to the Company Dashboard:

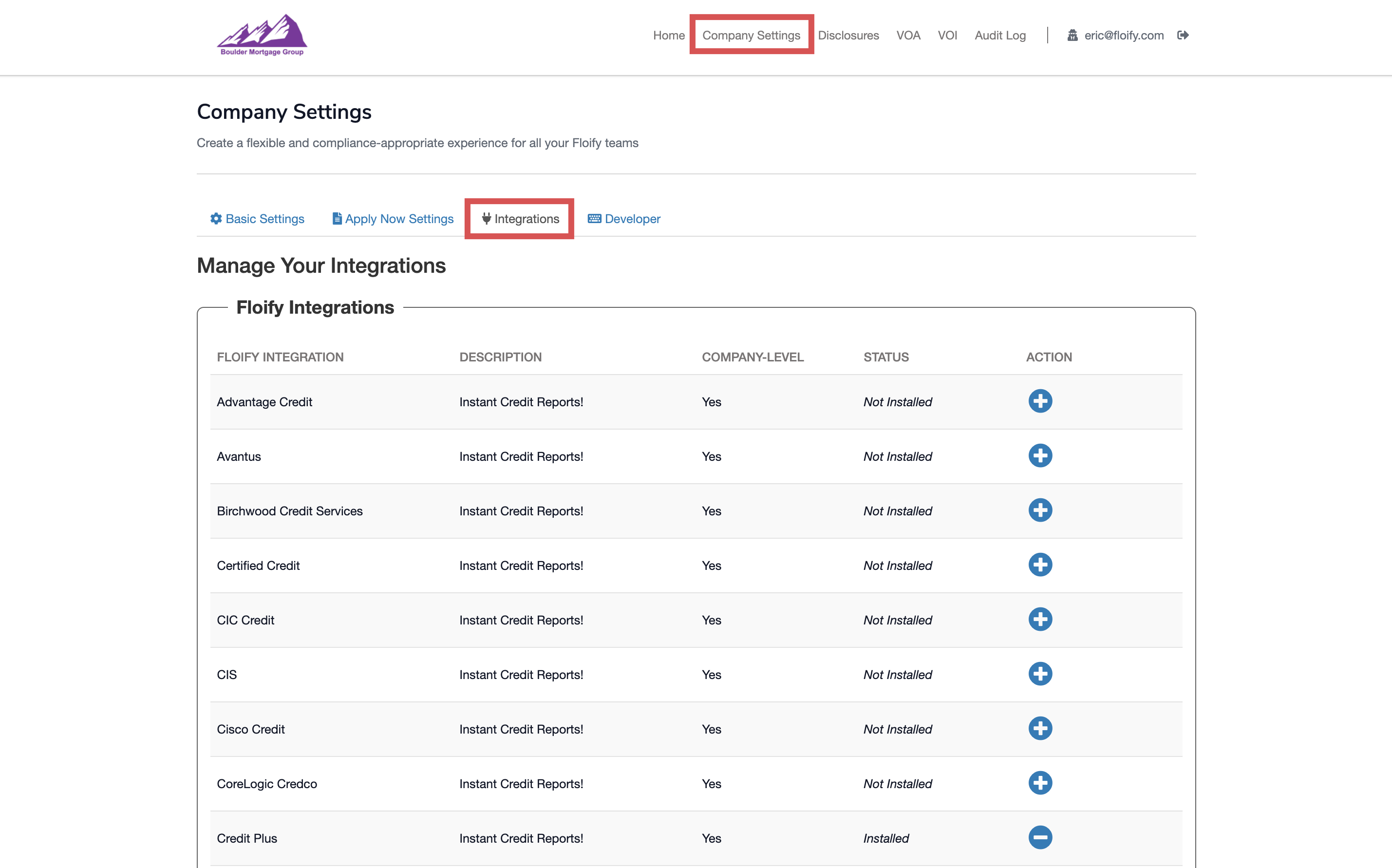

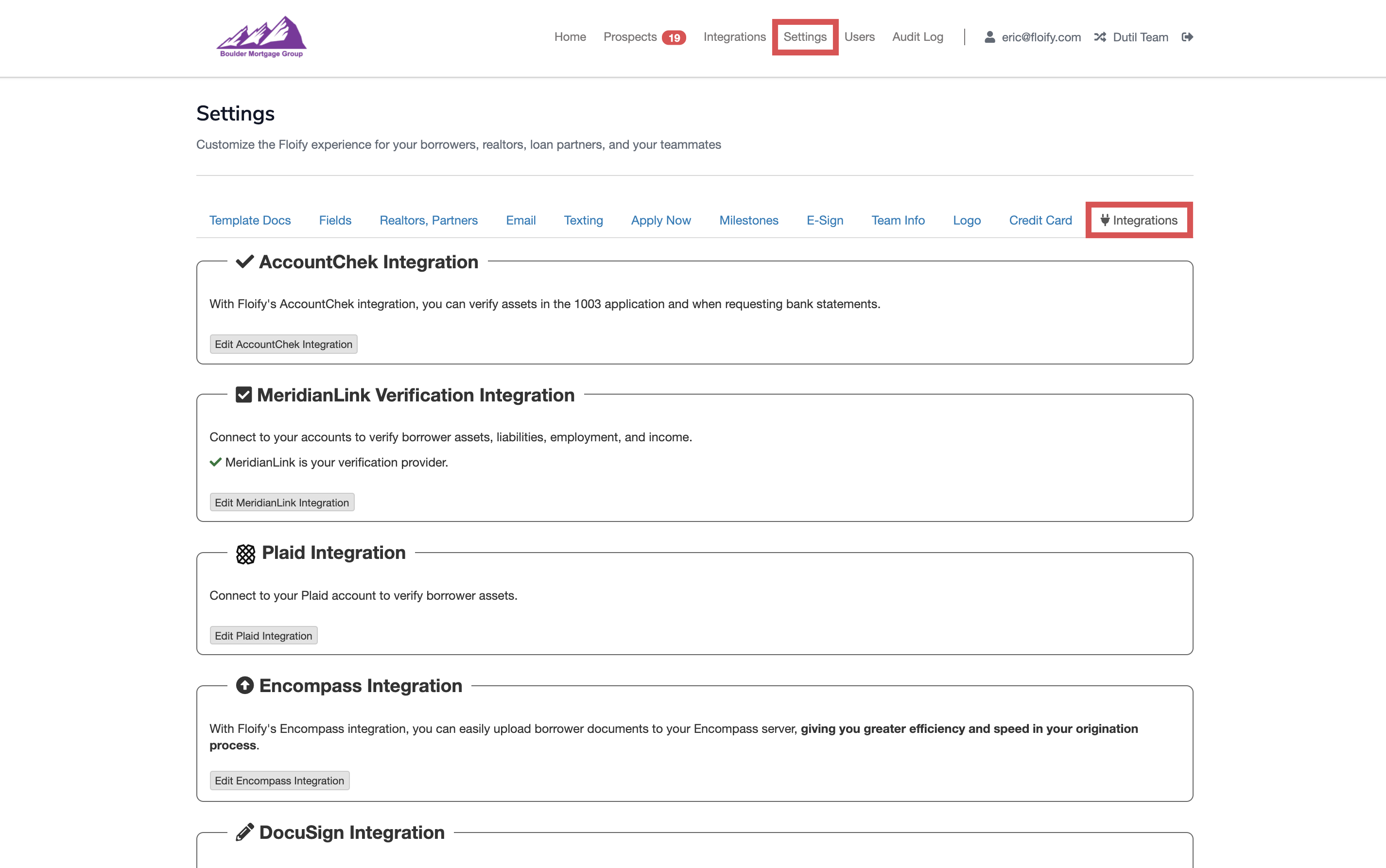

Navigate to Company Settings and select the Integrations tab:

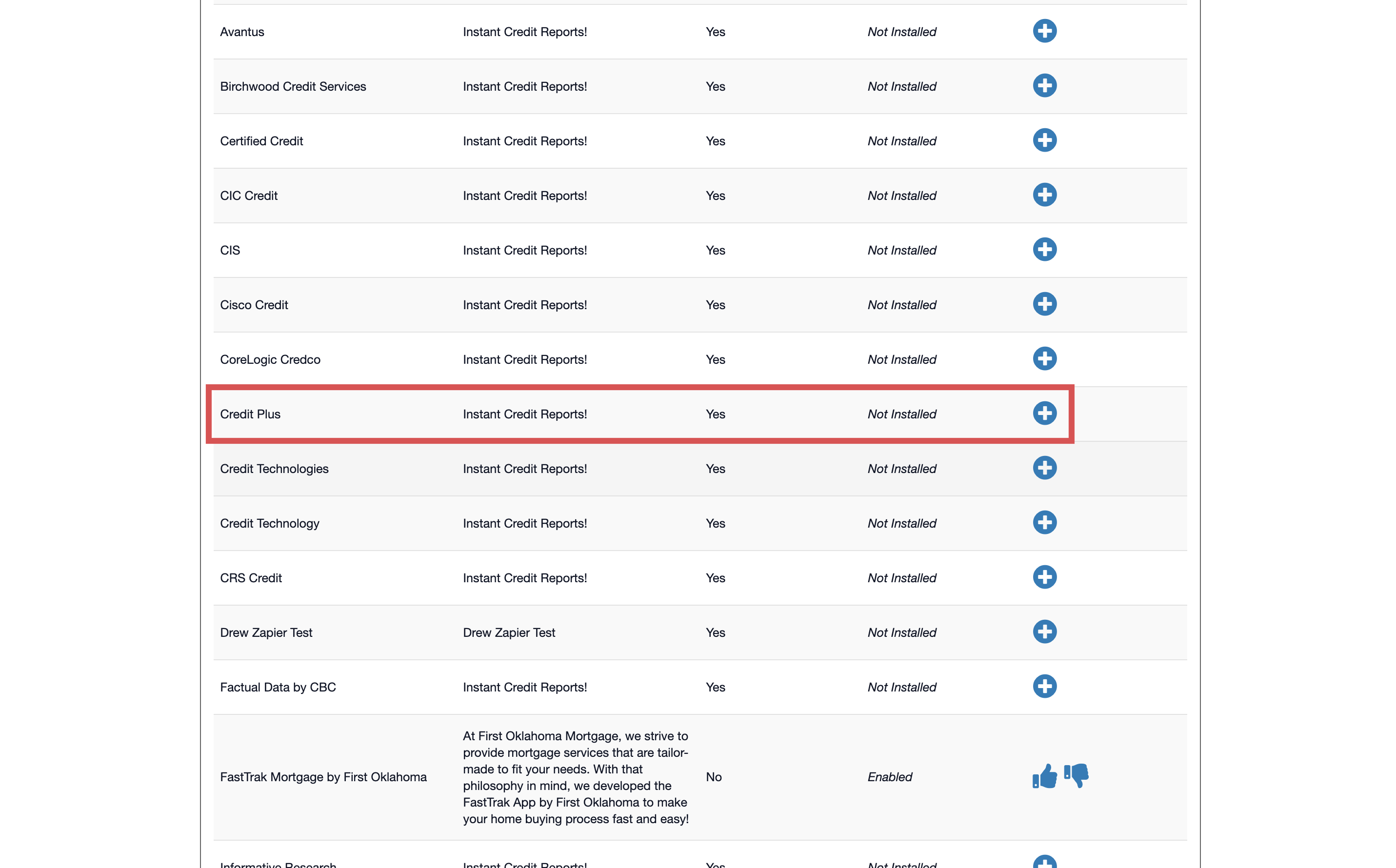

Locate your credit reporting agency and select the plus sign on the right-hand side to install:

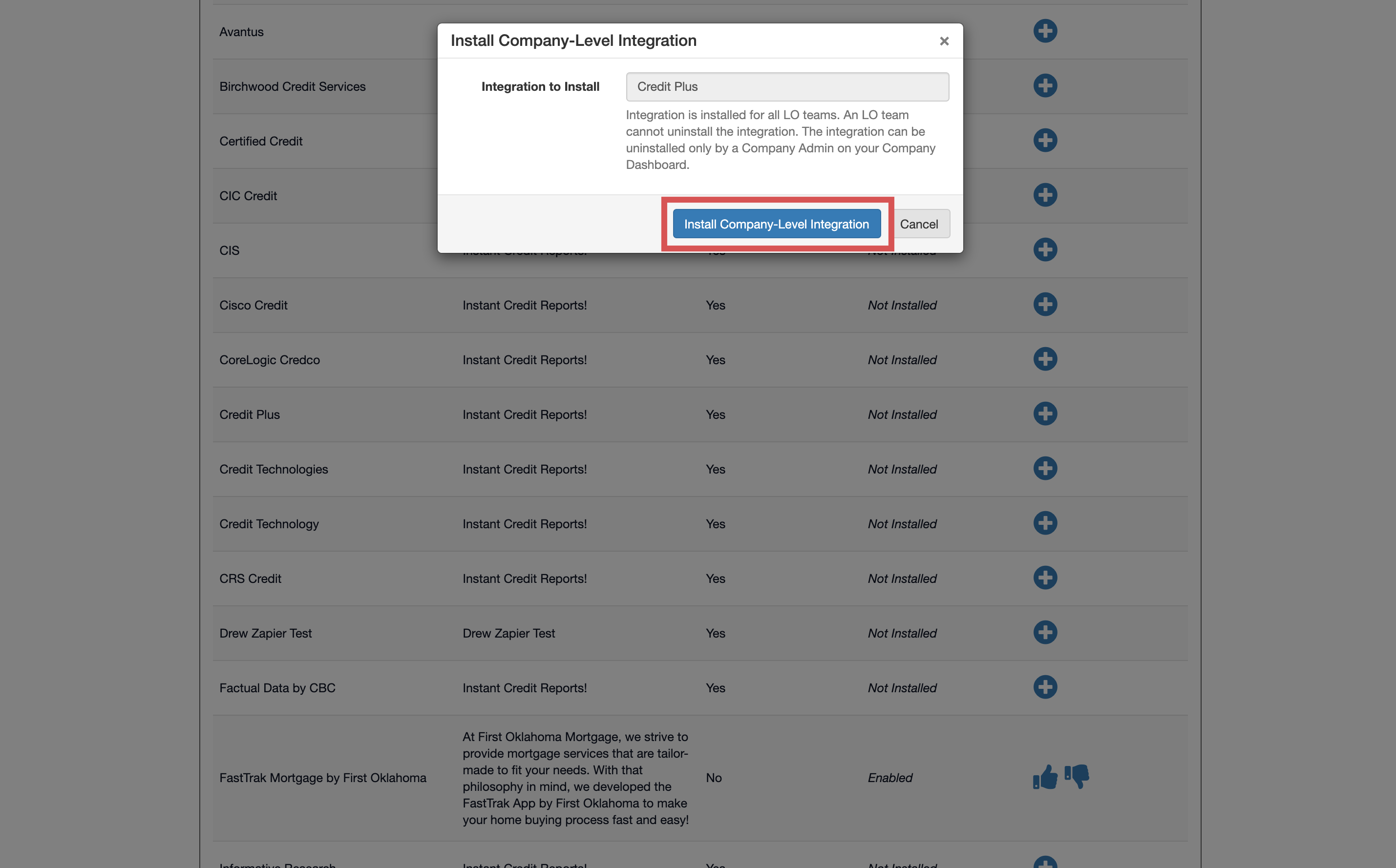

Select Install Company-Level Integration to confirm:

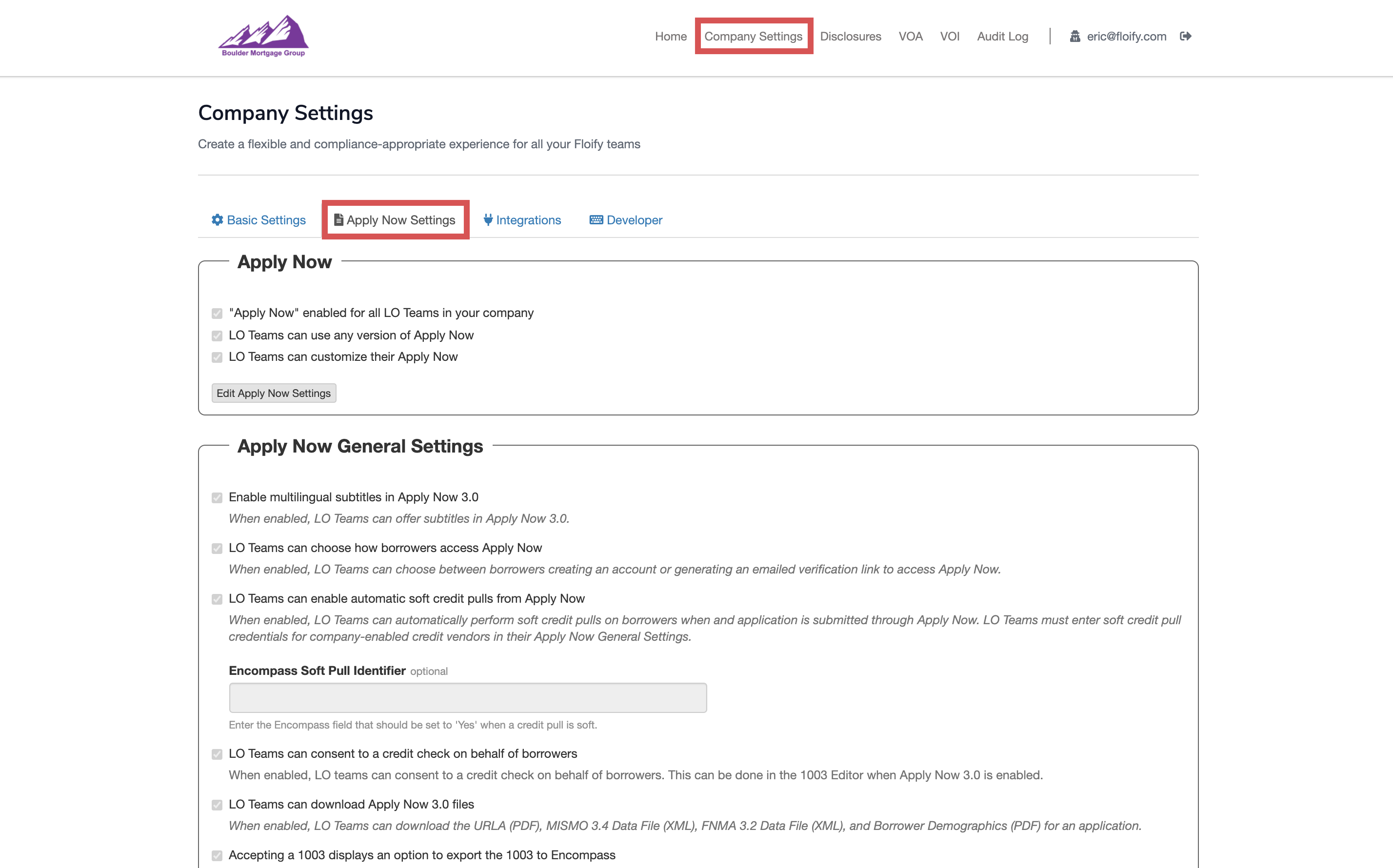

Navigate to Company Settings and then the Apply Now Settings tab:

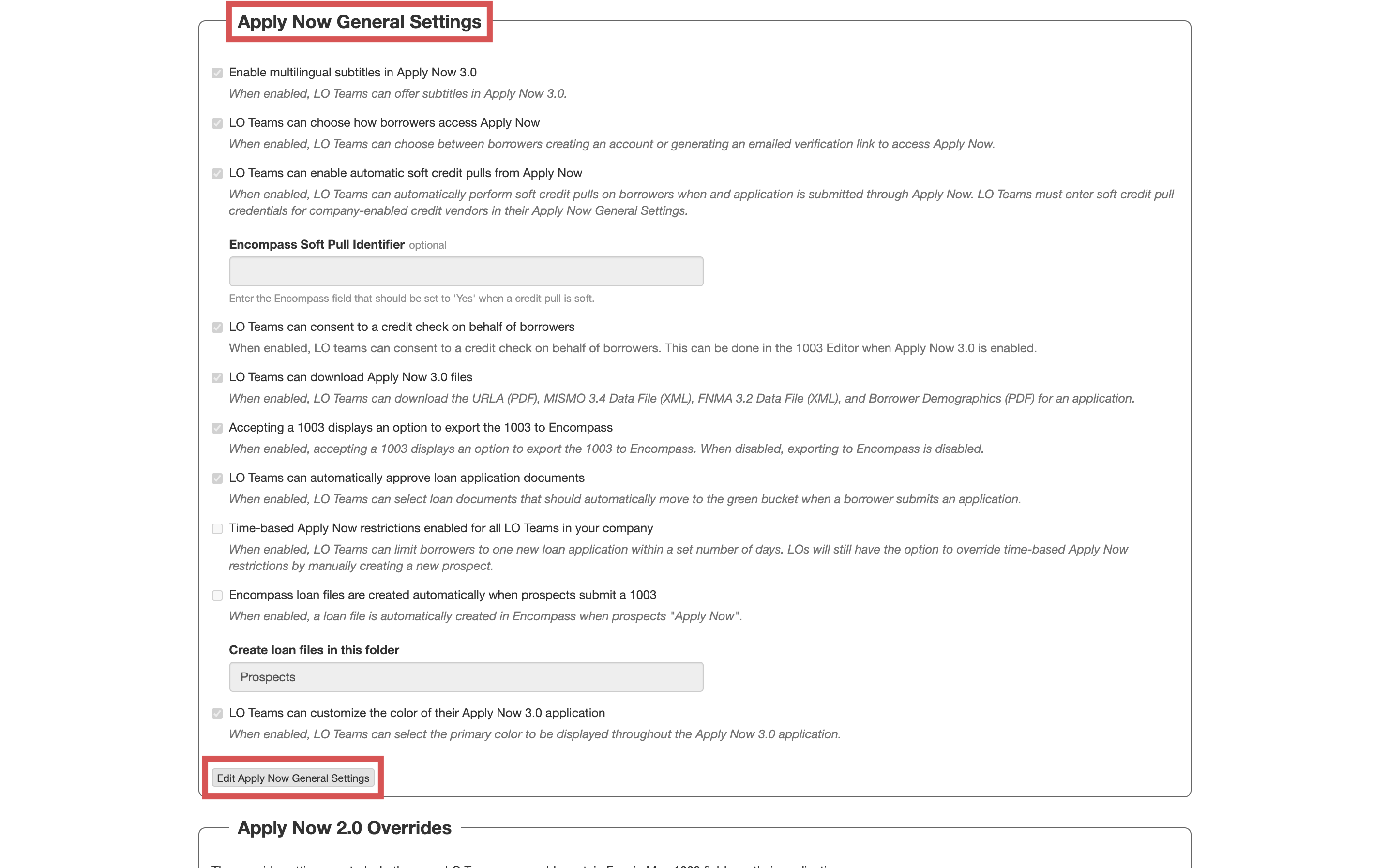

Scroll down to Apply Now General Settings and select the option to Edit Apply Now General Settings:

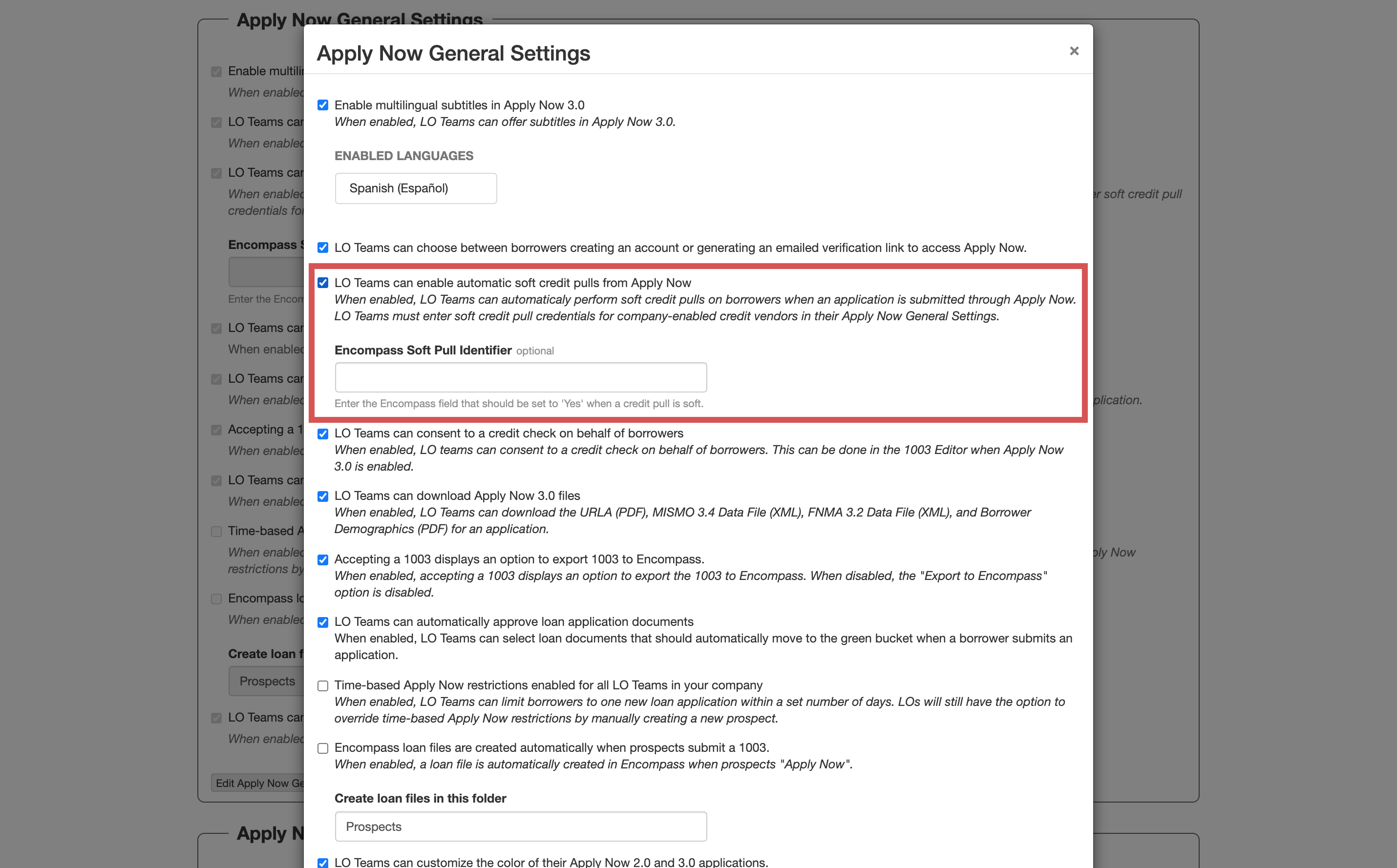

Select the option 'LO teams can enable automatic credit pulls from Apply Now'. Make sure you select Save to confirm the change:

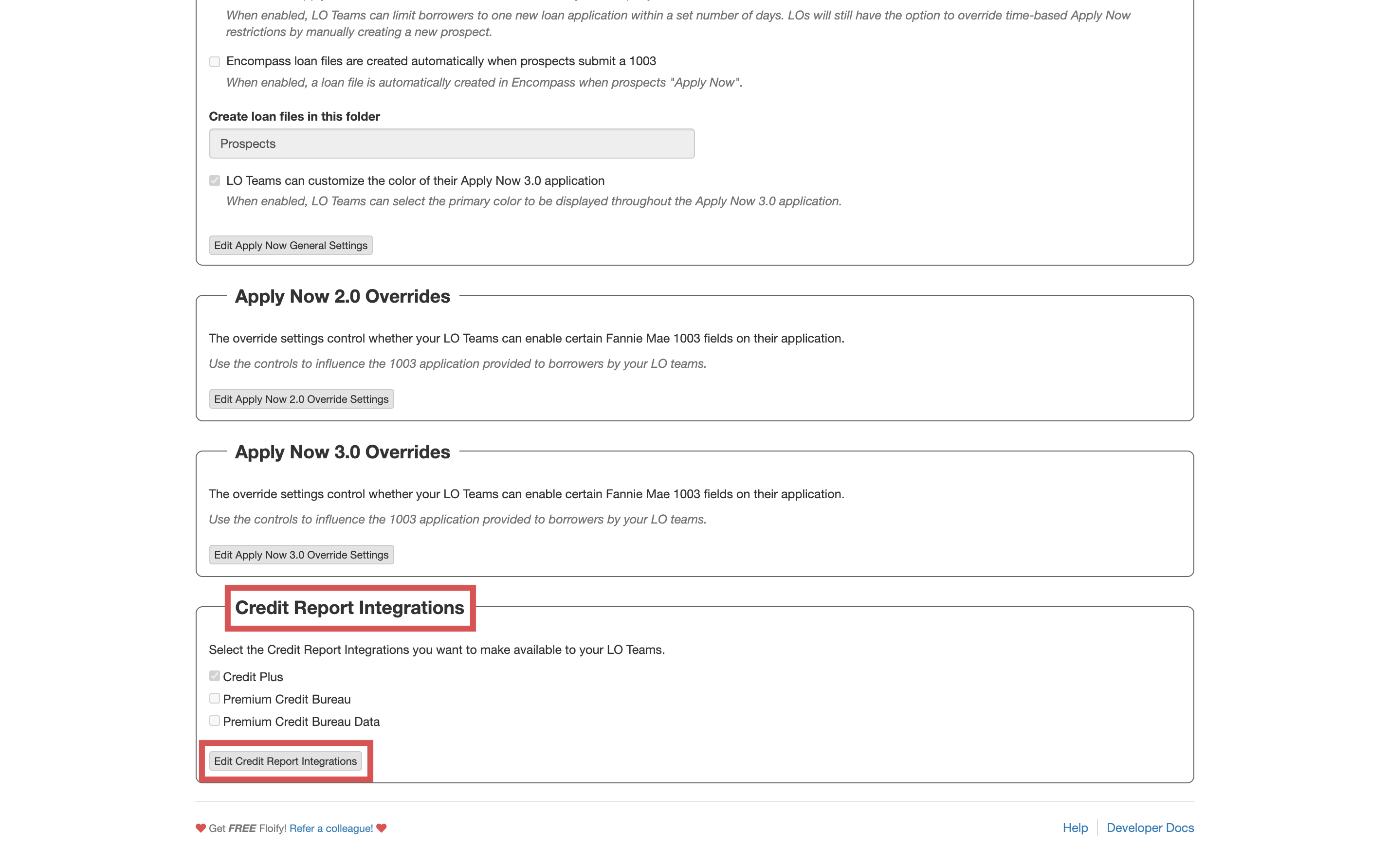

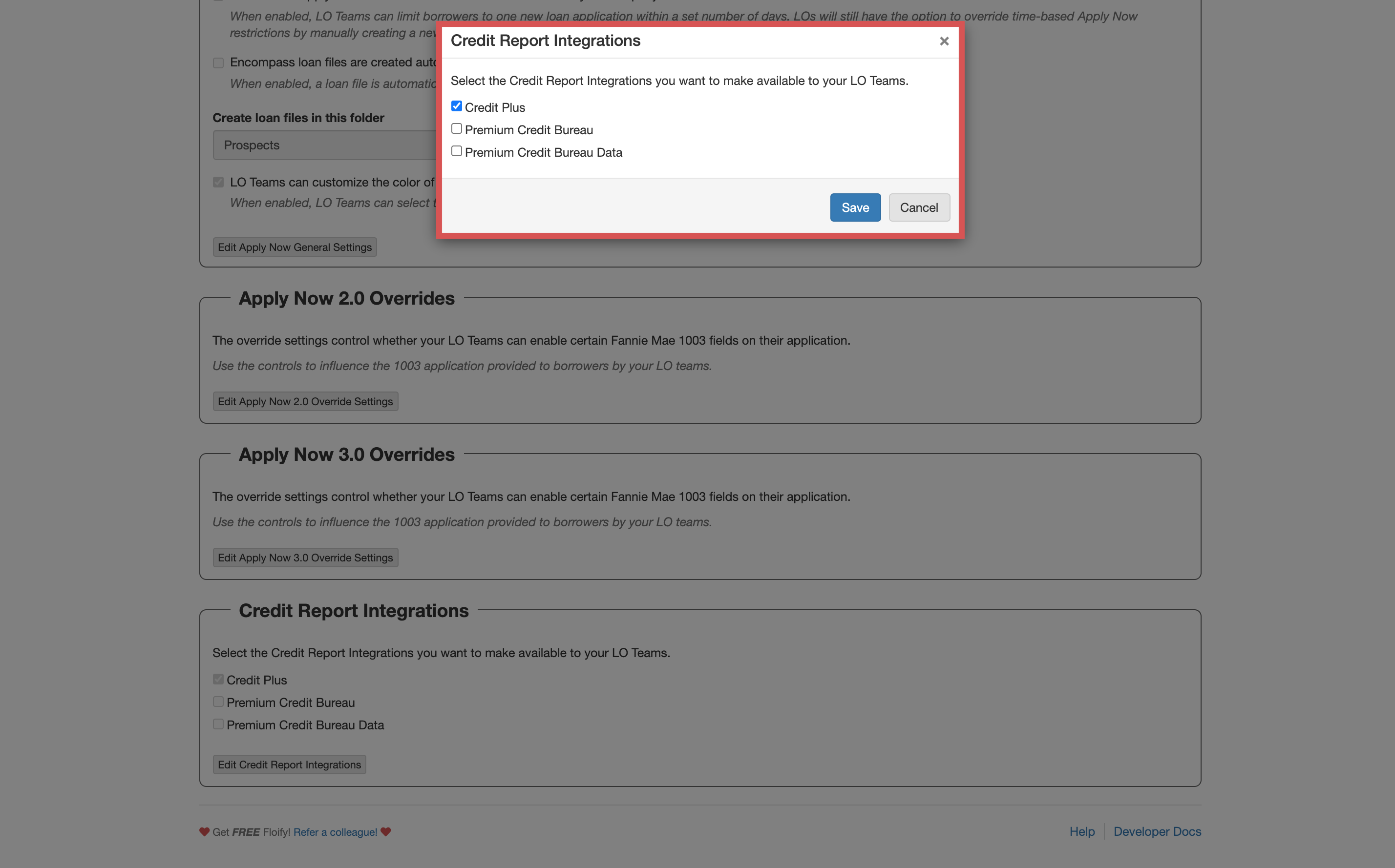

Scroll down to Credit Report Integrations and select the option to Edit Credit Report Integrations:

Select which integrations you'd like to make available to your LO teams. Make sure you select Save to confirm the change:

From your team pipeline, navigate to Settings and select the Integrations tab:

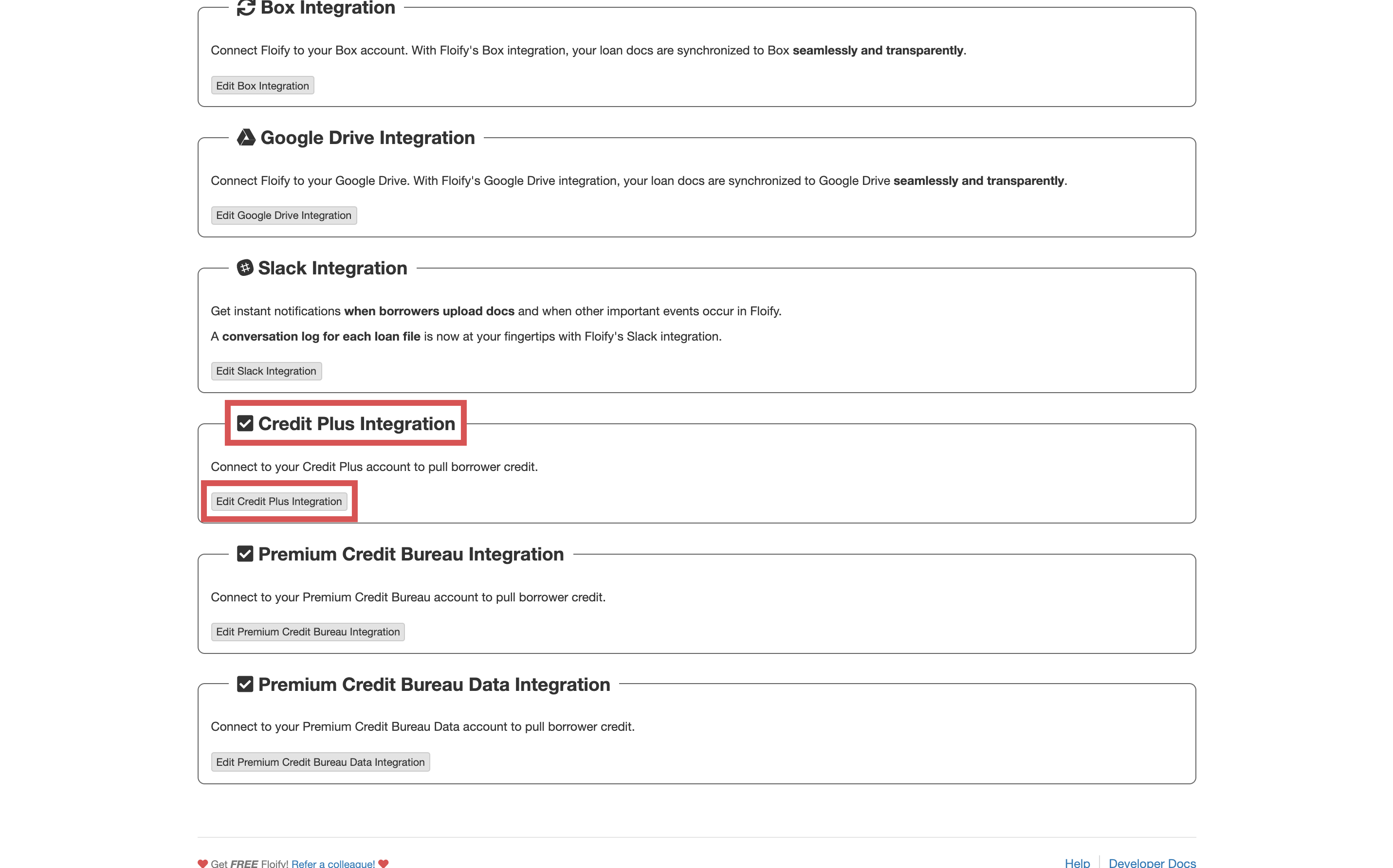

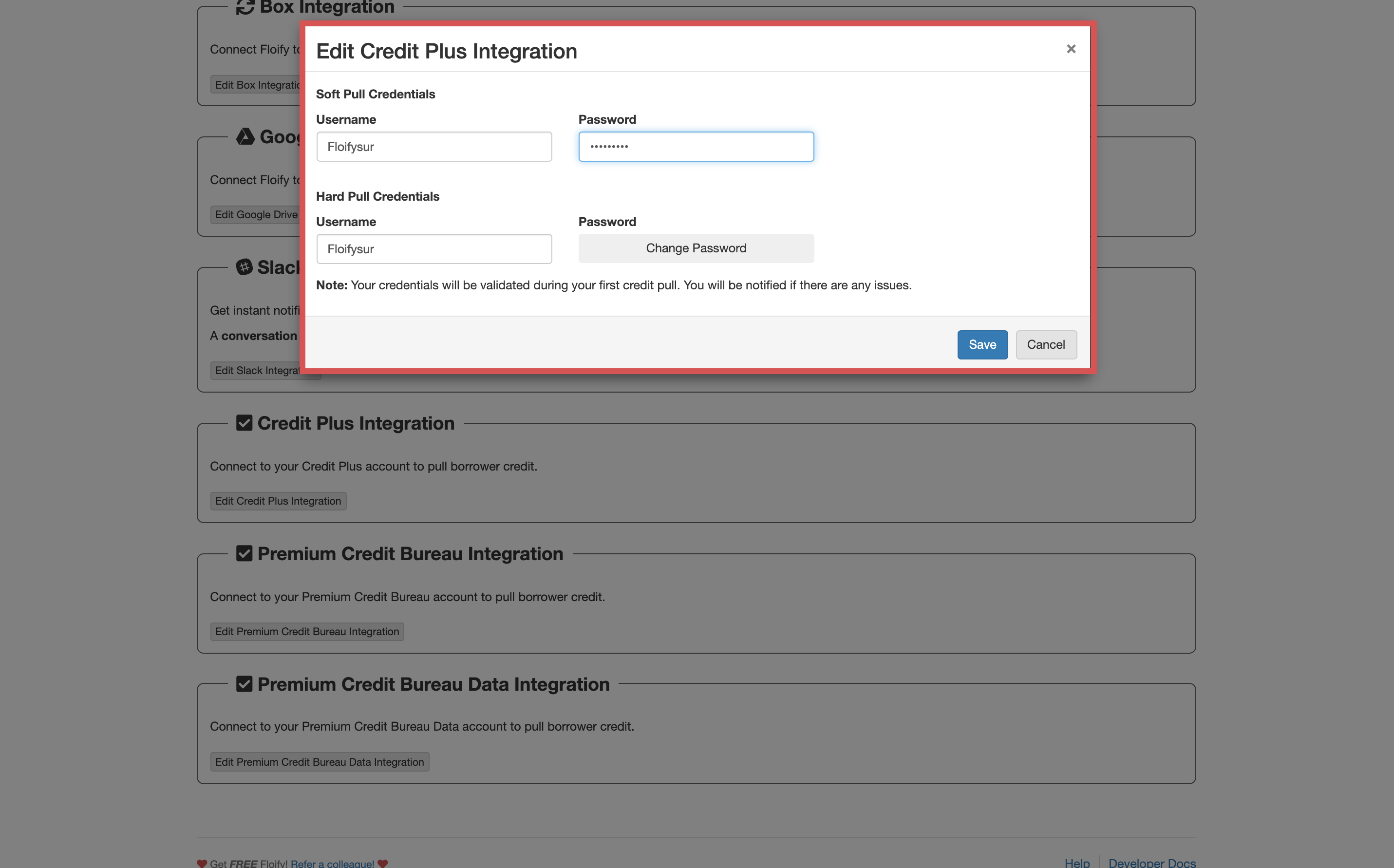

Scroll down and locate your credit reporting agency. Select the option to edit the integration:

Enter your credentials in the username and password slots available. You can update your credentials for both soft and hard credit pulls if they are separate. Make sure you select Save to confirm the changes going forward:

Note: Your credentials will be validated during your first credit pull. You will be notified if there are any issues.

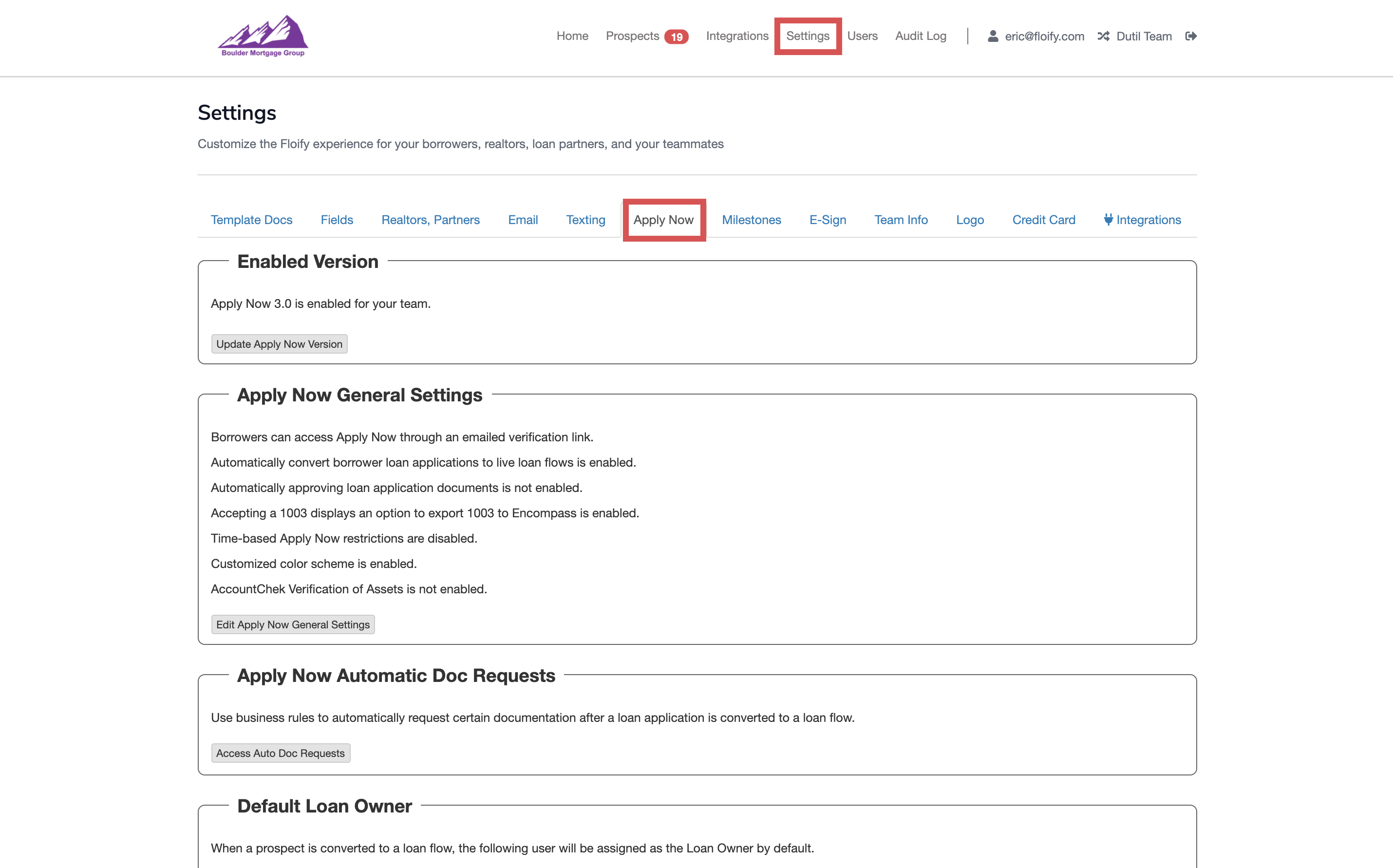

Select Settings and then the Apply Now tab:

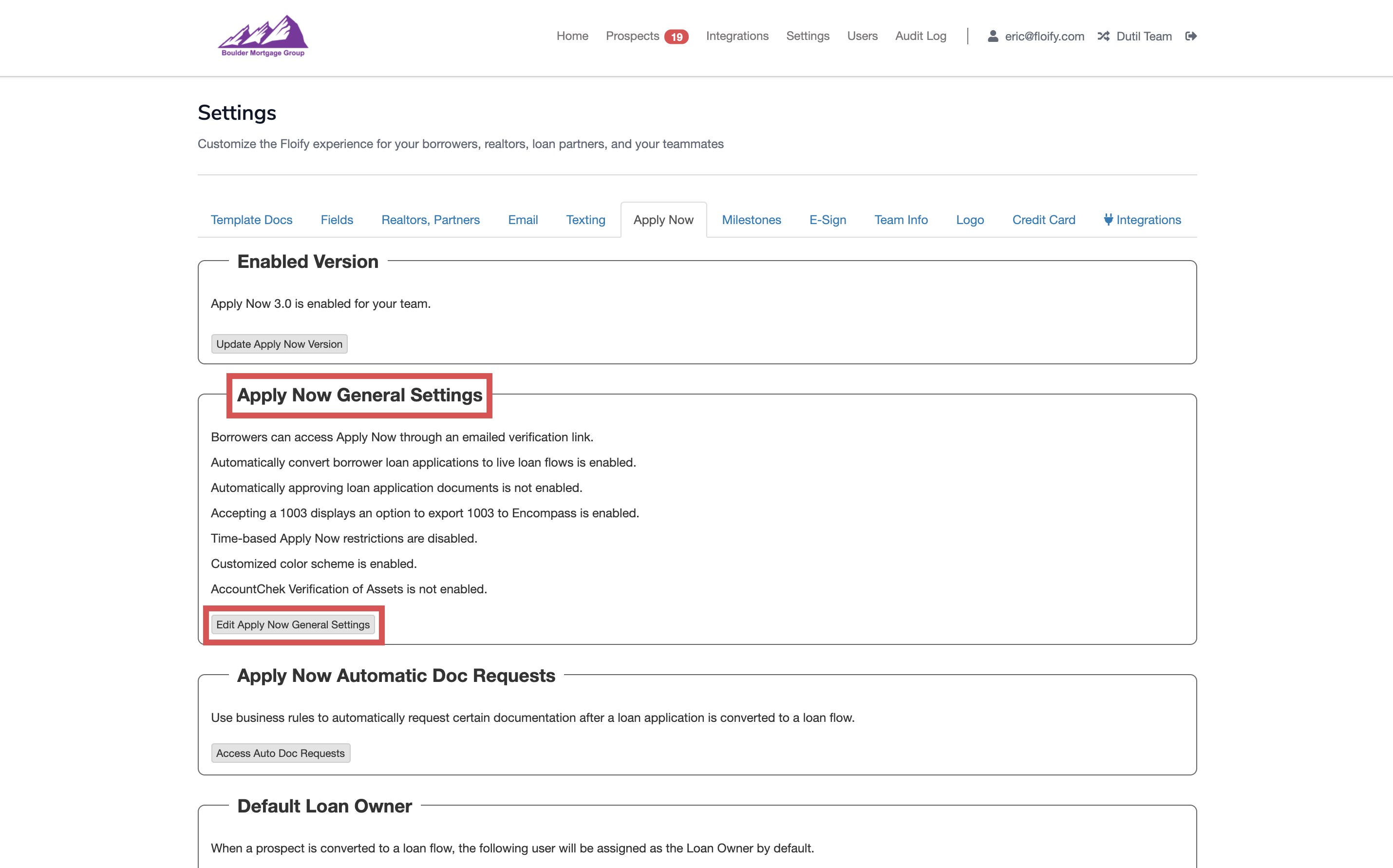

Navigate to Apply Now General Settings and select the option to Edit Apply Now General Settings:

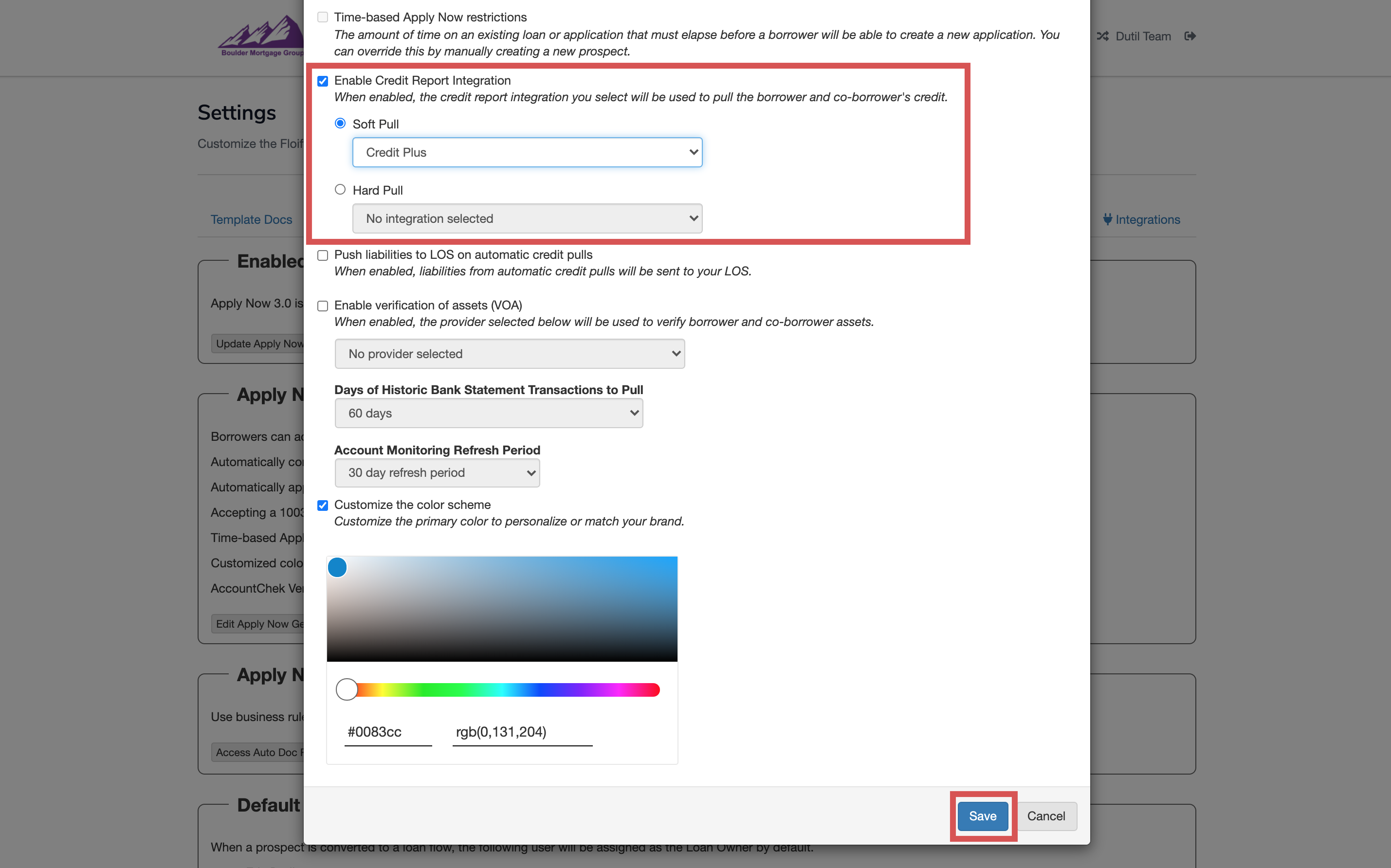

Select the option Enable Credit Report Integration. You will see the option to select a soft pull and select the credit reporting agency:

Note: Credit reporting agencies need to be enabled at the company level in order to appear as an available option here.

Floify will automatically perform a soft credit pull whenever a borrower completes an application via the landing page, apply now page, or if added via the Start New Prospect button on the Prospects page.

Please sign in to leave a comment.