Who is BluePrint?

BluePrint was created to be the change we wanted to see in the mortgage world.

When David Stamm, a leader in the software engineering field, and Mike Whitbeck, an executive level underwriter started BluePrint in 2013 they knew they had stumbled onto something. This was something different, no one had taken the time to combine the discipline of process and apply it to mortgage workflows. They knew their ideas for improving the mortgage industry were unconventional, but that's exactly why they knew it would work.

We took a deep dive into the challenges of mortgage operations. Challenges like inconsistent answers, unreliable turn time, non-existent training and broken pay plans. We pulled the best from other industries and developed a system and tools to support this new method of processing and underwriting workflow.

Fast forward a few years, with a team of driven individuals assembled, BluePrint Solutions has made its mark on the industry. By providing software tools, process consulting and training thousands of mortgage professionals BluePrint has become the change the founders wanted. BluePrint is committed to helping lenders improve all facets of the operations portion of loan origination.

Why Work With Us?

We give you the blueprints to the engineered process and workflow design. Combine that with the talent you already have, and the outcome is a continual process of improvement that can bring your team all the way to the top of the mortgage game.

Integration type: Productivity

What will the Floify— BluePrint Integration support?

Create a smooth flow of loan documents and income analysis reports from Floify to BluePrint and back.

BluePrint allows your team to choose any income type including all self-employed borrowers, rental income, commissions, or grossing up income you need for your borrower. BluePrint then provides the correct requirements, calculations, and proper documentation of that calculation to close the borrower without fear of a recourse buyback due to errors in income calculation.

By using BluePrint Income Analysis Software you now have a single solution to review all thirty-plus types outlined in agency guidelines. This results in better turn times, better quality, and far better communications on exactly what you can qualify your borrower on for income.

When utilizing the BluePrint/Floify integration, loan teams can create a file within the BluePrint Income Analysis Software by importing documents directly from Floify's mortgage point-of-sale system. After running the BluePrint analysis, generated reports can be sent back to Floify to maintain loan file integrity in a single location.

How to Set Up and Use

This integration is built and maintained by BluePrint. For any issues, please contact BluePrint directly.

You will need your Floify API Key to set up the integration in BluePrint.

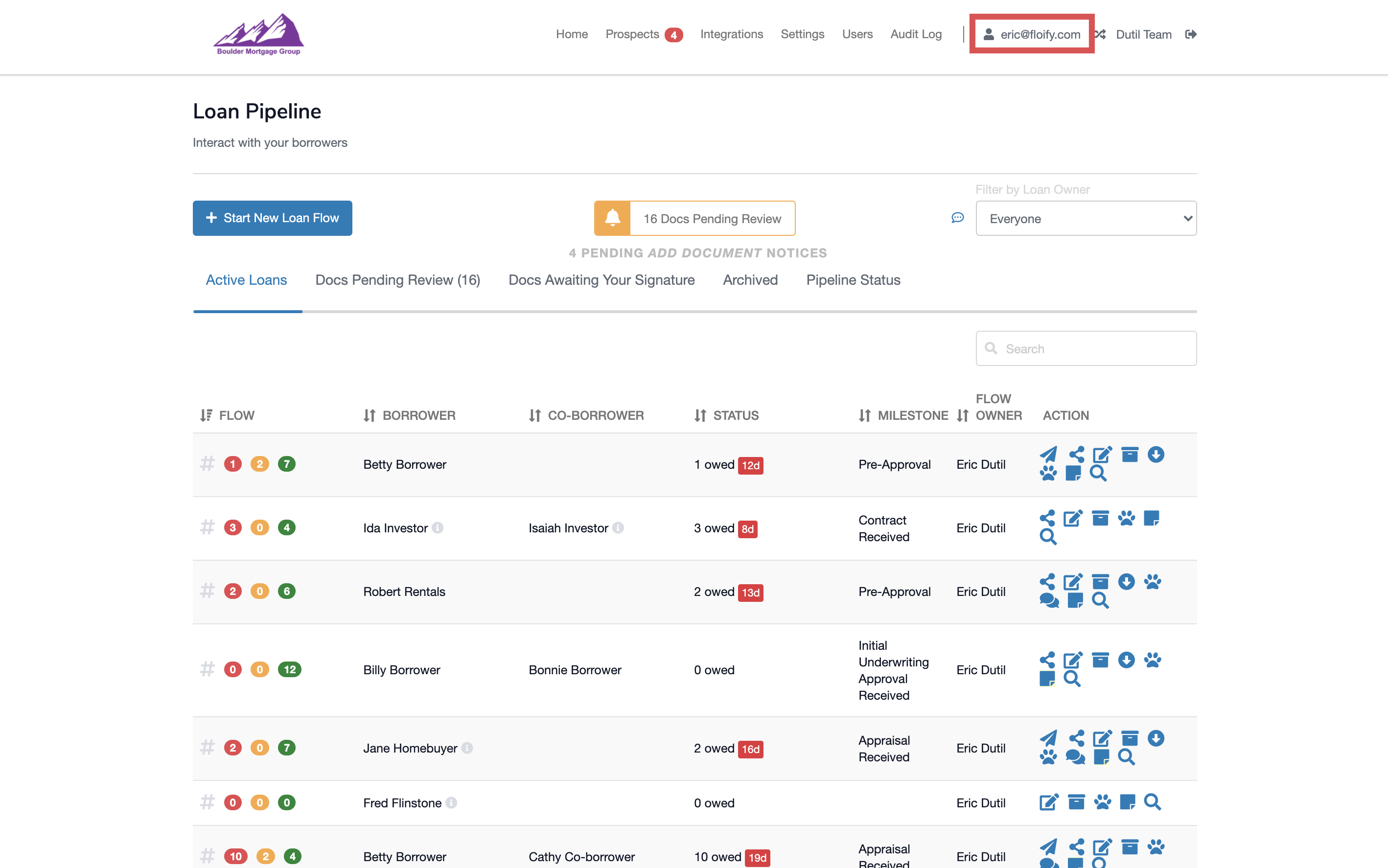

From your team pipeline, select your email address in the top right-hand corner:

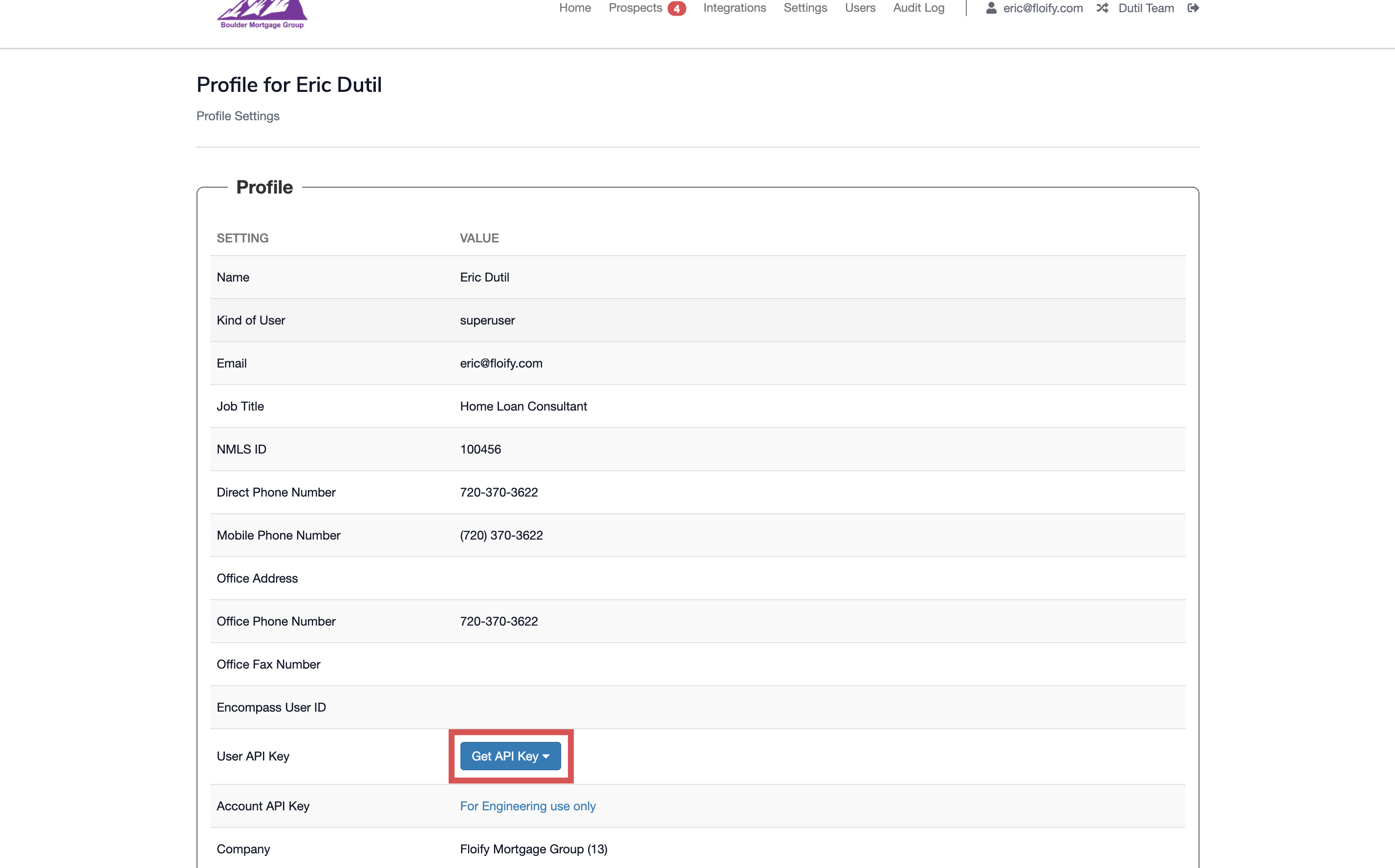

Scroll down to User API Key and select the Get API Key button. This will allow you to copy the key:

Navigate to your BluePrint account. Go to the Account page, enter your Floify API Key. and test.

Please sign in to leave a comment.