Who is LoanBeam?

Floify leverages LoanBeam’s OCR technology to classify and extract data from templated tax documents. The integration streamlines income calculations through automated tax doc analysis and needs lists for self-employed borrowers.

Integration type: Productivity

What will the Floify—LoanBeam Integration support?

Floify leverages LoanBeam’s OCR technology to classify and extract data from templated tax documents. The integration streamlines income calculations through automated tax doc analysis and needs lists for self-employed borrowers.

Floify's integration with LoanBeam will allow lenders to send documentation directly to LoanBeam for analysis.

How to Set Up and Use

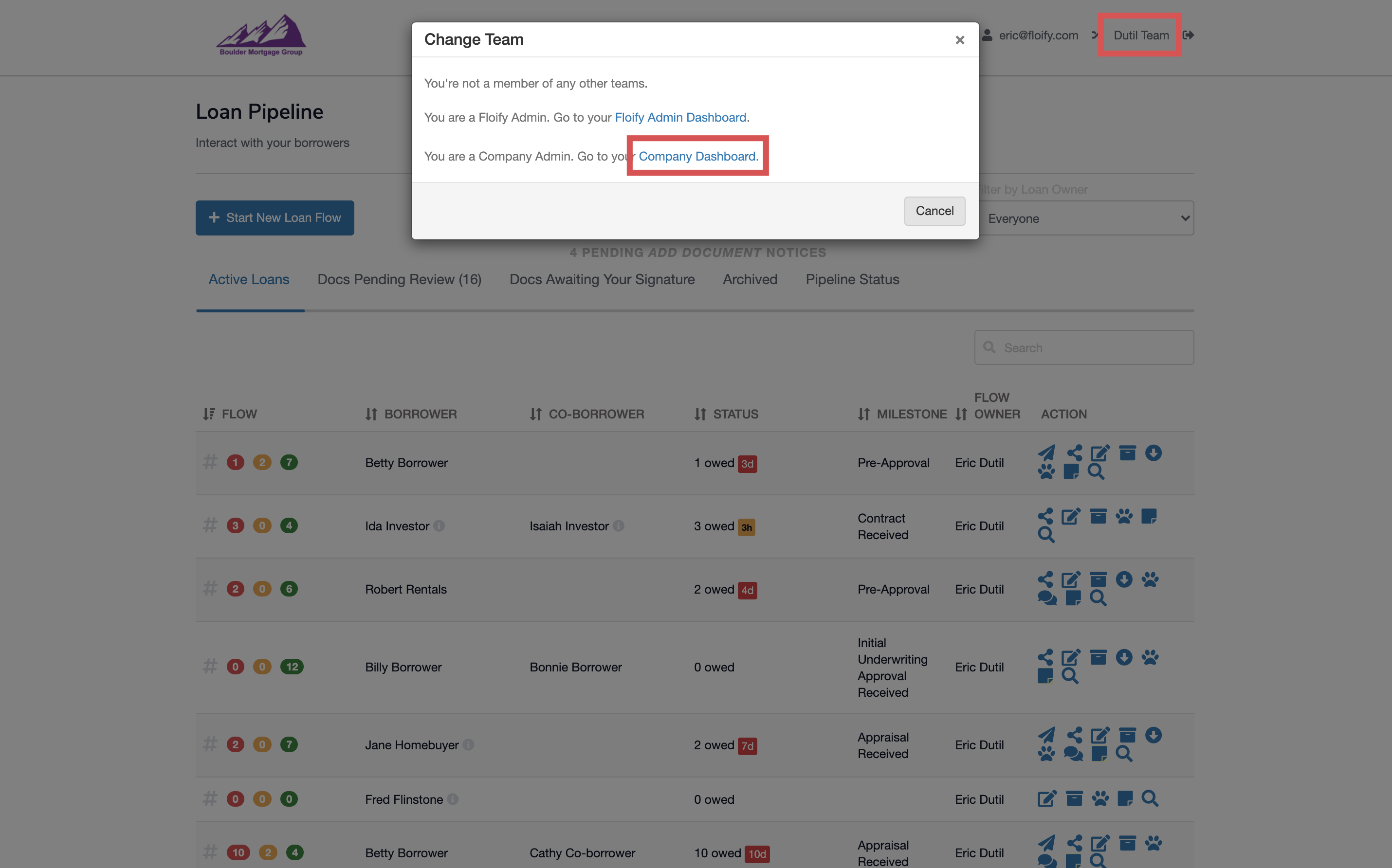

From the team pipeline, choose the team name in the upper right-hand corner and select the option to navigate to the Company Dashboard:

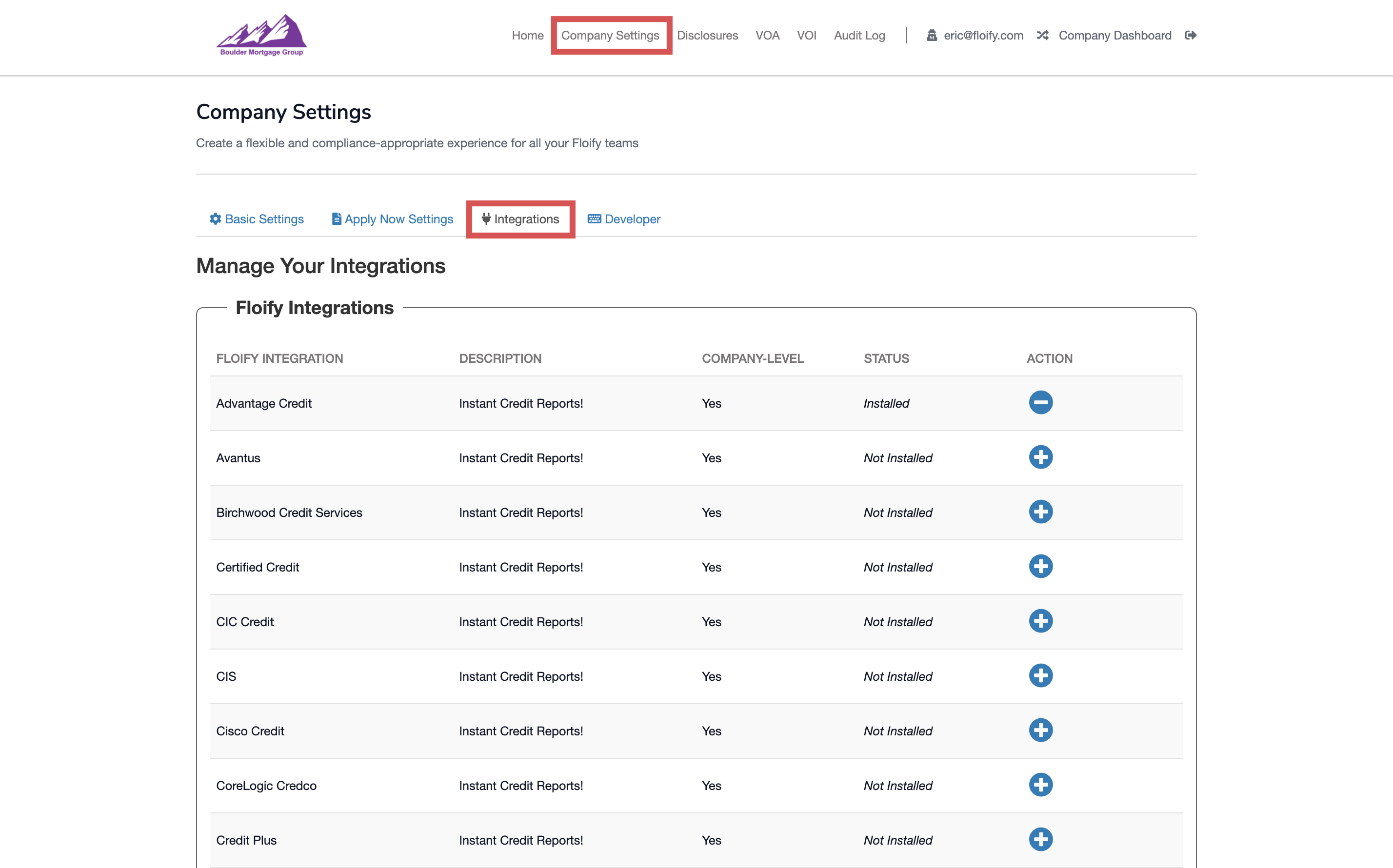

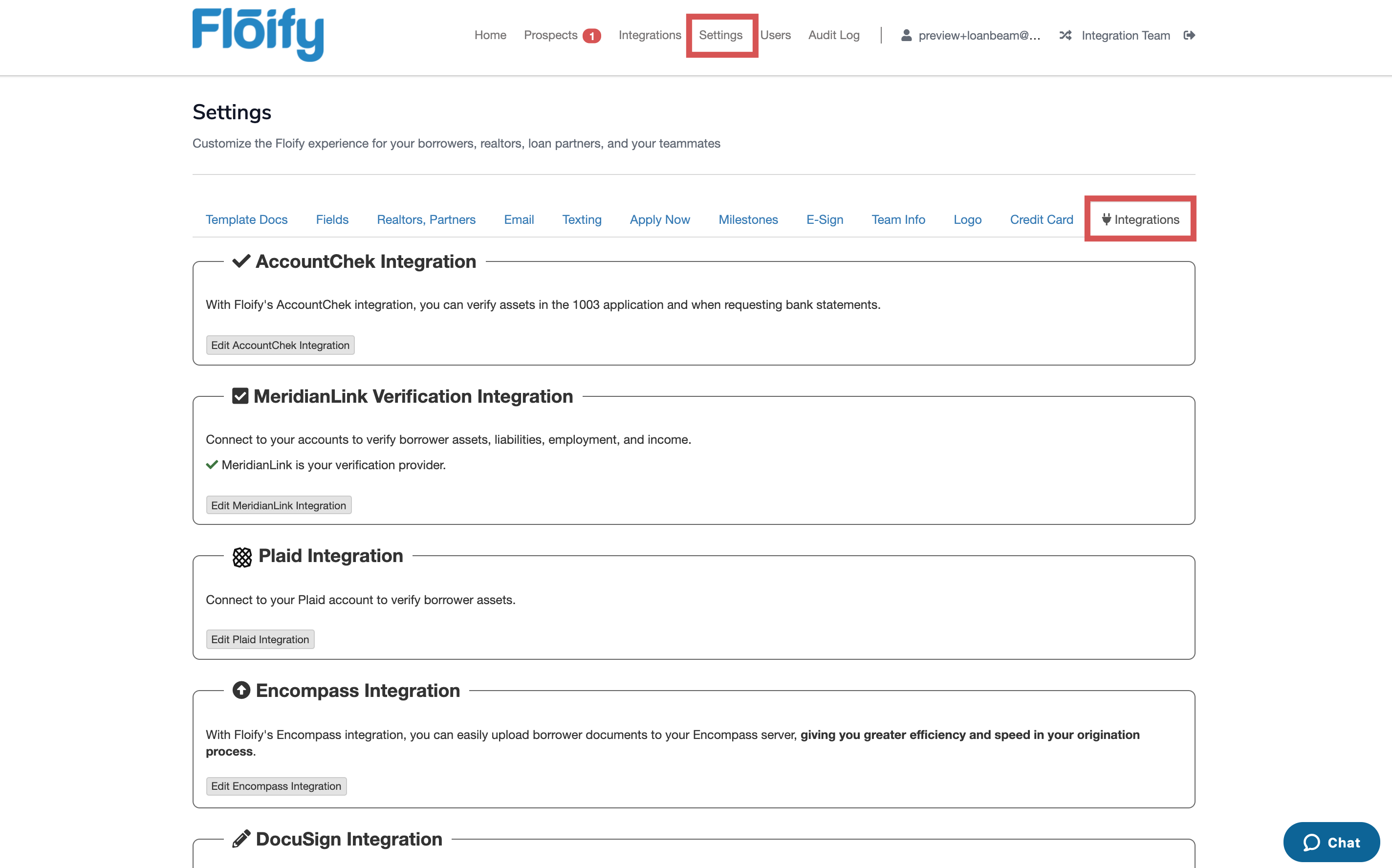

Navigate to Company Settings and select the Integrations tab:

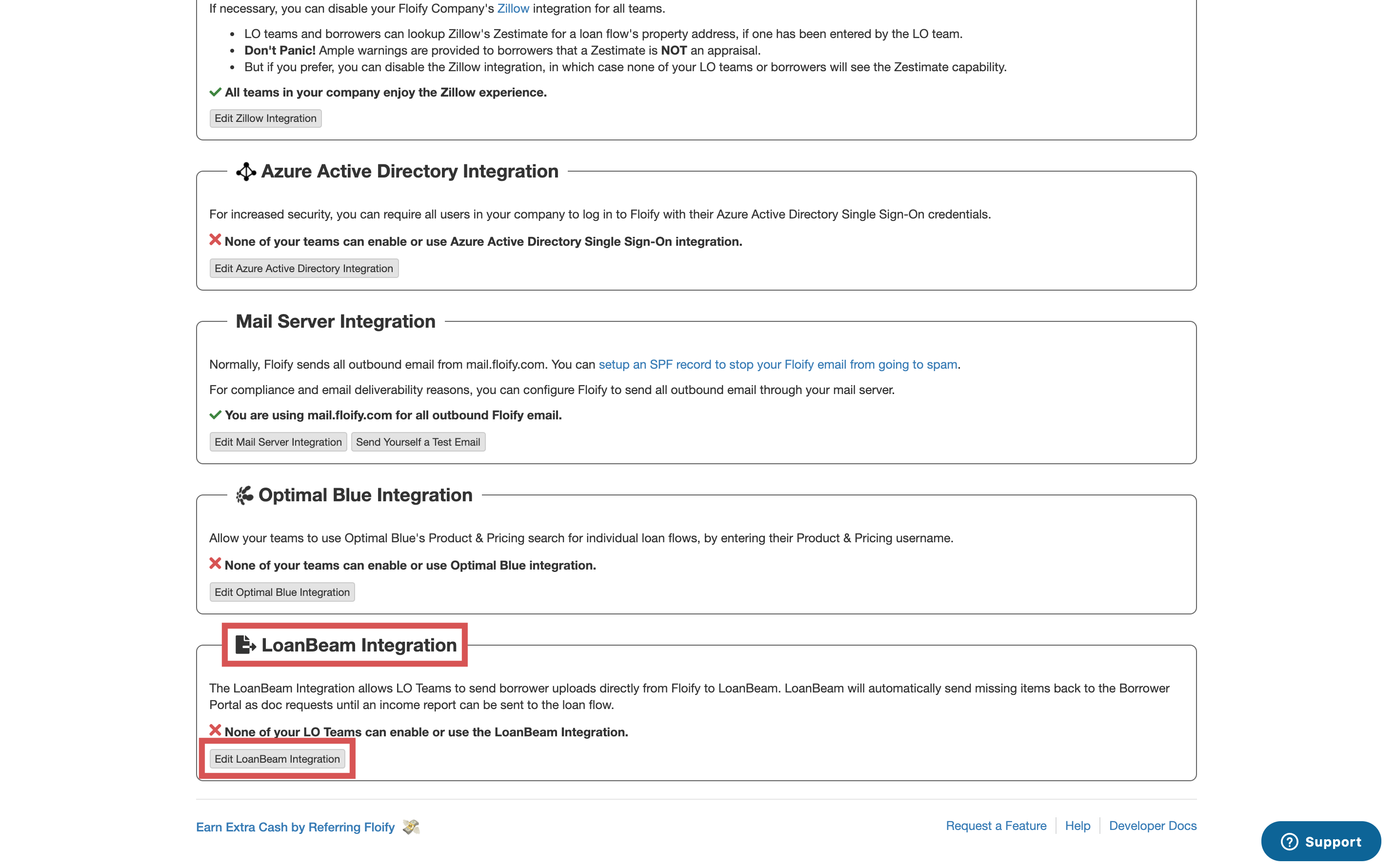

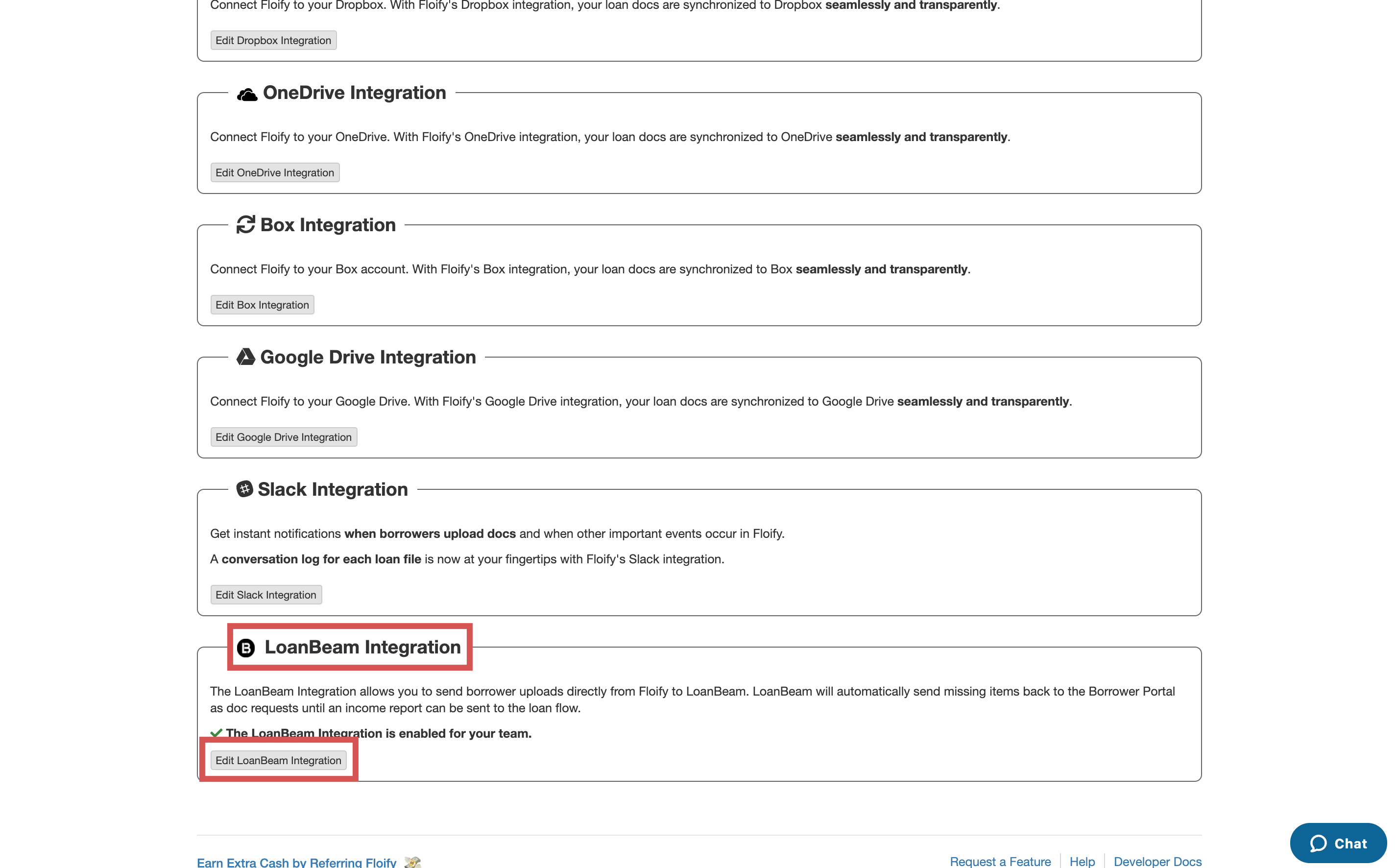

Locate the LoanBeam Integration and select the option to Edit LoanBeam Integration:

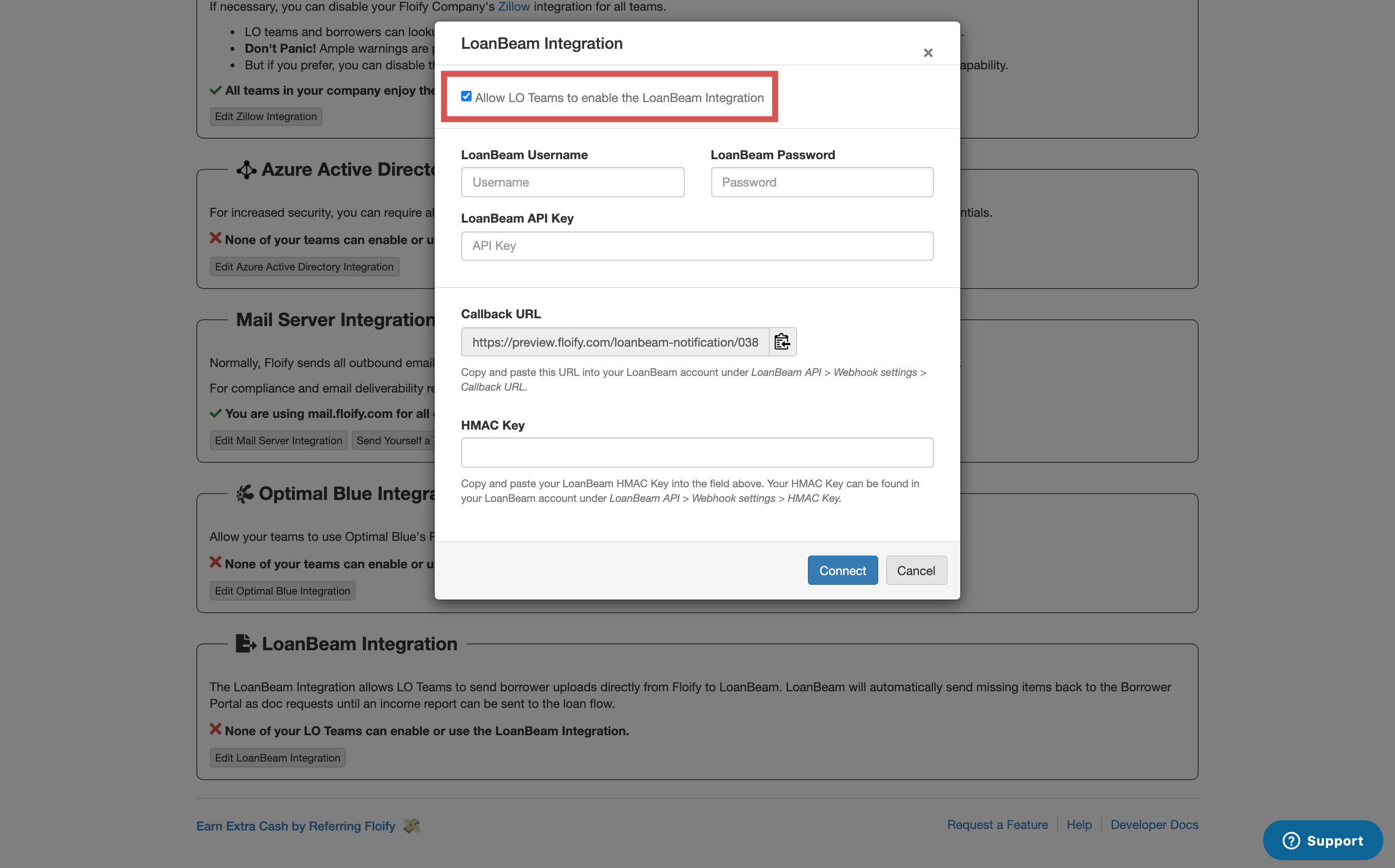

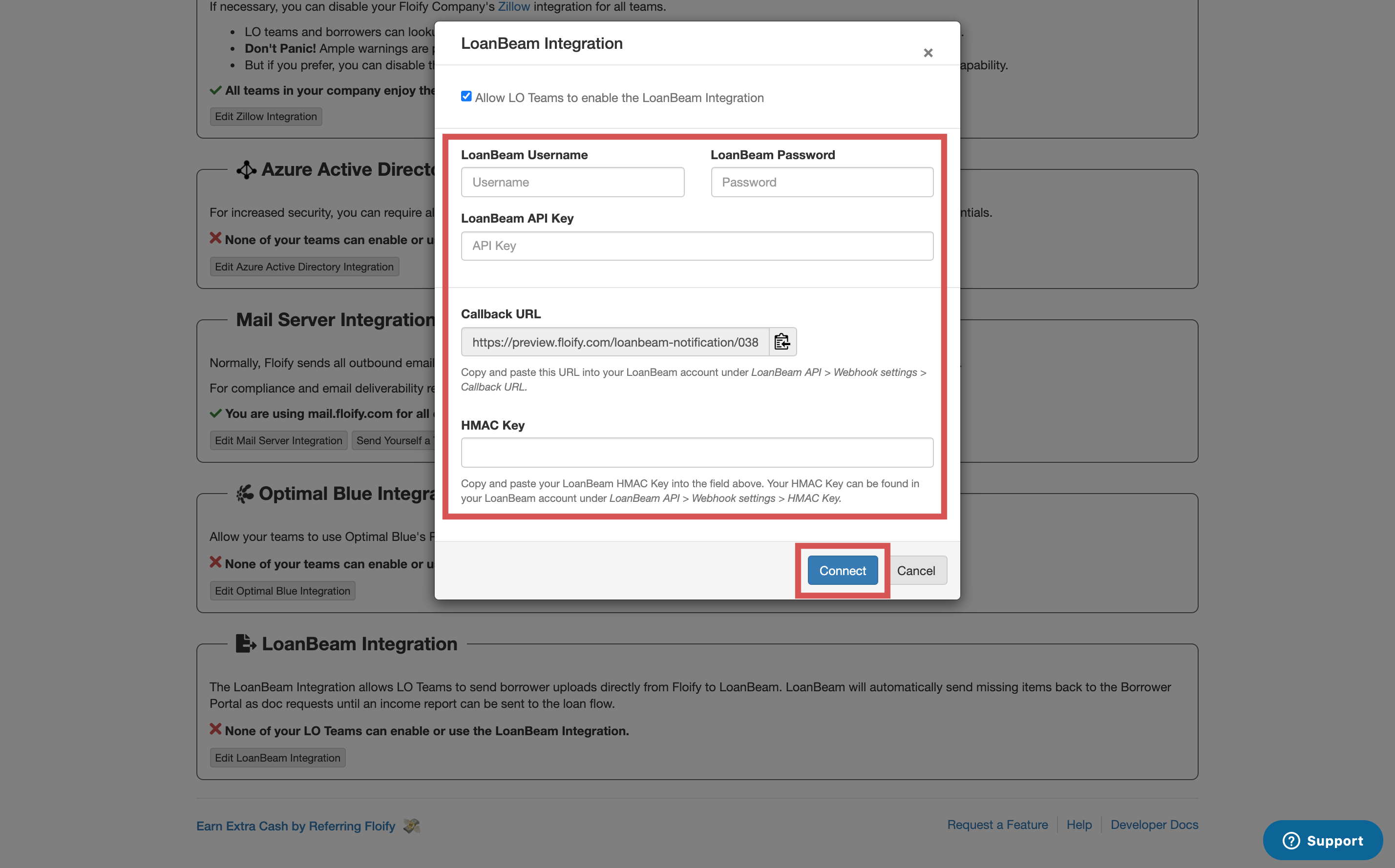

Select the option to Allow LO Teams to enable the LoanBeam Integration:

Input the LoanBeam Username, LoanBeam Password, and HMAC Key. Select Connect to complete the integration set up. Make sure you take the Callback URL and enter this directly into LoanBeam under LoanBeam API > Webhook settings > Callback URL:

Note: The LoanBeam API Key needs to be obtained by contacting LoanBeam directly.

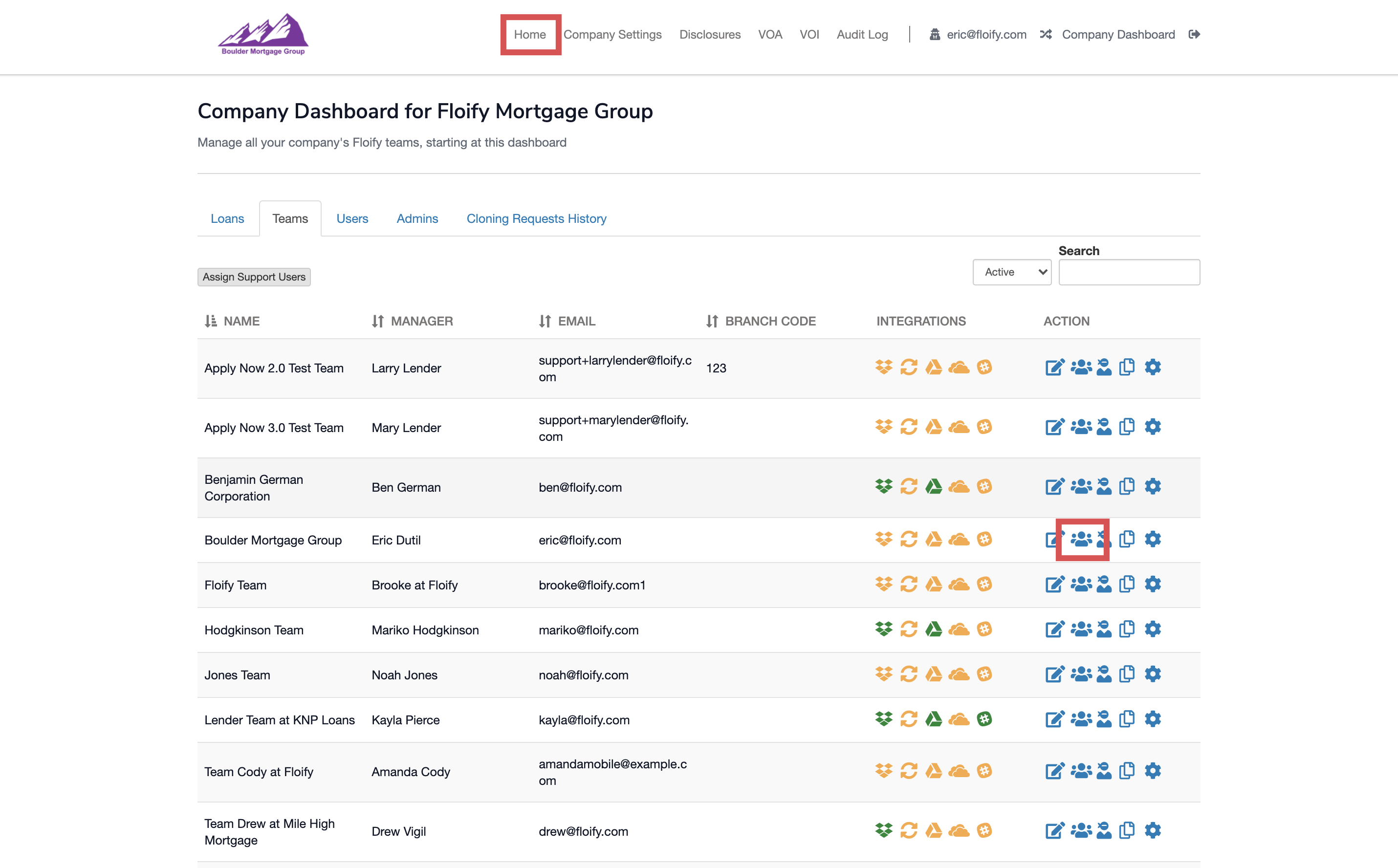

Navigate to Home and switch back into the user's account:

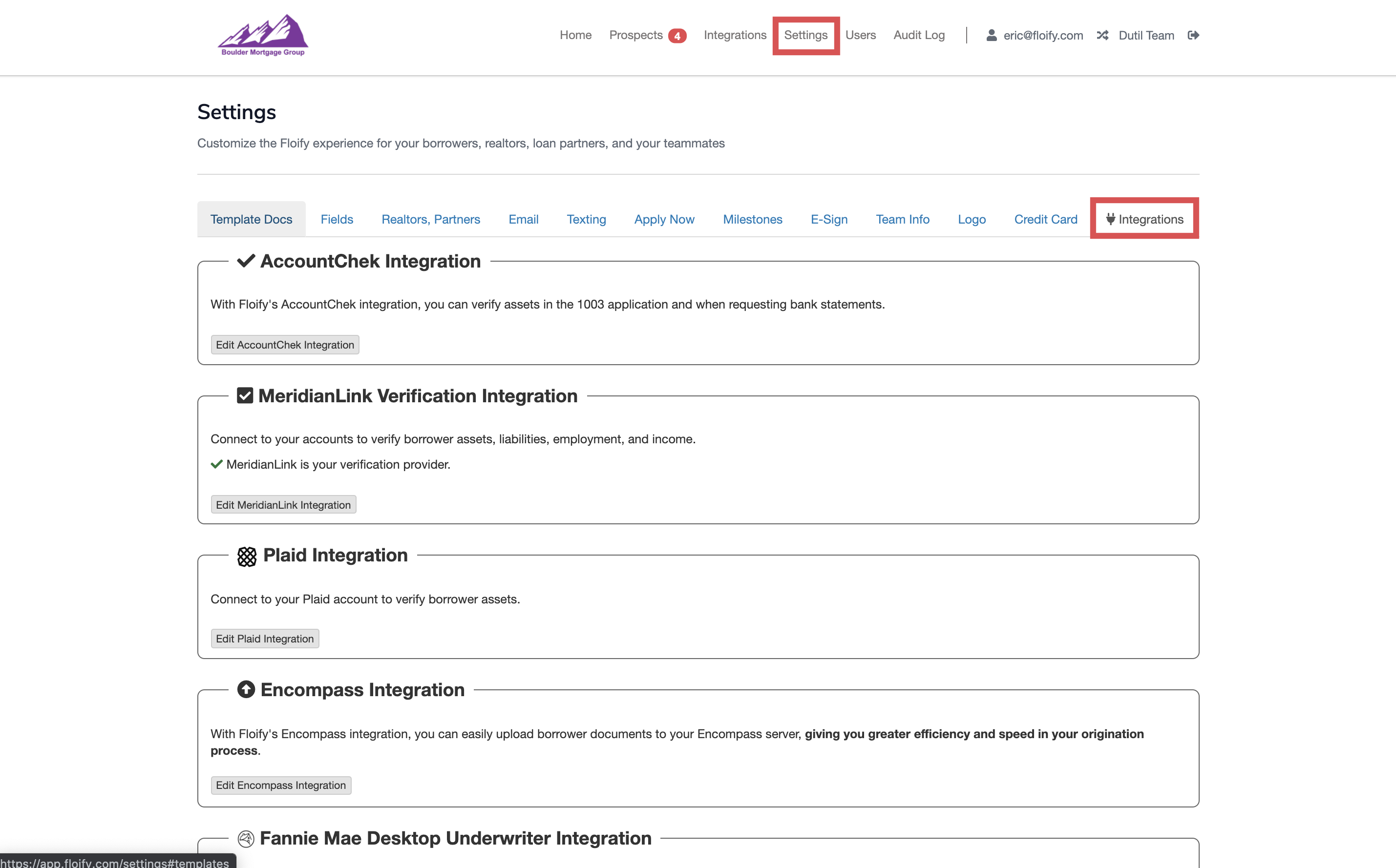

From the team pipeline, navigate to Settings and select the Integrations tab:

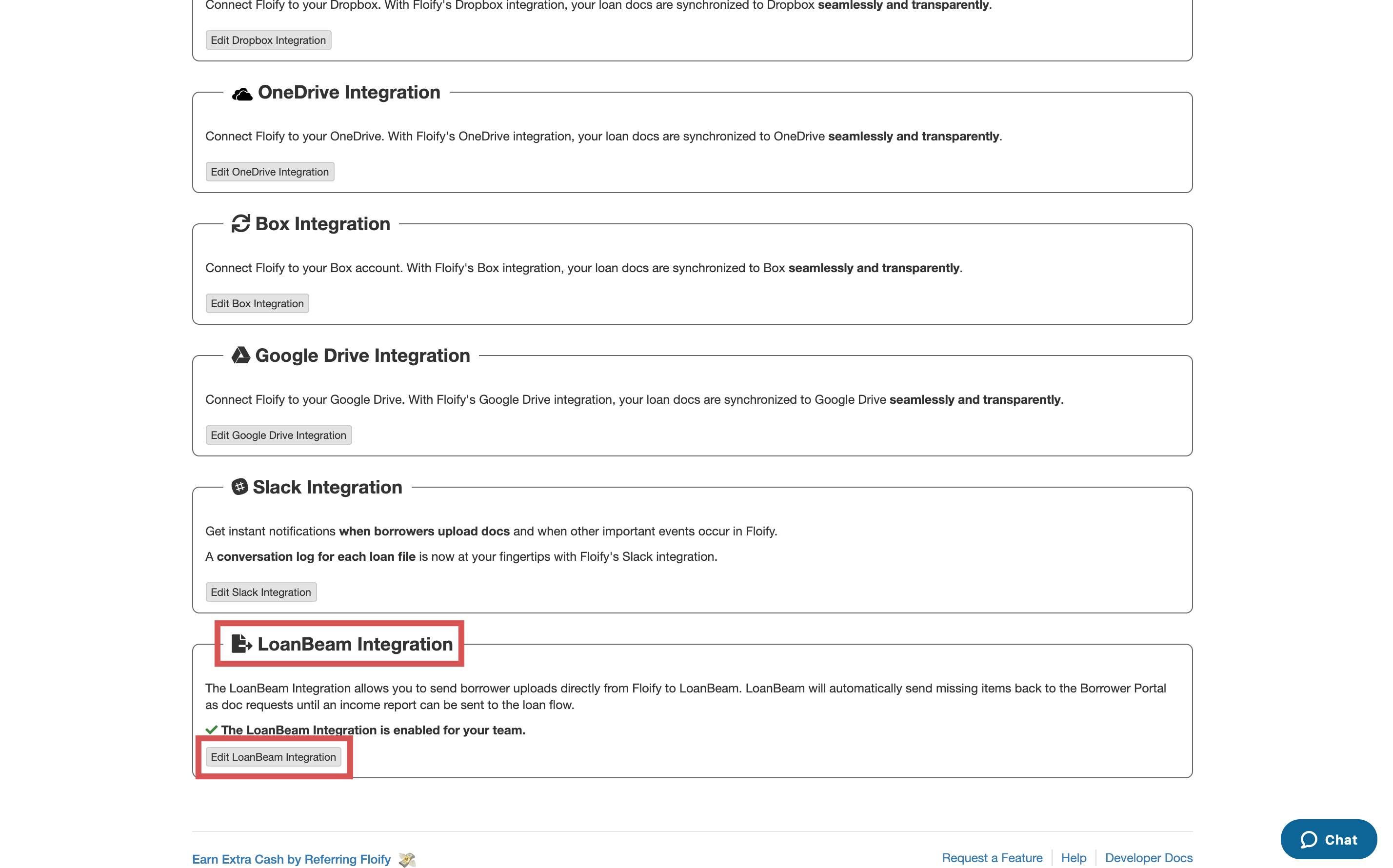

Scroll down to LoanBeam Integration and select the option to Edit LoanBeam Integration:

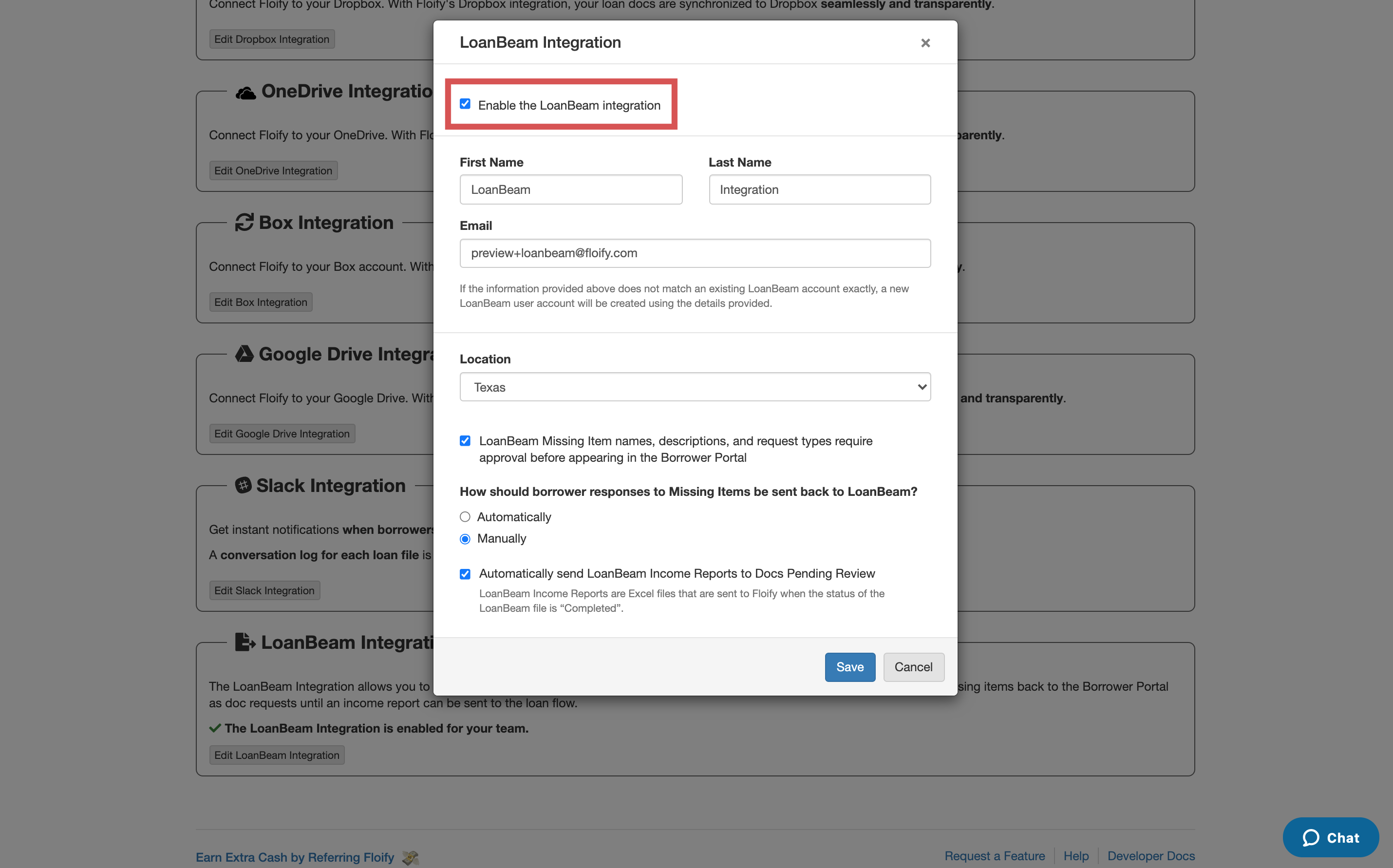

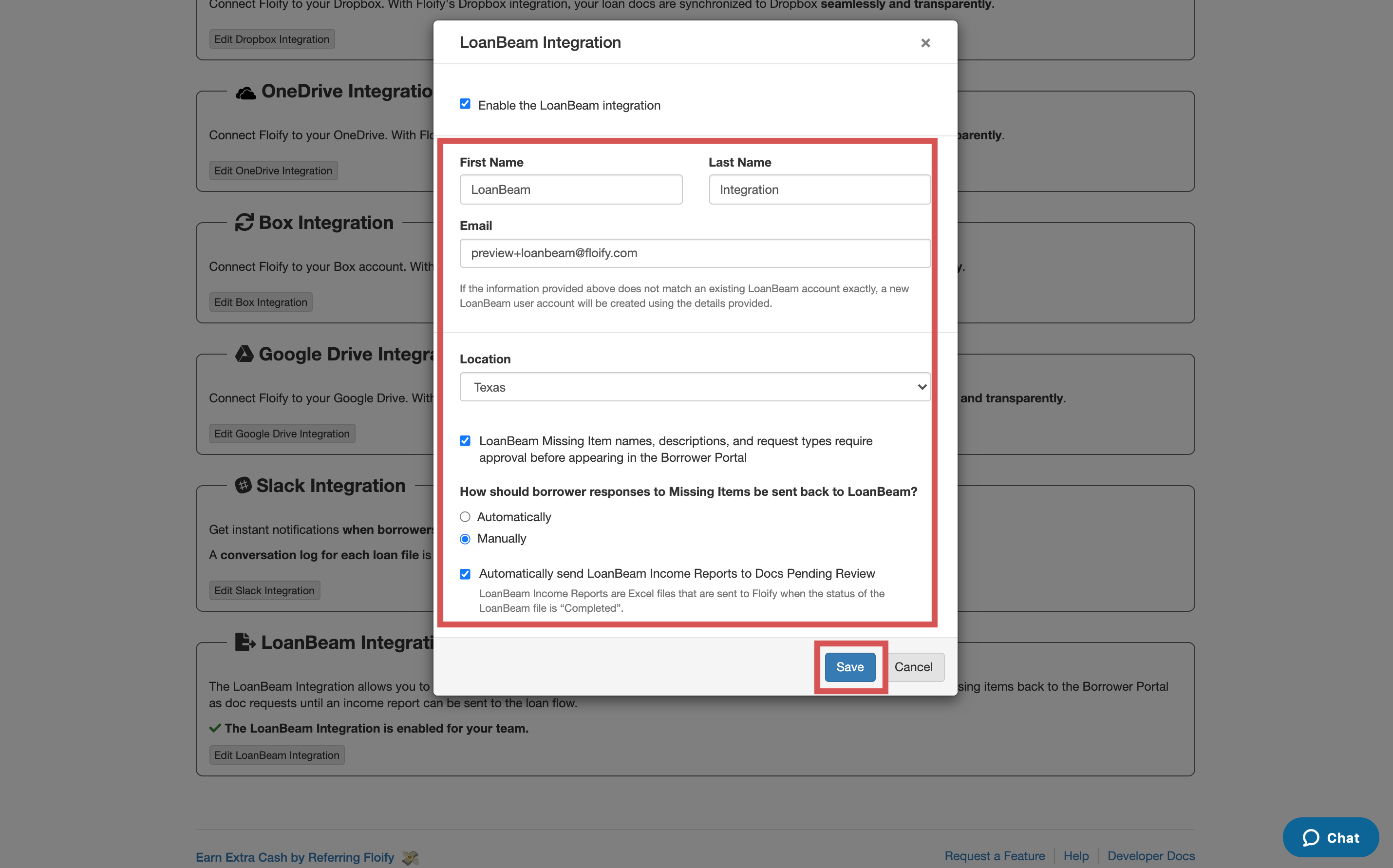

Select the option to Enable the LoanBeam Integration:

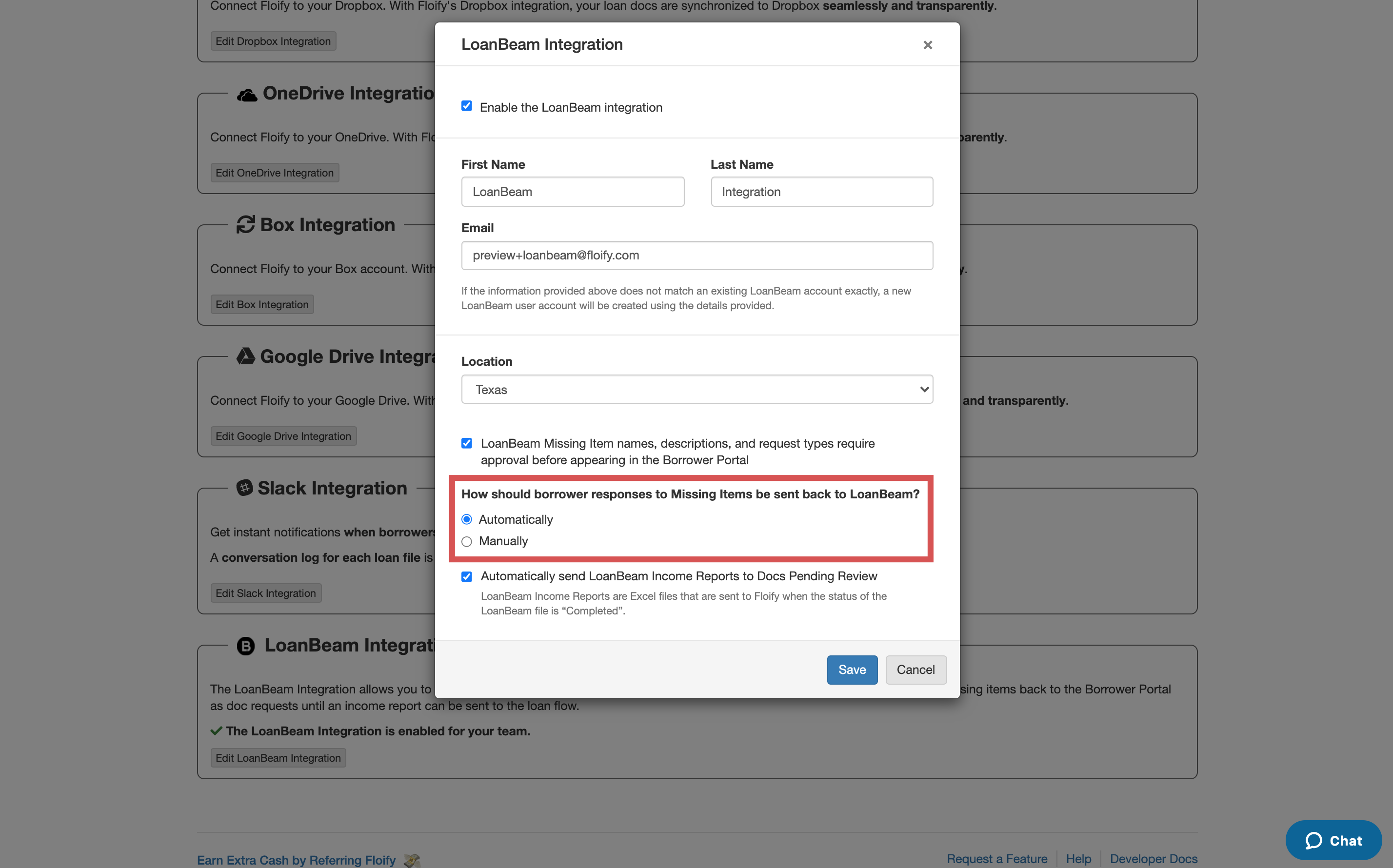

Input your first name, last name, email address, and location. You will be able to choose additionally if you'd like LoanBeam missing items to require approval before appearing in the borrower portal, how borrower responses to missing items will be sent back to LoanBeam, and if you'd like to automatically send LoanBeam Income Reports to Docs Pending Review. Make sure you select Save to confirm your changes:

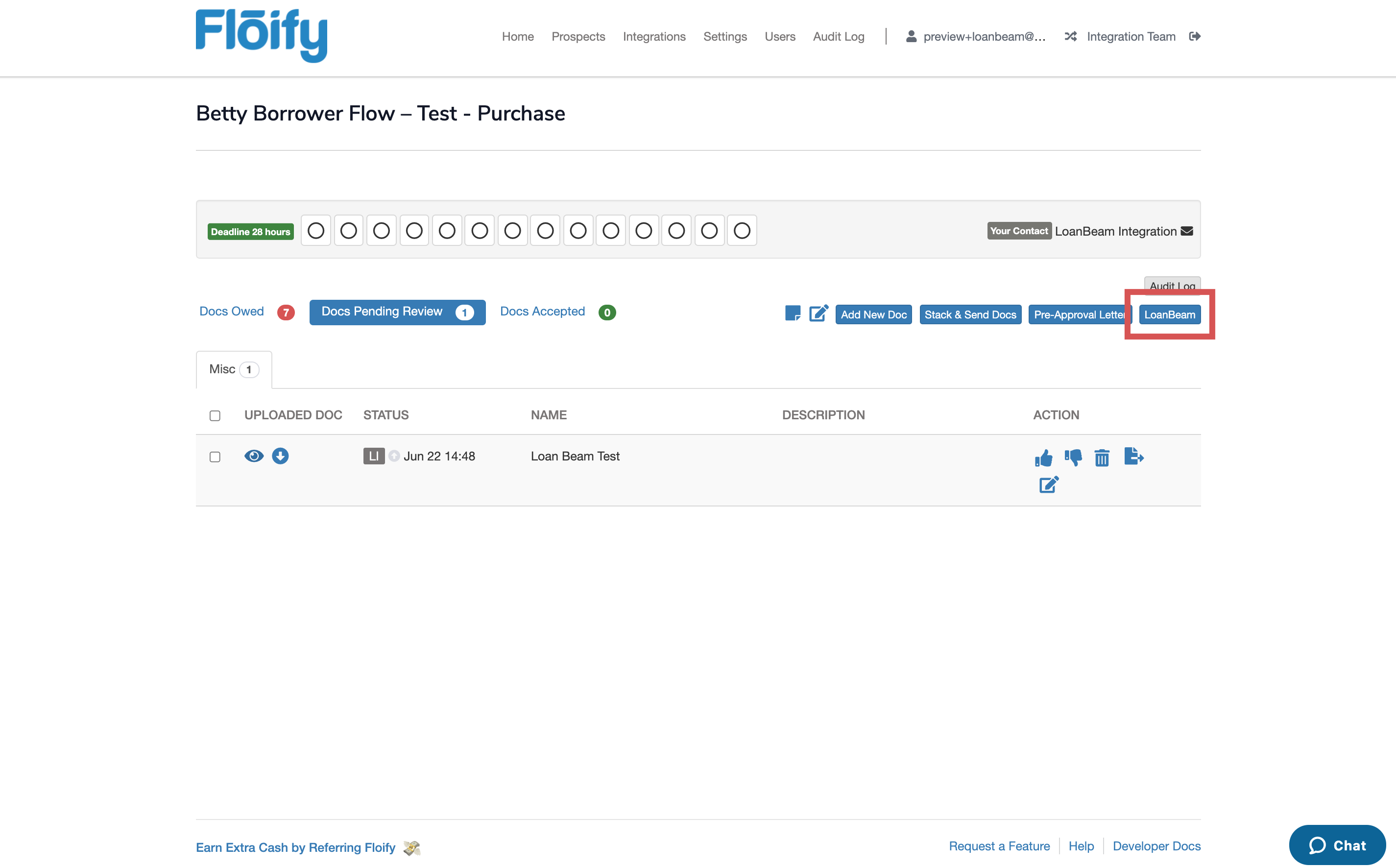

Once the integration has been enabled, a user will be able to use the new LoanBeam buttons on the Docs Pending Review and Docs Accepted pages. The new LoanBeam buttons can be found in 3 places, each with slightly different behavior.

The Send to LoanBeam button in near the right in blue will open the LoanBeam modal with no documents selected:

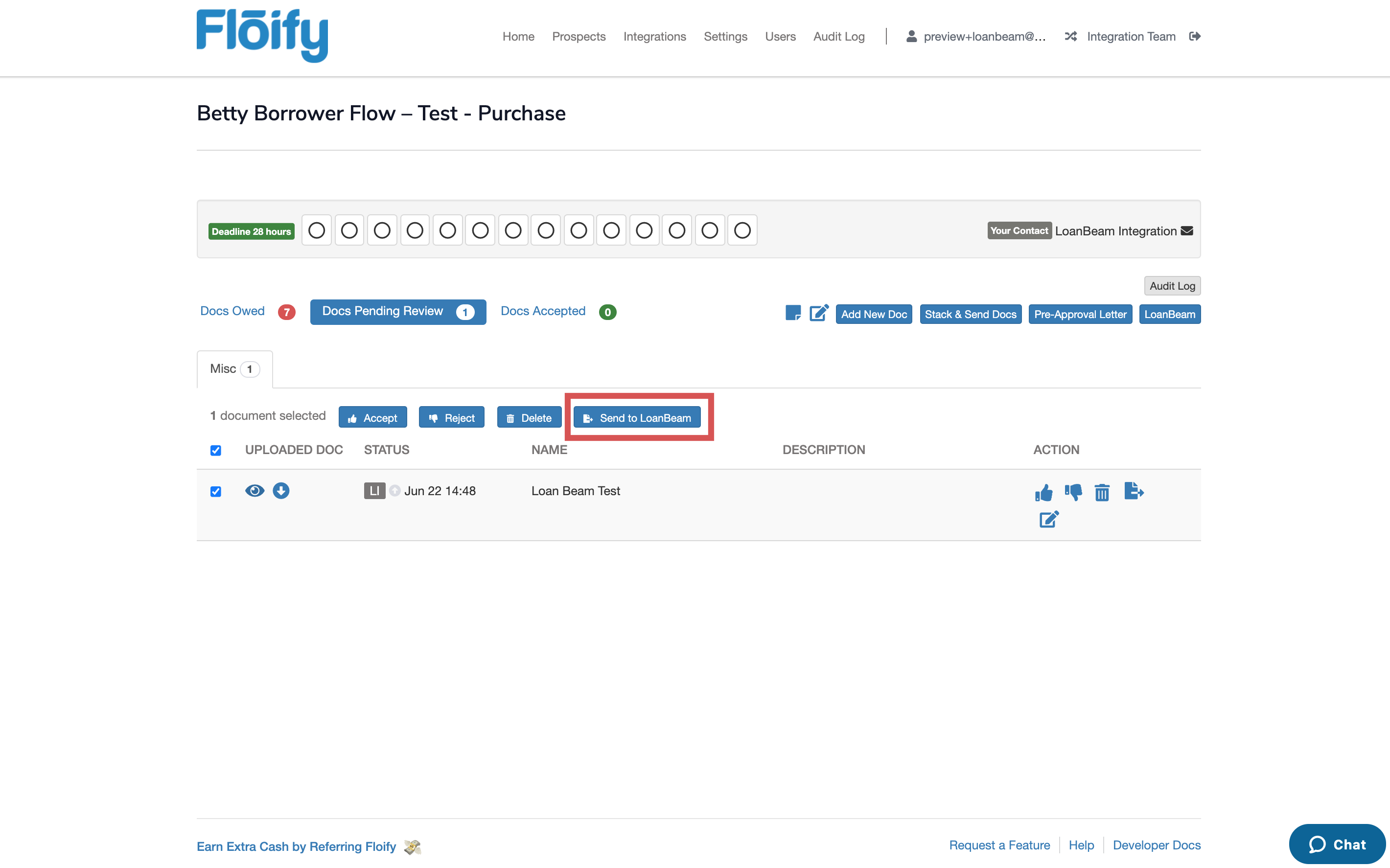

If multiple documents are selected via the bulk actions checkboxes towards the left of the document names, this will allow you to select the Send to LoanBeam button at the top of the tab. This button will open the LoanBeam modal with documents selected, matching the documents you've selected on the left:

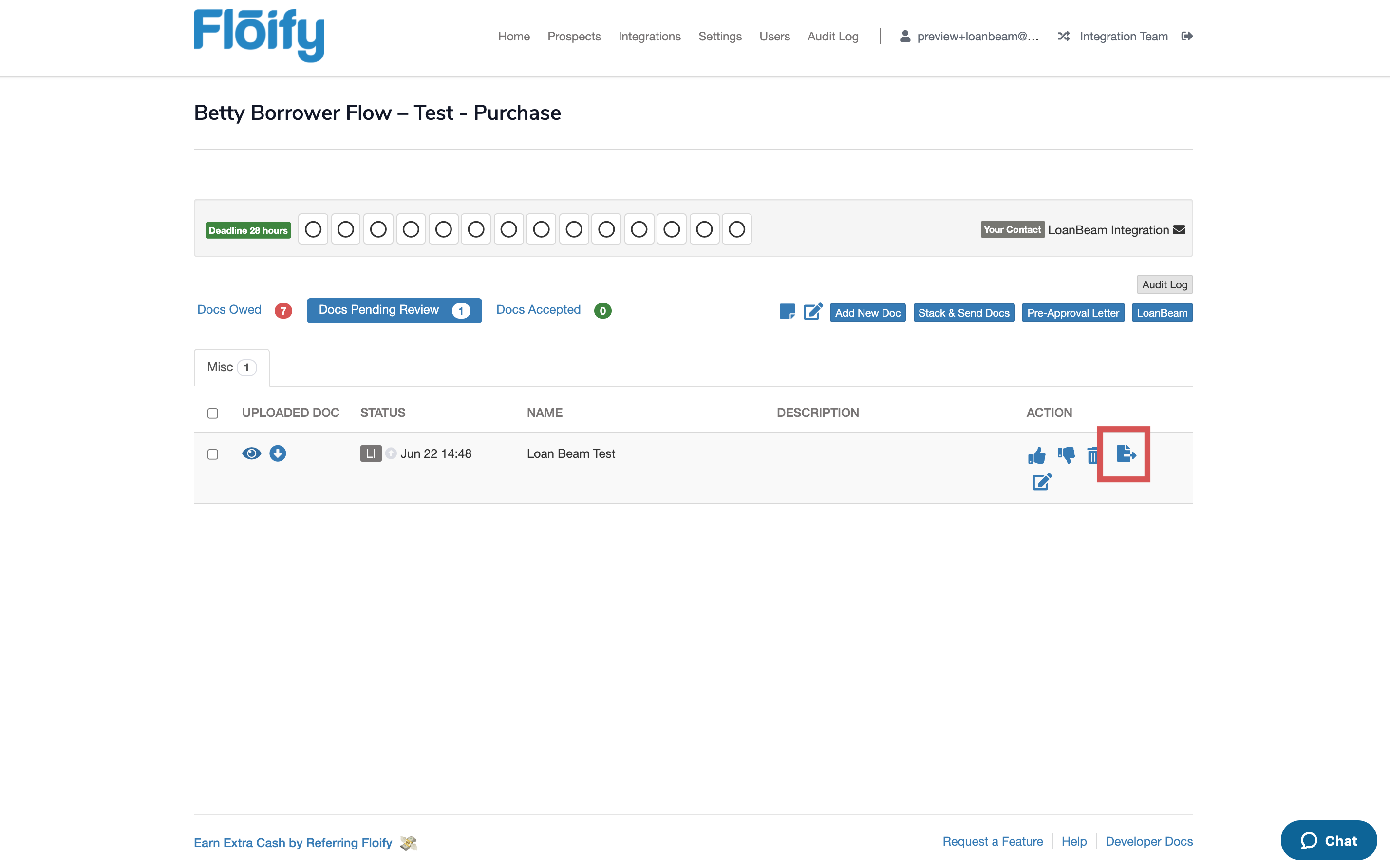

Each individual document will also have an action button on the right in blue to Send to LoanBeam. This button will open the LoanBeam modal with a preselection of the document associated with that particular action icon:

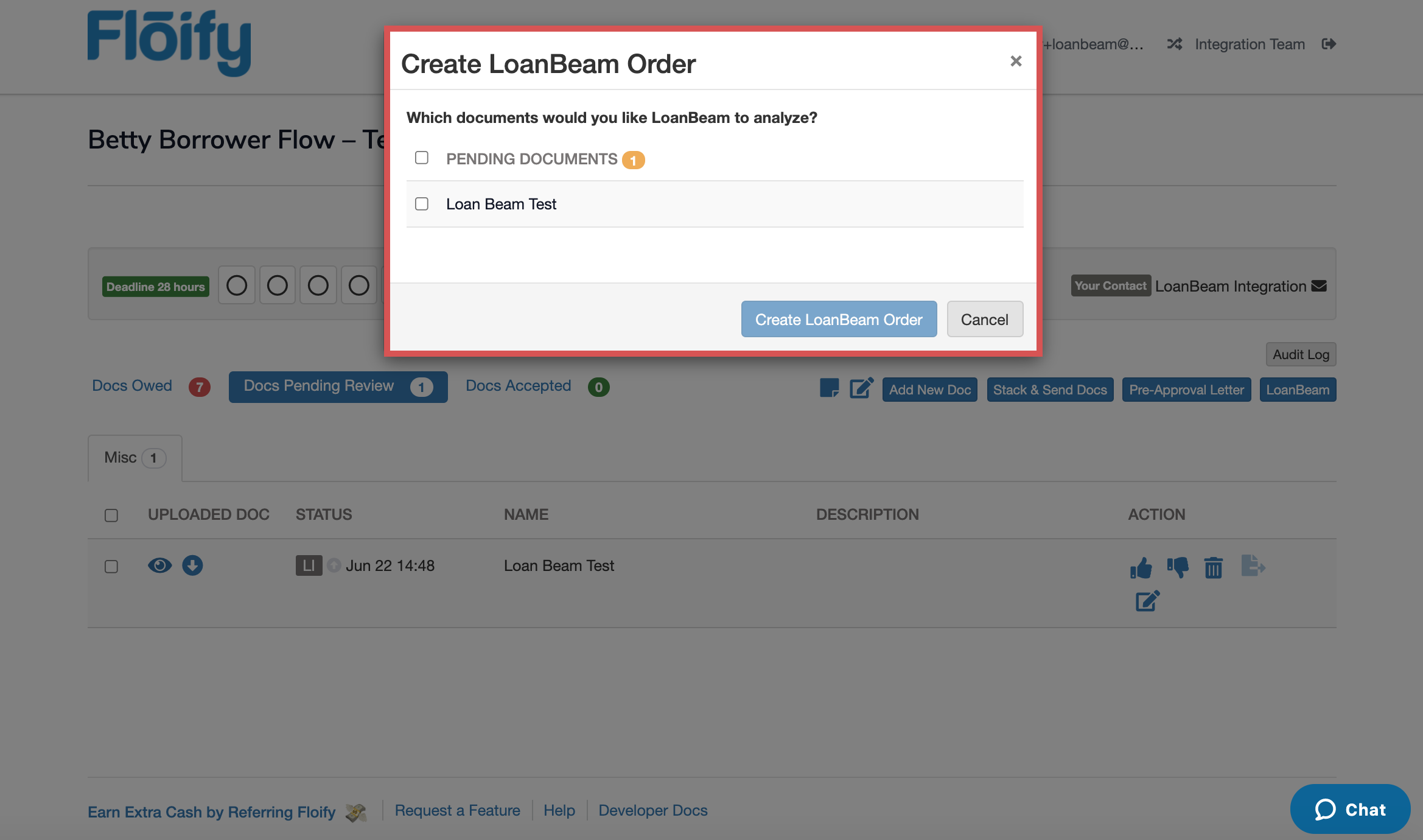

From there, you will be taken to the page to create an order. Here you can select which documents you would like LoanBeam to analyze. Select Create LoanBeam Order to begin the order:

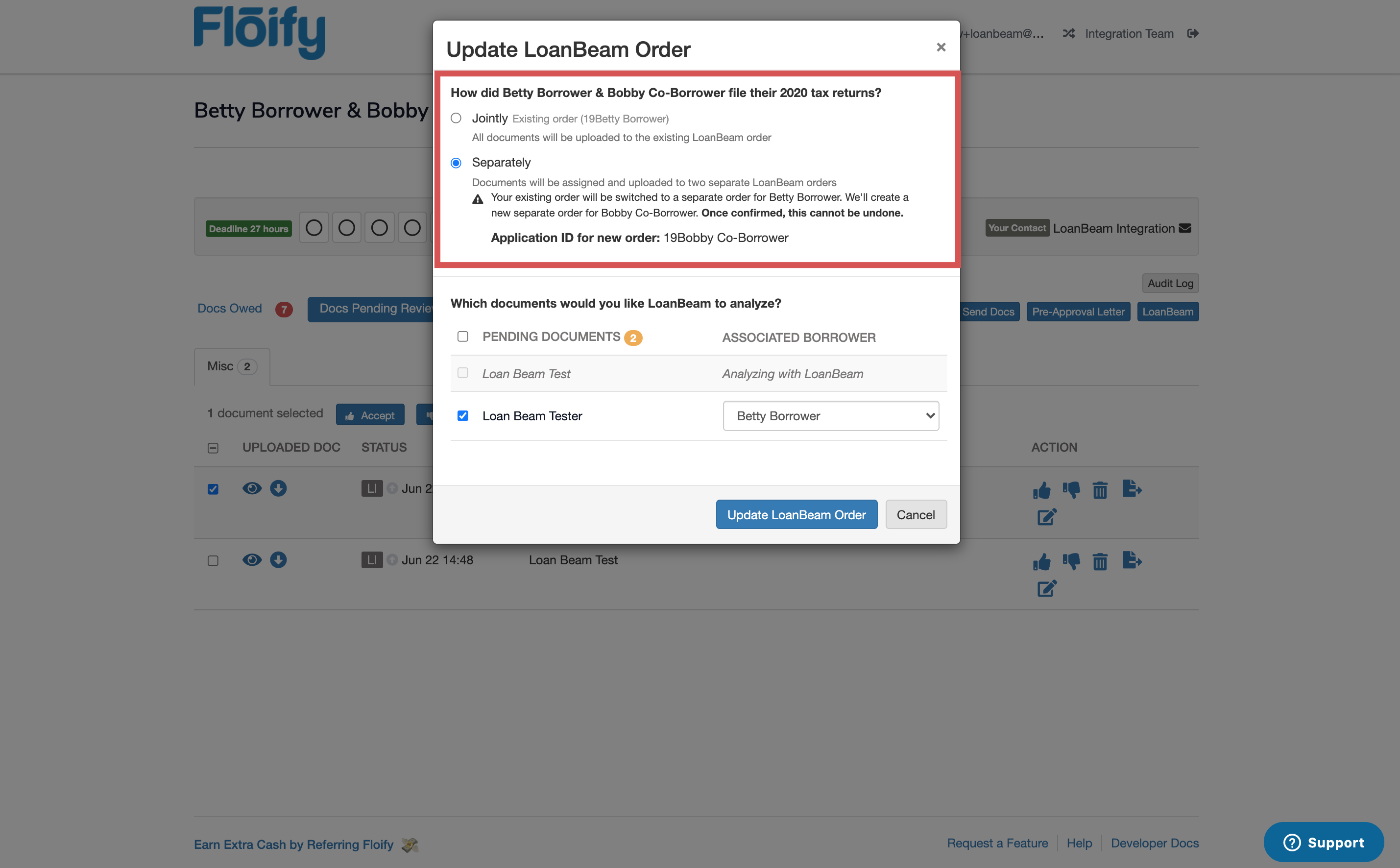

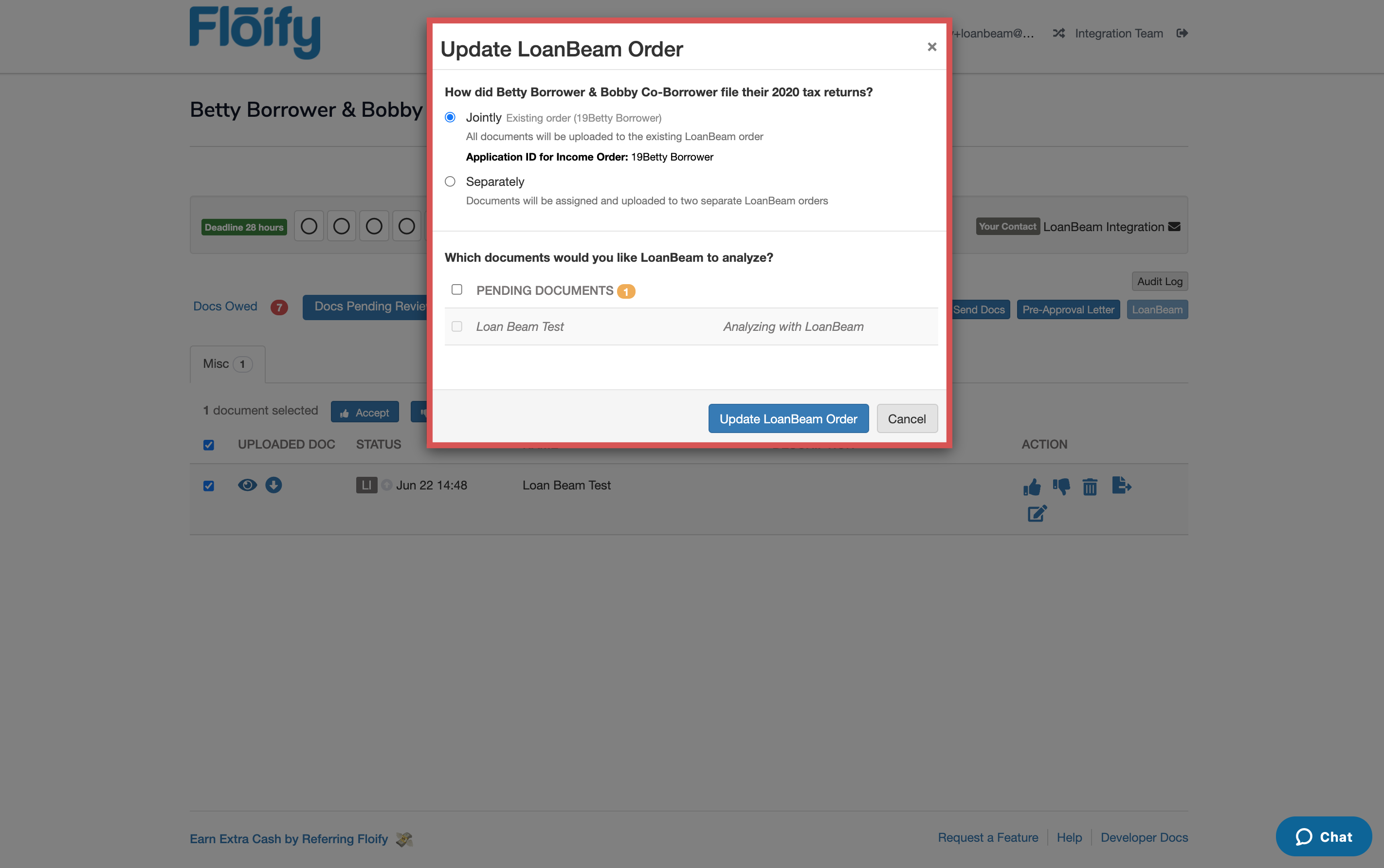

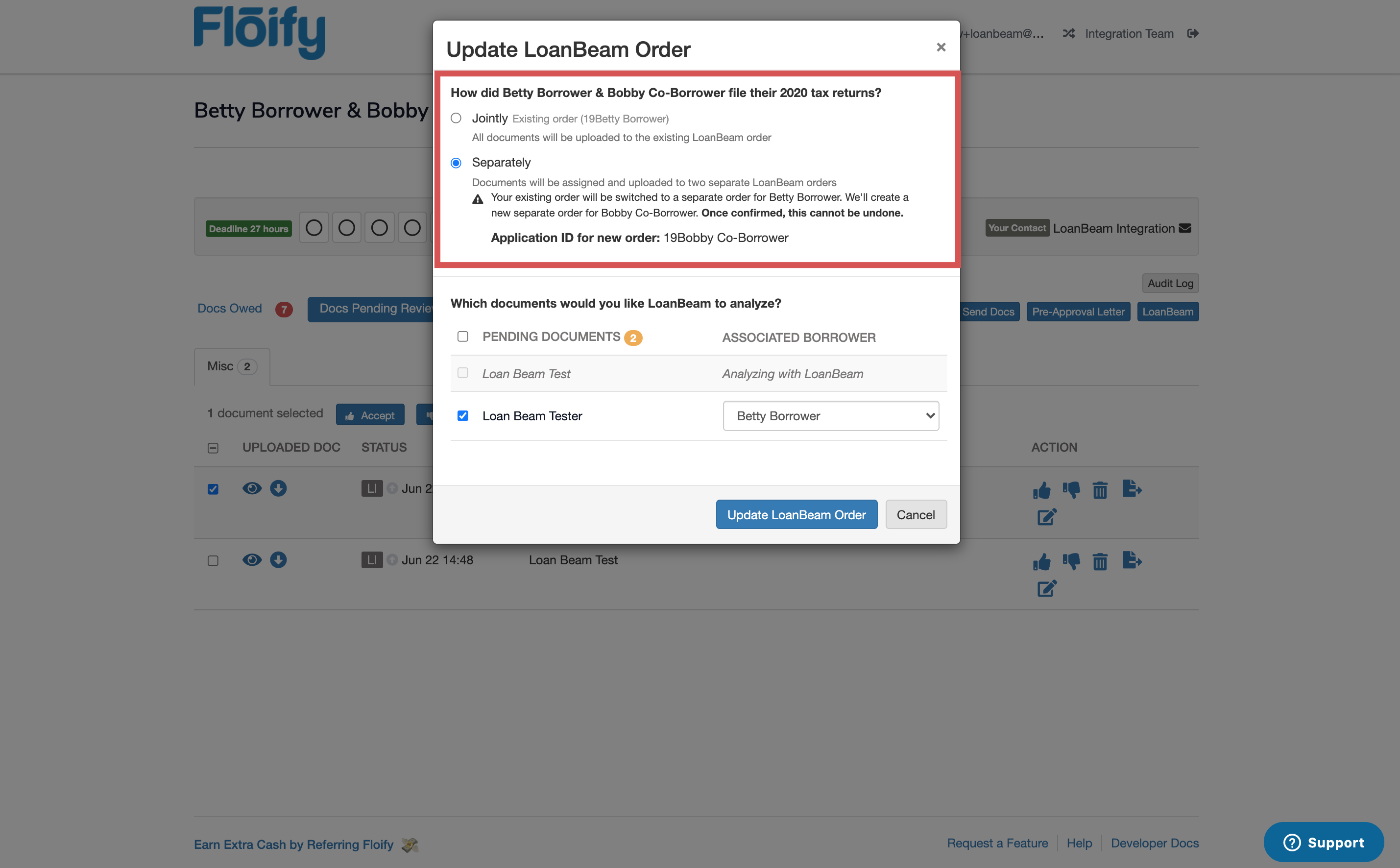

If a co-borrower has been added to the Floify loan flow, you will have the option to upload the items jointly or separately:

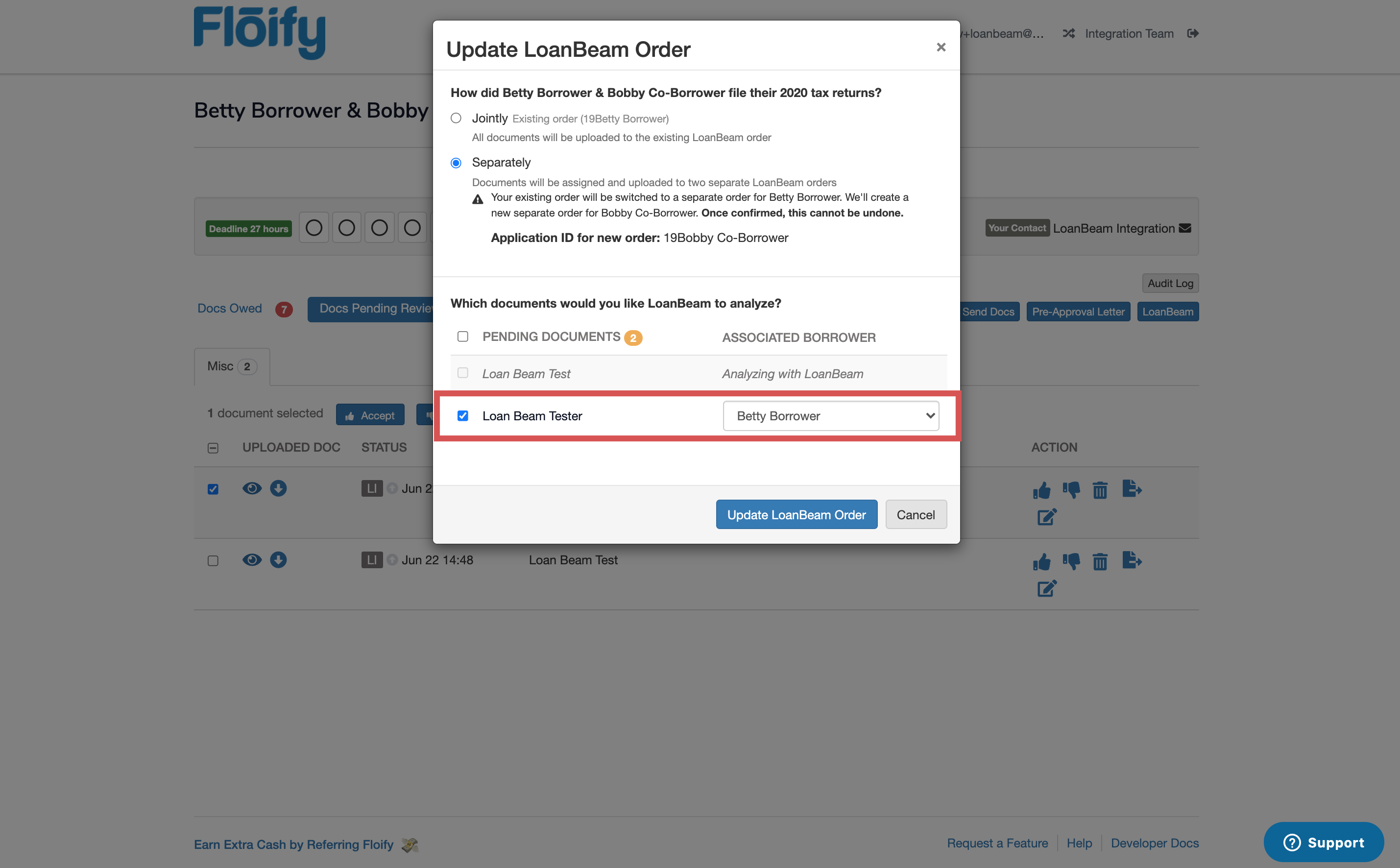

Additionally, you will be able to select the associated borrower to each document that you are asking LoanBeam to analyze:

The LoanBeam modal switches to 'update mode' if a co-borrower is present and an order has been placed. A user can then opt to 'split' their joint order to become two separate orders. If the user decides to not select 'Separately' and selects documents with the default selection of 'Jointly', the modal will simply upload new documents to be analyzed:

If the loan flow has an order created and there is only a primary borrower (no co-borrower), or if there is both a borrower and co-borrower, the LoanBeam button(s) will open in 'send mode'. In this mode, users can select additional documents to upload for analysis:

Once you send documents to LoanBeam, LoanBeam will begin analyzing them to create an income report. LoanBeam will often find "missing items" or new needs lists from initial analysis. The Floify/LoanBeam integration streamlines this by auto-sending any missing items back to Floify.

LO teams can choose to "approve" missing items before they appear in the borrower portal, or LO teams can choose to send missing items straight to the borrower portal without approval.

This can be enabled under Settings and then Integrations:

Scroll down to LoanBeam Integration and select Edit LoanBeam Integration:

Select if you'd like LoanBeam missing item names, descriptions, and request types to require approval:

LO teams can also choose between auto-sending or manually sending borrower responses to missing items back to LoanBeam:

This provides a streamlined way for lenders to gather all necessary income documents for generating a final income report.

If configured, once all missing items have been satisfied, LoanBeam's final income reports will be sent back to the lender's 'Docs Pending Review' bucket.

Please sign in to leave a comment.